1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverPress Releases

Trust key to insurance penetration; nearly 80% rely on personal recommendations for insurance consideration, says Policybazaar study

Policybazaar.com provides an in-depth view of India’s health and life insurance buying behaviour in its detailed report titled - How India Buys Insurance

Policybazaar.com, India’s largest online insurance marketplace has launched a consumer insights report titled “How India Buys Insurance”. The report provides a comprehensive view of consumer awareness, needs and frictions when it comes to the purchase of health and life insurance. The research examines the buying behaviour of 3,300+ respondents from 27 cities across India, including metros, tier II and tier III cities. With this study, Policybazaar intends to build a deeper understanding of the changing consumer needs, thereby helping the industry in improving its low insurance penetration.

Here are some key observations of the survey:

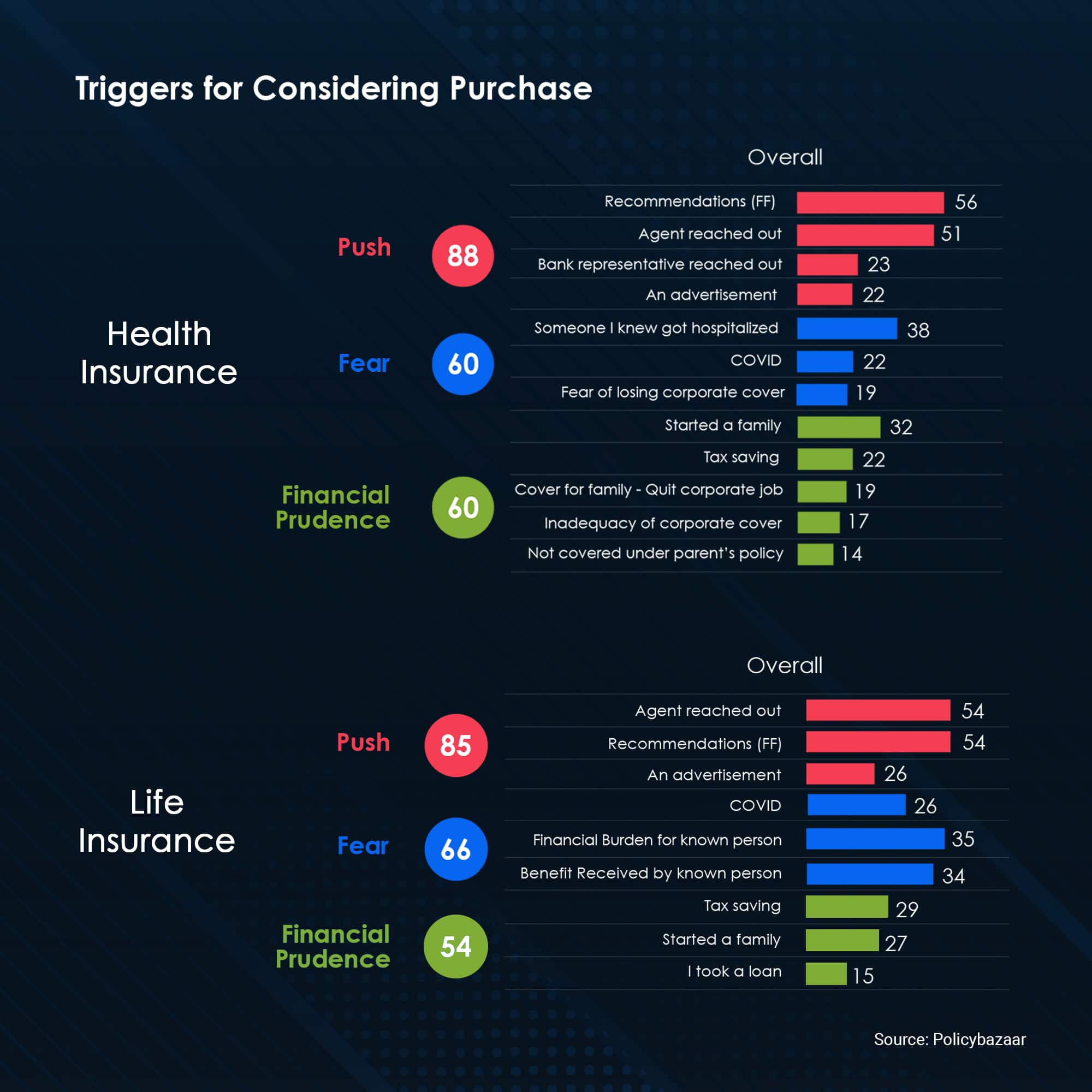

- Trust building is the key - Personal recommendation from friends and family or a known agent is the top trigger for insurance consideration for approx. 80% of the respondents. For 56%, a recommendation from friends and family was the main trigger for purchasing health insurance, while the number stood at 54% for life insurance.

