1

Q3 FY24: PB Fintech posts strong numbers, PAT positive with 43% revenue growthWhat's New

Covid-19 Accelerates Life And Health Insurance Awareness In India: Policybazaar Study

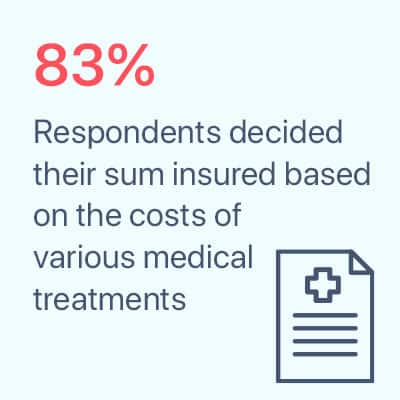

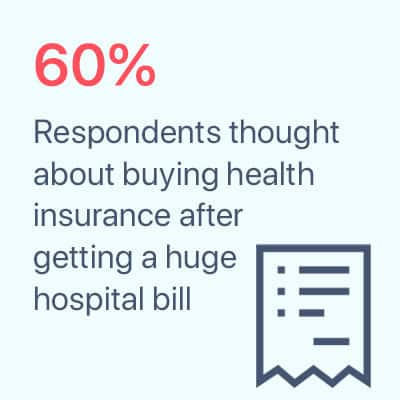

More than 60% of Indians are thinking about buying health insurance after being personally faced with a hefty hospital bill or learning of such experience from friends. Nearly one in three Indians are thinking about buying health insurance, motivated by the fear of Covid-19 this year. The findings were part of the annual survey conducted by Policybazaar.com to celebrate the National Insurance Awareness Day.

Rising healthcare costs in general and the recent reports of astronomical Covid-19 treatment costs at private hospitals have changed India’s attitude towards insurance and especially health insurance.

Policybazaar.com surveyed more than 4,000 existing insurance buyers who bought an insurance cover from its platform in the last six months to understand the attitude of Indians and their purchase triggers when it comes to life, health, and vehicle insurance. The survey was fielded to respondents between June 19 and 23, 2020.

((calculator))

HEALTH INSURANCE

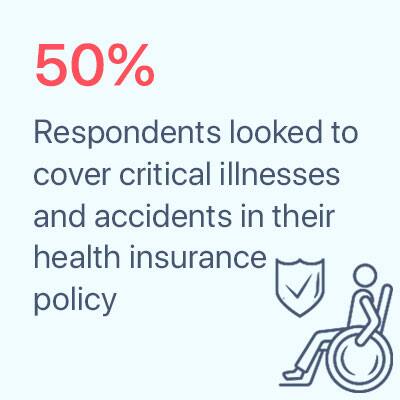

When choosing a health insurance brand, two-in-three Indians make a decision based on the network of hospitals it covered. About 58% of the respondents took into account the insurer’s claim settlement ratio and 43% of respondents looked at both when choosing an insurer. 6 in 10 respondents look for a combination of factors when buying health insurance, even though financial security against any health expense remained a consideration for 80% of the respondents.

TERM LIFE INSURANCE

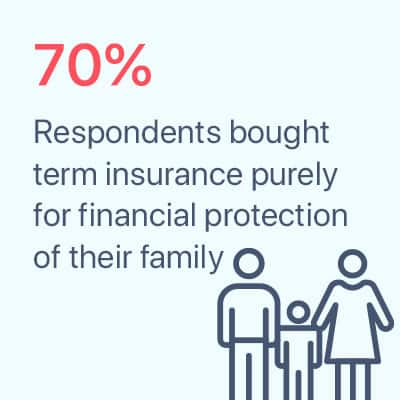

When it comes to life insurance, nearly seven in ten respondents purchased a term insurance plan as a means to protect their family’s financial future and not merely as a tax-saving instrument. This healthy awareness about the purpose of insurance is encouraging for a country with a low level of insurance penetration.

The findings mark an improvement in the number of people buying term insurance for long-term security (7 out of 10 vs 6 out of 10) compared to the survey in 2019.

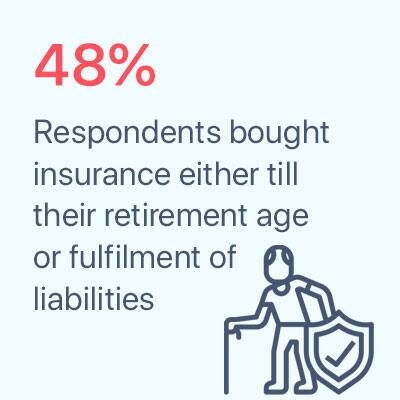

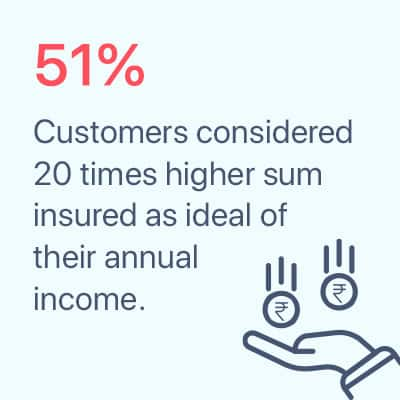

Those who are aware of the purpose of insurance were mindful of opting for a cover 10 to 15 times their current annual income, as is usually recommended by financial experts. Given the prevalent uncertain economic climate, nearly 51% of the respondents felt the ideal insurance cover was 20 times their current annual income. Peer group and friends’ networks have emerged as significant triggers for life insurance purchases. Nearly a third of the respondents were influenced by friends and 25% by online media while deciding on investing in life insurance.

((quote_1))

MOTOR INSURANCE

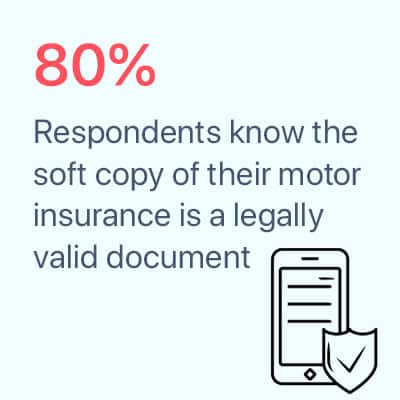

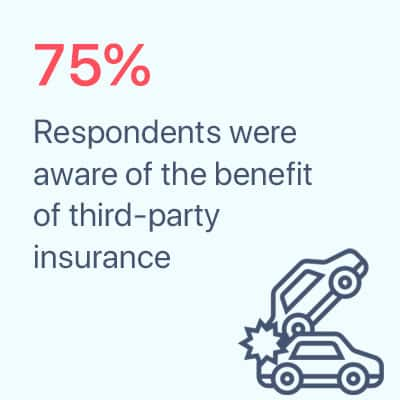

While the overall awareness about vehicle insurance grew, it is still seen as a matter of compliance. Three in four respondents said they were aware of the benefits of third-party insurance, compared to 60% last year.

The awareness about zero-depreciation cover also increased to 70% from 50% last year. Nearly 60% of the respondents knew that they could renew their lapsed motor insurance policy online, and eight in ten understood that an electronic copy of motor insurance was a legally valid document.

((newsletter))