1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverSpecial Story

How India Buys Insurance: Key takeaways from our consumer insights report

At Policybazaar, we're always on the lookout for opportunities to connect with our consumers better. That’s the reason we decided to conduct an exhaustive research - How India Buys Insurance, to understand how our prospective customers perceive and buy health and life insurance. We met 3000+ people in over 27+ Indian cities, including metros, and tier ? cities! We bet you’re curious to learn what were our findings from the research. We compiled some of the most captivating insights from the report for you:

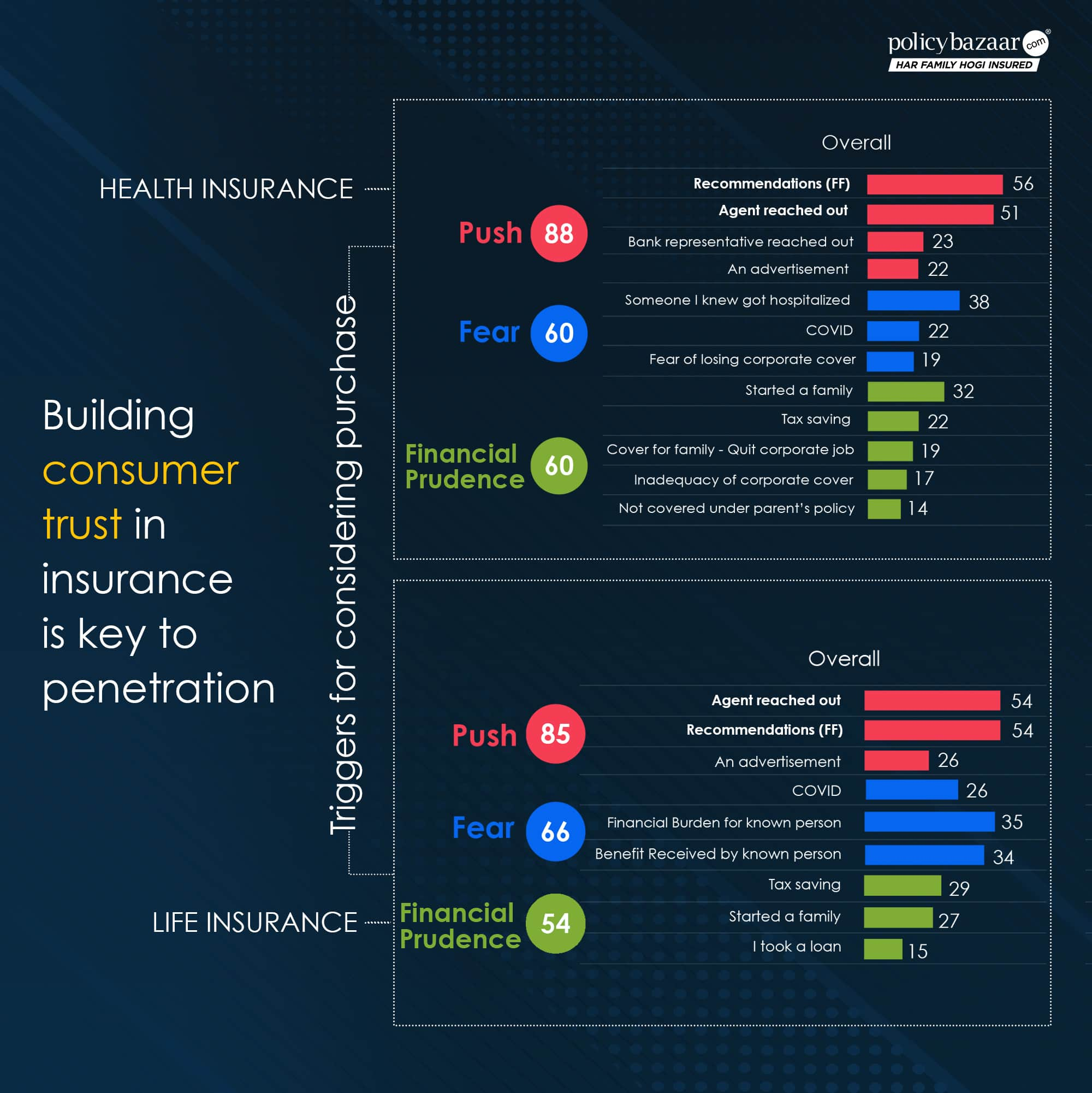

Building consumer trust in insurance is key to penetration

Trust is paramount when buying an insurance product. This is evident in the consumer purchase journey wherein friends and family emerged as the top source of information and a known or recommended agent as the top channel of purchase.

