1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverWhat's New

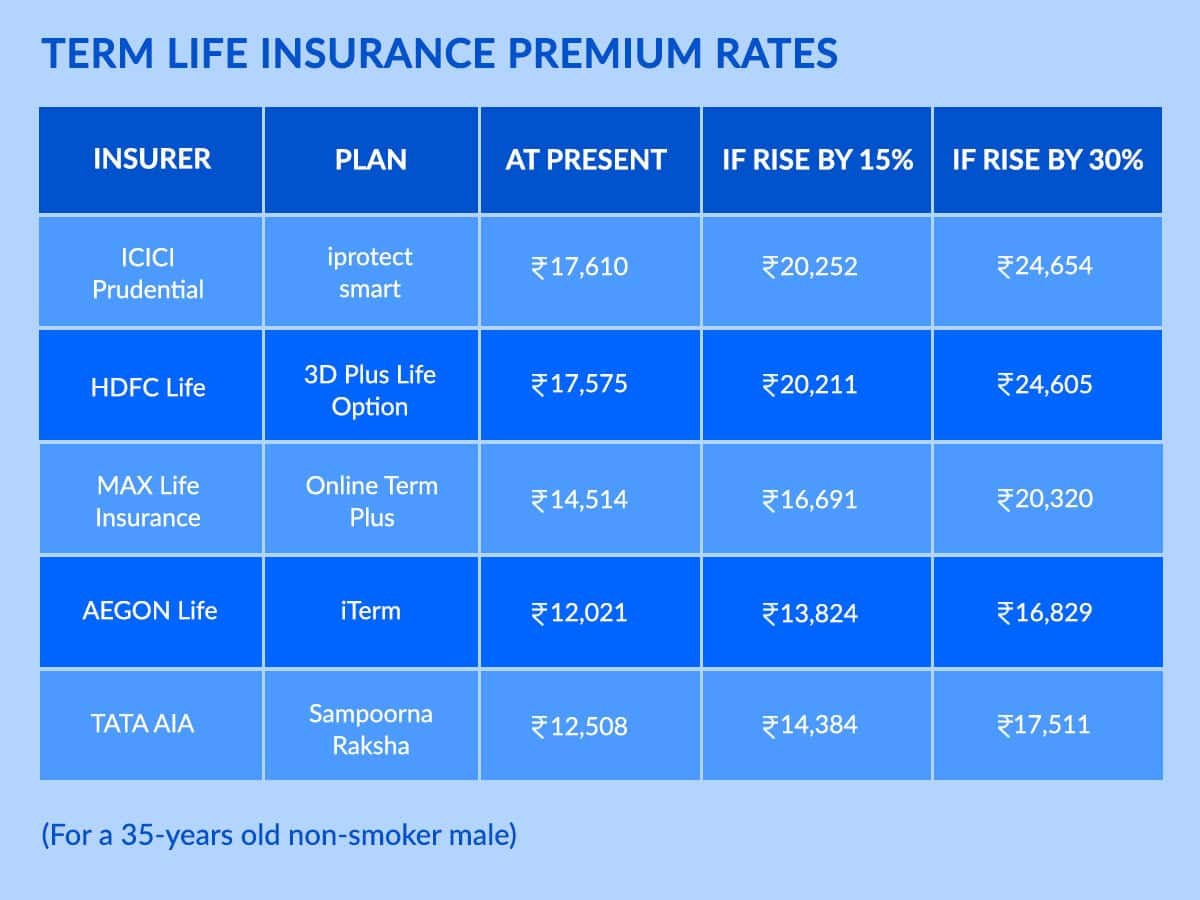

Term life insurance premium set to rise from April 10

Missed getting yourself a term insurance cover before the March 31st deadline? Here’s some good news for you. The price hike of term life insurance premiums, which was earlier slated for April 1, 2020, has been deferred till April 10. Due to coronavirus outbreak and nationwide lockdown, insurers have decided to extend the deadline in a move to aiming at extending the benefit to the consumers.

“Given the current lockdown situation, the industry has decided not to burden the customers with a price rise. Hence, they have extended the deadline, and will continue to offer the current plans without any price hike till April 10,” says Santosh Agarwal, Chief Business Officer, Life Insurance, Policybazaar. Therefore, those who are planning to buy term life insurance or are inadequately insured can still get lower rates to buy a cover for financially securing their family.

((calculator))

Agarwal adds, “In the current scenario, we have also extended support with the tele-medical facility, wherein customers don’t need to physically visit a diagnostic centre and can get a check-up done via a phone call while sitting at home.”

Over the past few years, the premiums for term insurance covers have been on the lower side, largely due to market competition and available mortality rate data. In India, term insurance premiums have been based on the LIC mortality tables as no other data was available. The insurers have assumed that fewer deaths will occur and hence kept lower premiums. However, according to latest industry data, mortality rate is higher than what was used to calculate premiums.

((newsletter))