1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverTechnology

How Digital Payments Team Aced Work From Home

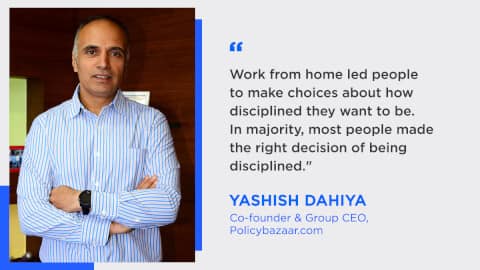

The pandemic has led organizations to adapt to the new normal i.e. Work from Home. Contrary to the perception before the pandemic that work from home is easier, now that we have been practicing it for a year, we have realized that it has its own set of challenges and difficulties. As they say, difficult situations make us stronger, and the way Policybazaar aced work from home is a testimony to these beautiful words. Let us take you through the journey of how our centralized payments team has been tackling these challenges.

Firstly, let us understand what the centralized payments team at Policybazaar does?

- Ensuring a seamless payment experience across our platform.

- On time fund transfers to the merchants from multiple nodal accounts.

- Implementation of maximum payment modes considering various business models.

- To follow PCI DSS Certification guidelines.

- To maintain Nodal Account as per the RBI guidelines.

- Timely closure of agreements & invoices.

Challenges during work from home

Since, the centralized payments team has to deal with multiple stakeholders, it becomes imperative to prioritize & align their work. They also need to ensure communication across multiple teams, manage technical glitches, navigate their dependency on merchants and execute agreements.

Being proactive is the key to success

Planning & developing a product from a product/tech perspective and being proactive in gathering all relevant details helped the team emerge as winners and deliver their objective successfully. Through this strategy, they could easily tide over the key challenges such as - unexecuted agreements, account details unmapped in nodal account, live merchant ids not released by payment aggregator.

((relatedarticle_1))

Clarity & better communication makes you a winner!

The Payment Gateway team proactively started asking all the stakeholders about their new requirements one week before the start of any new sprint.

- They email all the stakeholders, along with a confirmation on WhatsApp groups.

- They conduct scheduled & daily hangout meetings with Product, Operation, Legal, Finance, Business teams to avoid any last minute delay or discrepancy.

- They are using JIRA & creating sprints with proper timelines. They also mention all requirements on JIRA ids against each team member from developer to QA. It makes everyone responsible & gives complete clarity of the work. Additionally, they do daily morning sprint meetings with teams on Hangout for regular updates.

- Since the beginning, they have been conducting a meeting on the first Tuesday of every month where all the stakeholders share their requirements, concerns, future ideas etc. They have shifted this meeting on hangouts while working from home.

All the mentioned strategies have helped the team in being clear, proactive & prioritizing the work plan for the coming month in advance. It also ensures that they are working in the right direction & their vision is the same as the business.

Compliance maintained? A challenge in itself

The undefeated conviction with which Payments team is working from Home is commendable. Being PCI DSS compliant, no team member can be complacent and is always alert regarding any fraudulent activity that might take place and they have put stringent measures to keep a check on the same.

Maintain tracker and share with all stakeholders

The compliances in PCI DSS Certification & nodal accounts are stringent & have to be maintained strictly on weekly, monthly, quarterly, bi-quarterly & yearly basis. In case of WFH with respect to PCI DSS compliance & Nodal accounts, a few things have to be in place including:

- The team has to get an Approved Scanning Vendors (ASV) scanning certificate at the end of every quarter from a third party audit firm which involves multiple stakeholders. With the help of a tracker, we were able to achieve it successfully.

- Nodal account audit done on quarterly basis with the external Auditor.

- It is an RBI Requirement and we have to submit the Nodal Certificate to the Bank at the start of every Quarter in which the auditor visits our office for the audit.

- Again, the team needs to maintain and track transaction data on a daily basis. They were able to share the data timely despite work from home and there were no glitches.

Persistence is necessary

For the payment gateway team, collection of funds and transferring those to the insurer happens on a daily basis. The team needs to ensure consistency in their reconciliation process which includes:

- How many transactions & amount received against each insurer business-wise?

- Whether the Payment gateway partners have transferred the amount in nodal a/c against each successful transaction?

- How many refunds, adjustments are pending/made against each insurer?

- Is the invoice checked against each transaction, if checked uploaded in ERP or not?

- Is timely payment done to Payment aggregators?

- Are Agreements timely renewed with every merchant?

All these how’s can be only achieved by consistency & persistence because if there is a miss in any of the above mentioned points, it will affect the complete ecosystem. To ensure this, the team communicates on a daily basis at 4 pm because their settlement deadline time is 6 pm. Rest assured from collection to settlement, business is as per TAT and the team is more confident than ever before!

((newsletter))

.png)