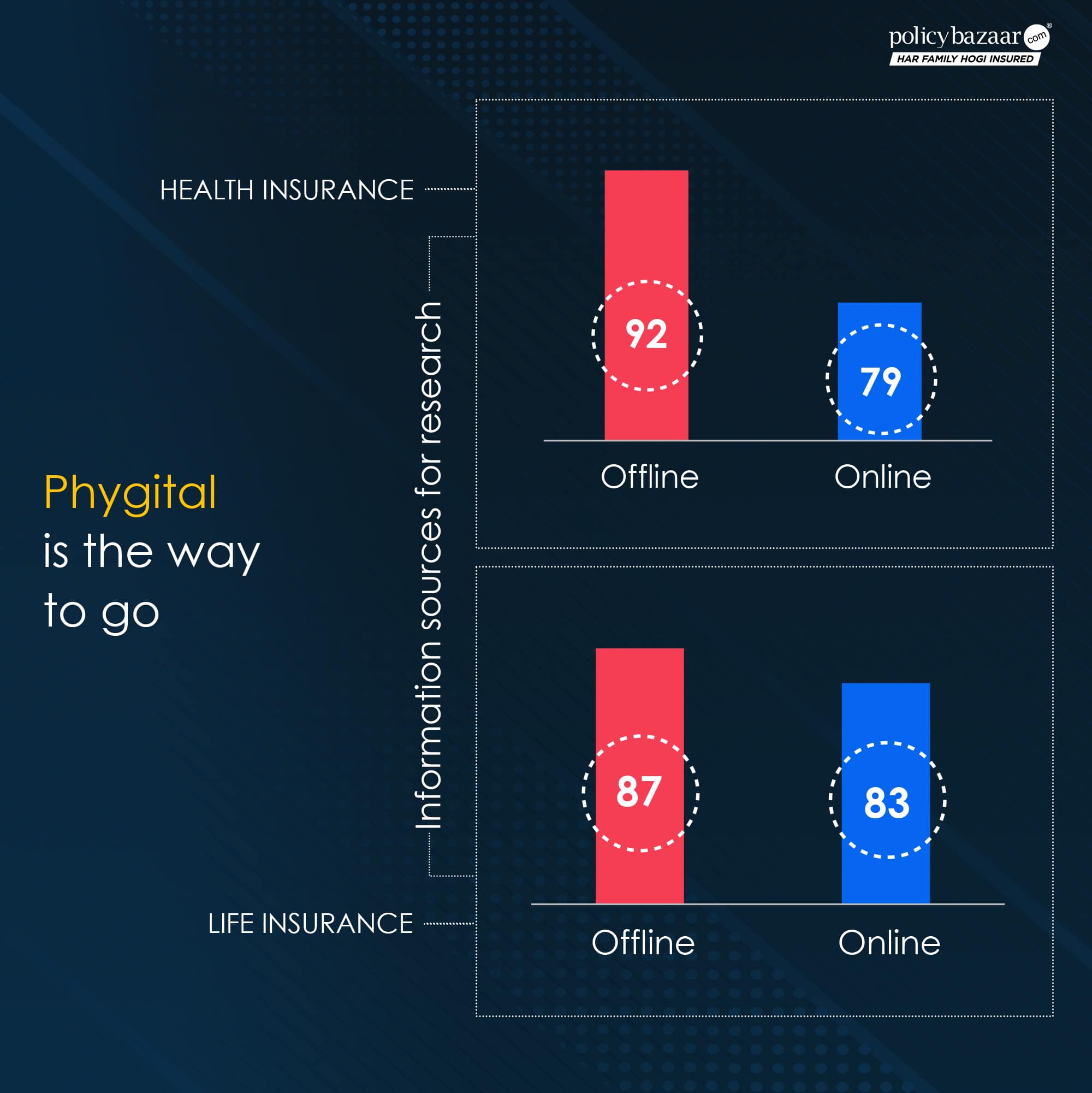

Phygital is the way to go

While consumers do research by themselves online, a large majority still need human intervention - someone who can explain things to them simply, guide them on what’s best for them and help with application and claims.

