1

FY24: 34% Revenue growth, PAT improved from a loss of 488 Cr to a profit of 64 Cr, improvement of 552 CrTechnology

How Policybazaar Revamped Investment End to End Journey

The pandemic has led to a deep realization towards the importance of term life and health insurance among consumers in their lives. India has been witnessing a strong demand for protection products as more and more people want to come under the insurance umbrella. For Policybazaar, offering the best-in-class services to our customers especially during these tough times has always been of prime importance to us. We have continuously introduced unique, relevant and highly customized products fitting the customer needs. While we rigorously work towards providing the most suited insurance policies to the customer, it often leads to a complex project architecture as every insurance plan is unique in its own way.

Standardization of internal and customer-facing services

Usually, we used to develop and host a new project, each time we worked on a new insurance plan. However, we wanted to move to new, better and faster technologies. We also wanted to standardize all our internal and customer-facing services across insurers.

Buying a policy at Policybazaar.com involves multiple steps:

- Customers compare and choose the plan that suits them the most amongst a variety of options.

- They then choose how much and for how long they want to invest to get the desired maturity value before providing us with the basic details.

- After all this is done, customers make payment.

- Post payment, we ask a host of questions to customers regarding their education, work, lifestyle, medical information etc.

The sole objective of taking this herculean task at hand was to ensure enhanced customer experience, reduced complexities and robust common architecture.

((relatedarticle_1))

Single platform for plans across insurers

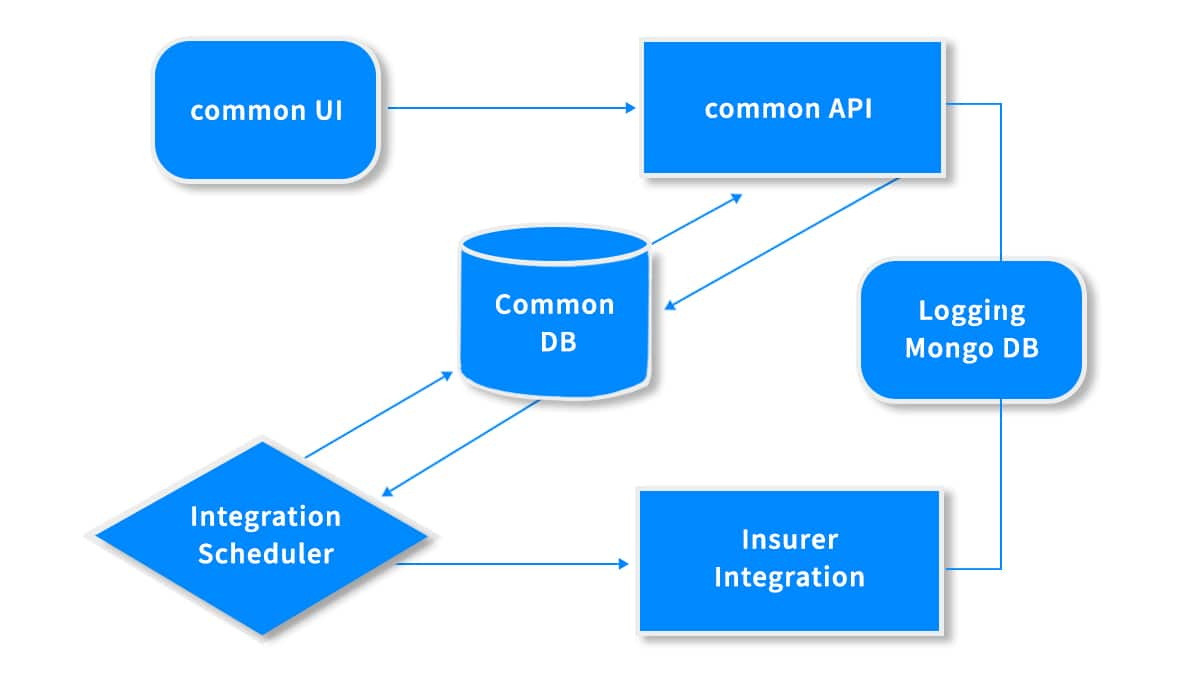

Instead of making different systems for each insurer and their plans, we came up with an architecture where we create a single platform and run all our plans across insurers. Insurers need all kinds of information from the customers like contact, lifestyle, medical details etc. We capture this data using dynamic JSON forms.

To create a standard ecosystem, we developed the core of our front-end using JSON (JavaScript Object Notation) as configurable forms. JSON is a lightweight format for storing and transporting data. We also developed a common structure through which all the data transactions will happen. We built a common database and services which would incorporate all kinds of plans across all insurers.

How does it make life easier?

This common architecture helped multifold. It has proven to be more efficient since new features for all plans can be implemented in one go and don’t require action on each plan for each insurer. There is now just one Database on which the team needs to work for all Investment plans instead of juggling with multiple insurer-based databases.

This eradicated redundancy at work and at the same time, we can put our energies on Innovation. With this solution, the time to deliver new insurance plans on the website also reduced by 40%.

With changing times, there is an expected upswing in the Insurance industry, and technologies have to be robust, should have the ability to Scale and be low maintenance at the same time. Our implementation of this common architecture has not only been able to fulfill the above but at the same time has allowed us to think and replicate this across our business unit. The developer productivity and quality of Code have also seen a very positive upside. Amidst all this, the core still remains ‘Customer Centricity’ as everything eventually gives an Enhanced Customer Experience.

((newsletter))