1

Q3 FY24: PB Fintech posts strong numbers, PAT positive with 43% revenue growthSpecial Story

India’s Investment Readiness: Key takeaways from our latest consumer insights report

The ultimate choice for Indian taxpayers this year was - Old Tax Regime vs. New Tax Regime. So, what swayed them eventually? The allure of long-term savings or instant gratification through some extra cash-in-hand?

Our latest research report ‘India’s Investment Mindset’ addresses the above questions and delves deep into the consciousness with which Indians chose their Tax Regime this fiscal year. Our core objective behind this study? To gain a deeper understanding of consumers’ changing approach to personal finance. We compiled some of the most intriguing insights from the report for you:

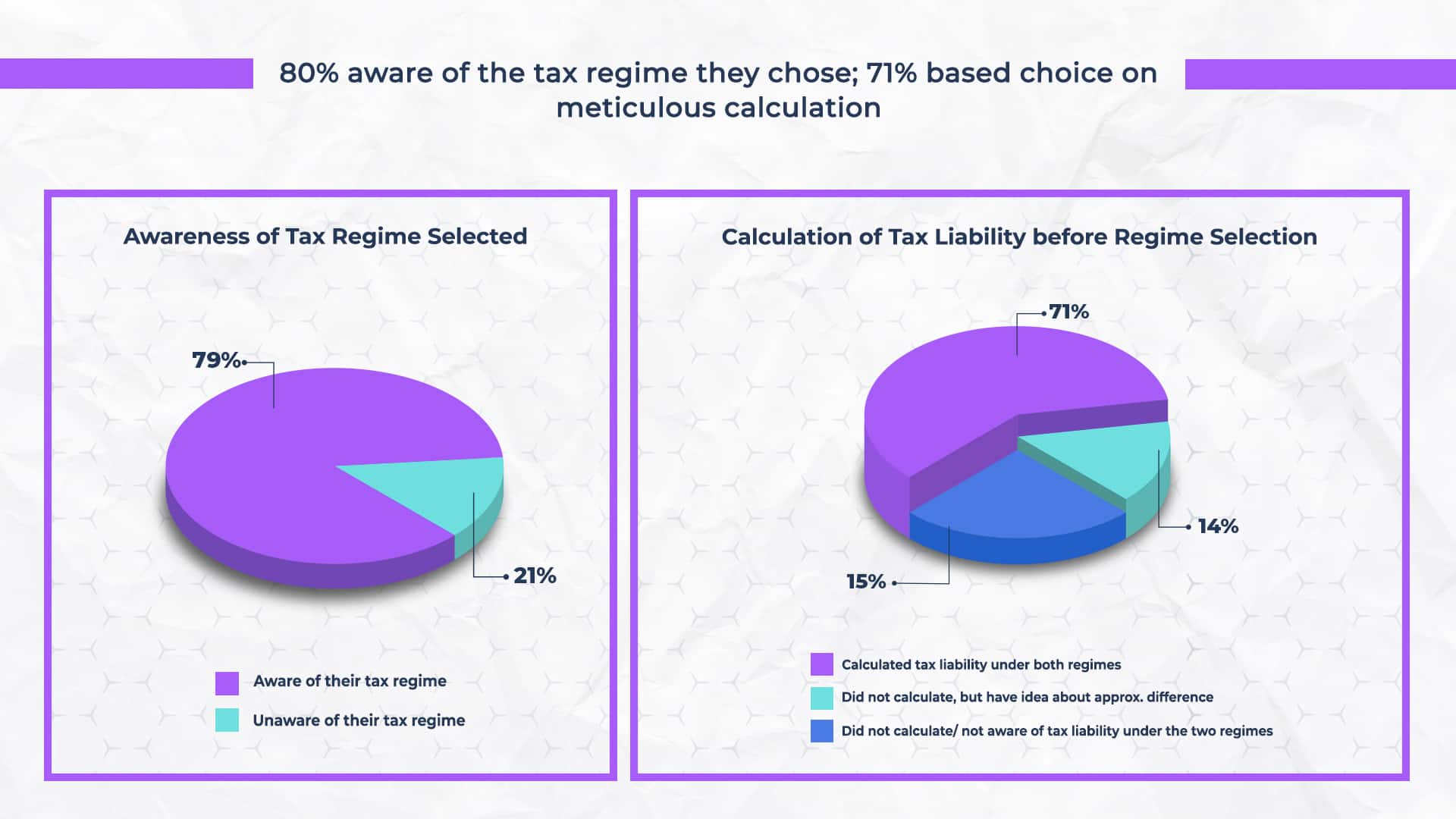

Indians are making informed financial choices

Our survey reveals that Indians are becoming more financially astute and making informed decisions when it comes to managing their finances. Here’s what we found: Out of the surveyed respondents, 80% were aware of the tax regime they had selected this year. 71% of those aware had made the selection after calculating their tax liabilities under both regimes while 14% were broadly aware of their liability under both regimes.

Long-term investment mindset gains traction

Our investigation revealed that the respondents had a distinct preference for the Old Tax Regime. Out of the 80% aware of their selected tax regime, 63% ended up choosing the Old Tax Regime as against 37% who opted for the New Tax Regime.

The choice between the two tax regimes essentially boiled down to a choice between liquidity and long-term investment. The New Tax Regime, which became the default option this year, gave taxpayers the convenience of immediate liquidity – if they chose to forgo the option of long-term benefits that one can leverage in the Old Regime.

Women exhibit better financial attitudes than men

Traditionally, men fare better on the financial literacy front than women. According to the 2020-21 report by National Centre for Financial Education (NCFE), financial literacy among women at 21% was lower than the average of 27% for the total adult population.

Our survey shows that despite the knowledge gap, women possess a slightly better financial attitude than men. We learnt that 74% of women calculated their tax liability under both regimes as against 71% of men.

Protection products gaining popularity

While the government-backed instruments continue to retain their appeal, insurance closely follows as a preferred tax-saving instrument. PPF and life insurance investments (including ULIP and traditional life insurance policies) were the most favoured tax-saving instruments in the current financial year, chosen by 39% and 34% respondents respectively.

Collectively insurance (health and life insurance) was the top tax-saving tool this year and surpassed PPF. 46% respondents leveraged life or health insurance policies or both to save tax under the old tax regime.

South leverages tax-free investment the most

India largely seems geographically united in their choice of tax regimes. While South India displayed the highest propensity to leverage tax-free investments with 65% choosing the old tax regime, it was closely followed by North and West at 63% each. Respondents in the East had the lowest inclination towards the old regime at 57%, even as the difference is not too stark.

Have we piqued your interest? Click here for the full report.