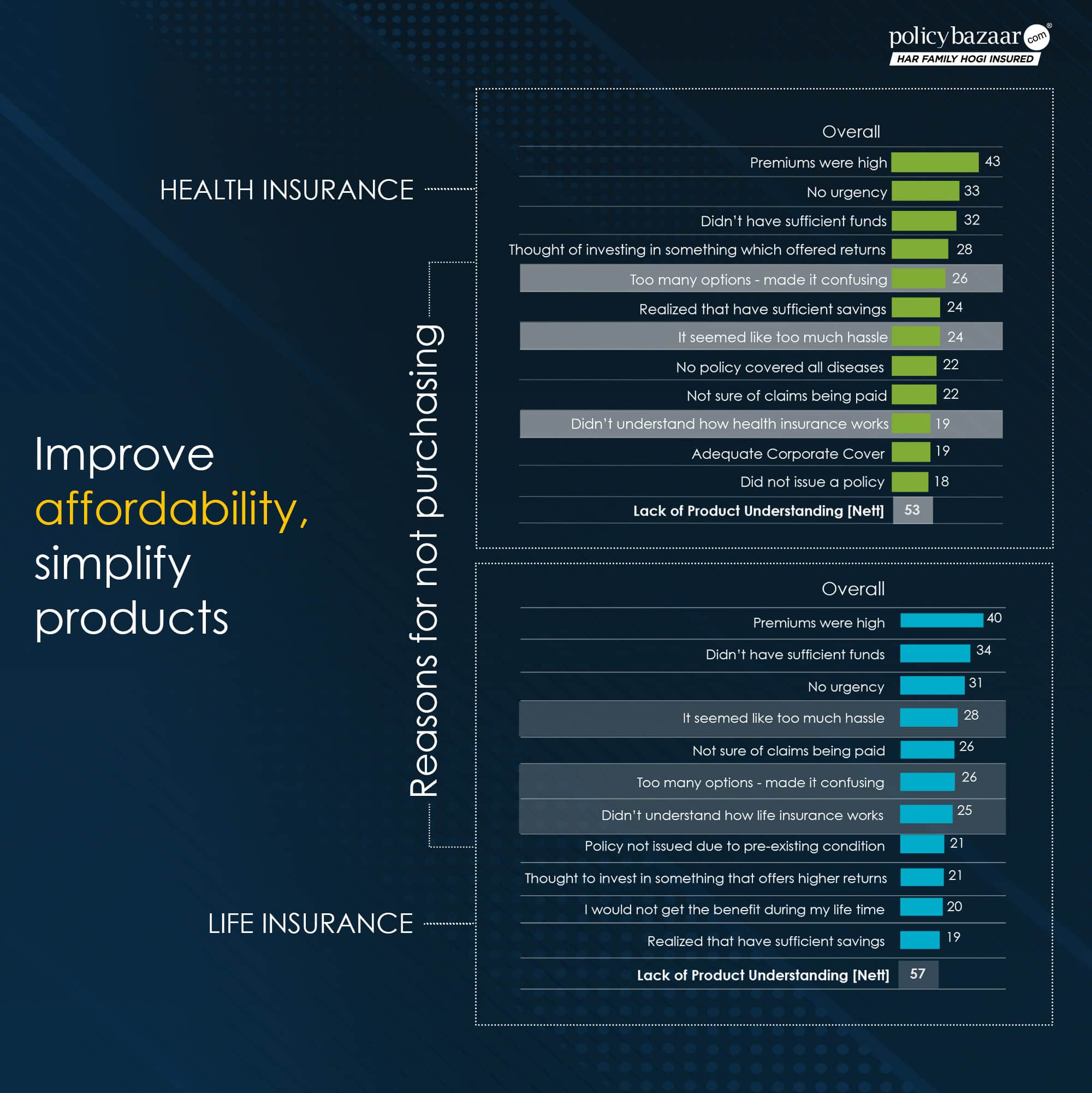

Improve affordability, simplify products

The study revealed that a lack of sufficient funds to pay current premiums hold back a significant part of the population from purchasing/ renewing their health/ life insurance.