- Brand familiarity is important - Apart from this, brand familiarity and vintage seemed to play a key role in trust building. 58% and 64% respondents said that they trust the brands they are familiar with or the brands that have been around for a long time, both while purchasing health insurance and life insurance respectively.

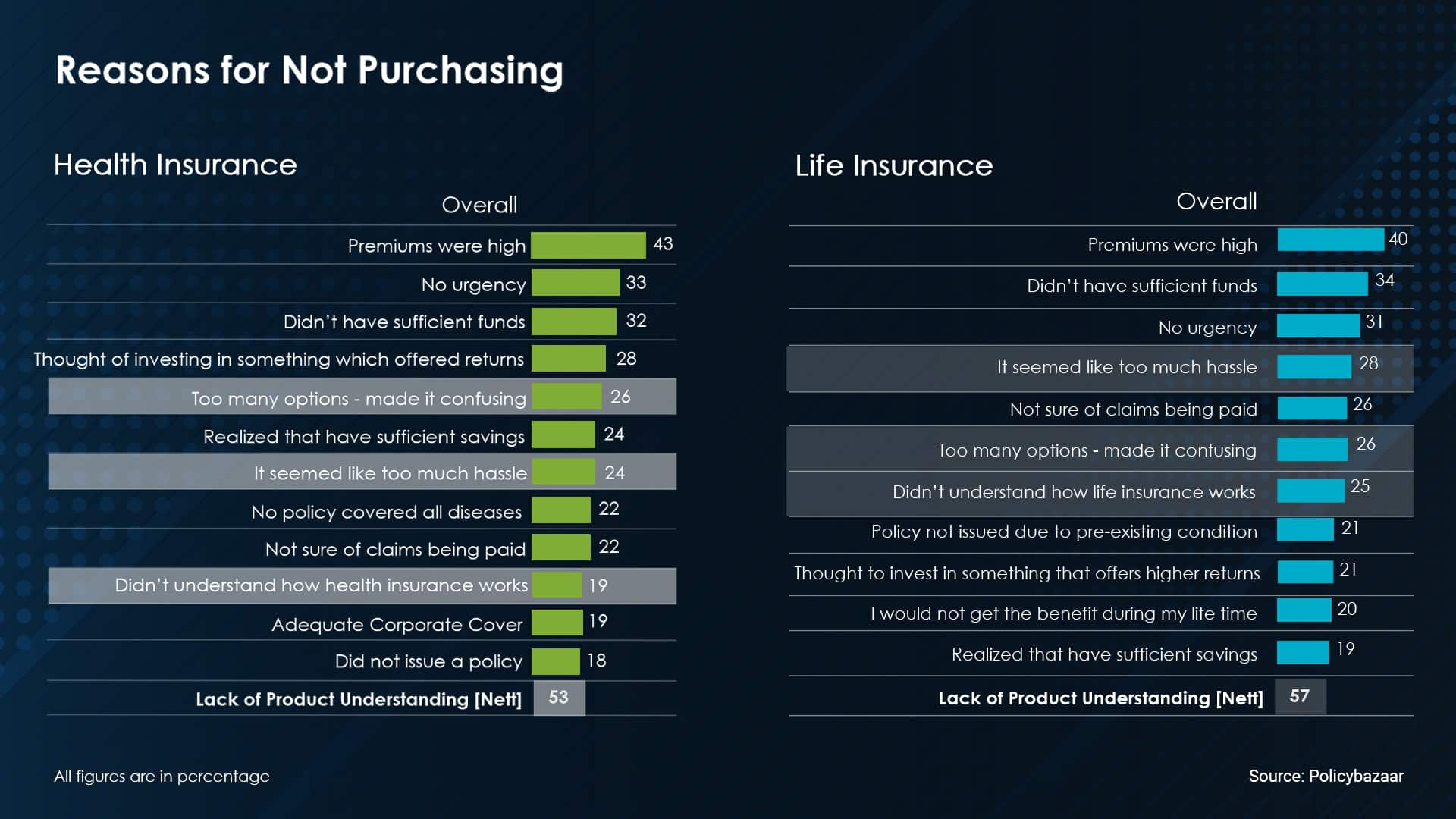

- Affordability issues and lack of product understanding key barriers: Two key reasons that deterred the purchase of both health and life insurance included affordability issues and difficulty in understanding the product. While more than 40% respondents cited high premiums as the reason for not purchasing health and life insurance, around 53% found the products/ process difficult to understand and thus, dropped out. This indicates a clear need for education in the category along with simpler, more affordable options. The earlier this education starts, the easier it will be to hit the message home.

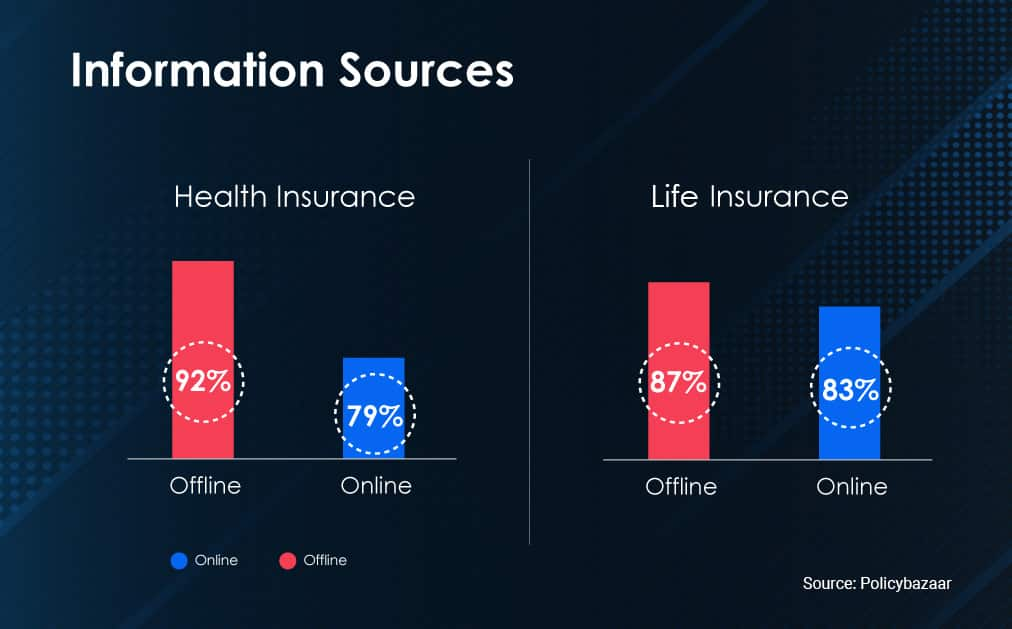

- Adopting a Phygital approach - Around 80% respondents across health and life insurance looked online for information before purchasing the policy. However, over 85% ended up purchasing offline primarily through an agent they knew or was recommended by friends and family.

The convergence of online and offline mediums seems to be the way forward for the insurance industry.

On the launch of the report, Sarbvir Singh, CEO, Policybazaar, said, “Policybazaar’s efforts to maximize insurance penetration are in alignment with the IRDAI’s vision of a fully insured India. In order to achieve that objective, we need to deeply understand the changing consumer needs. With a detailed series of face-to-face interactions, we have gone beyond tier-I and tier-II cities in this research and also explored the perspectives of tier-III India. We hope that the insights from our research will pave the way for more relevant and consumer-centric solutions from the insurance industry.”

The detailed report covers many more such insights including triggers that lead consumers to consider purchasing health or life insurance and barriers that hold them back. It also explores the behavioural differences across demographic and geographical segments of consumers.

To read the full report, click here.

About Policybazaar (www.policybazaar.com)

Policybazaar.com is one of India’s largest insurance marketplaces. It is the flagship platform of PB Fintech, which owns the fintech brand, Paisabazaar.com, and the lending & insurance marketplace in the UAE region, Policybazaar.ae. The Policybazaar.com Group has backing from a host of investors including the likes of PE funds and other family offices. Policybazaar.com started with the purpose to educate people on insurance products and with its offerings has addressed the large and highly underpenetrated online insurance markets.