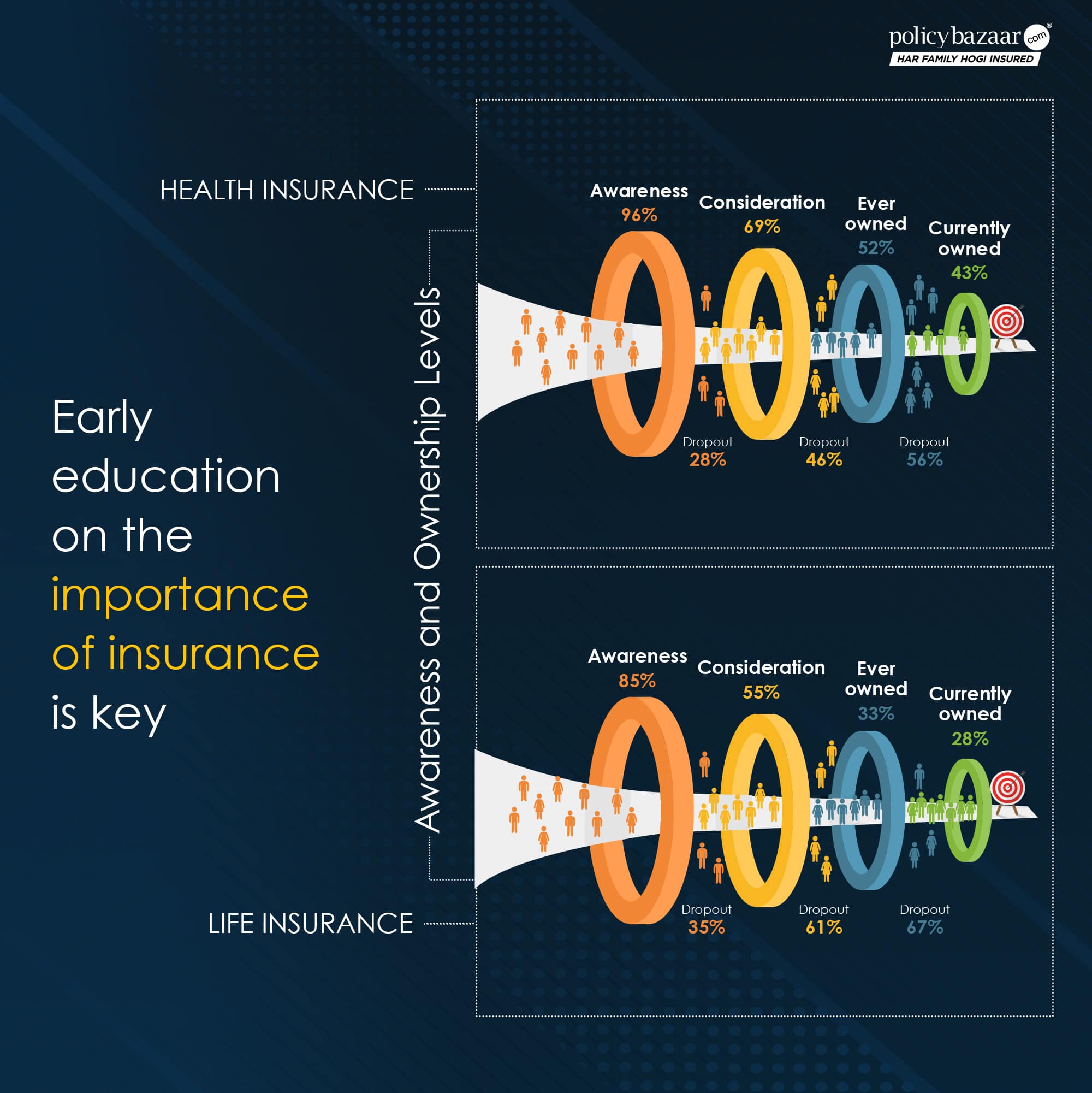

Early education on the importance of insurance is key

The study also uncovers that financial prudence is least often a trigger for insurance purchase consideration. It’s too late by the time people realize the importance of insurance, (as we have seen, especially, in the case of life insurance).

To learn more such intriguing insights, click here.