1

FY24: 34% Revenue growth, PAT improved from a loss of 488 Cr to a profit of 64 Cr, improvement of 552 CrLeadership View

Term life insurance: Should you opt for lump sum payout or staggered payout?

Traditional term insurance plans are believed to be the simplest and cheapest form of life insurance. Under these plans, the policyholder pays a yearly premium for a fixed time period, generally over 30 to 50 years, against a total sum assured.

In case the policyholder dies, the insurer pays a lump sum amount, equal to the sum assured, to the beneficiary of the policyholder. However, if the policyholder survives the term period, nothing is paid to the family or the policyholder.

((calculator))The premiums for traditional term insurance plans are relatively low and there is no return of premium plan if the policyholder survives the term.

Staggered payout

It is often observed that most families do not have proper or even required knowledge when it comes to handling the finances, and they fail to make the best use of the total amount received as a one-time payment.

In order to overcome this concern, insurance companies have come up with some different payout options like monthly or periodic payout option. Under this, the beneficiary rather than receiving a lump sum amount on death of the policyholder, receives some portion or percentage of the total sum assured.

The total remaining amount is received by the beneficiary in the form of monthly payments over a pre-decided period that is generally 15-20 years.

Generally, most insurance companies offer three payment options within the staggered payout plan – lump sum with monthly income, monthly income plan and increasing monthly income plan. All these plans aim at offering maximum benefit to the policyholders.

Here is a brief description of each of these plans:

Lump sum with monthly income: Under this plan, the beneficiary of the policyholder receives a percentage of sum assured that is mutually decided by the insurer and the policyholder at the time policy. Rest of the amount is paid through monthly instalments. This helps the family of the insured to meet the day to day financial needs.

Lump sum with increasing monthly income: Under this plan, the monthly instalments paid to the beneficiary have an annual increase of 10-20 percent. No doubt, this remains one of the best options available in the market as it helps the dependants in dealing with yearly inflation. The lump sum amount received helps to take care of any immediate loan repayments or bulk cash requirements.

Total sum assured in monthly income: Under this plan, the beneficiary receives the total sum assured in equally divided monthly instalments for a pre-fixed time period. It actually acts as an income replacement for the dependants.

Total sum assured in increasing monthly income: This payout plan acts as income replacement for the dependents and it also plays a major part in helping the family to beat inflation. The monthly instalments received by the beneficiary have an annual increase of a fixed percentage.

Popular options available

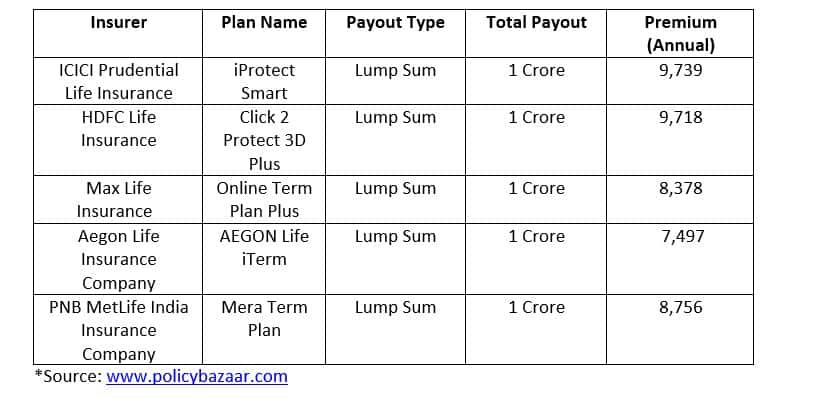

The following is a comparative table of 5 leading insurance companies providing term insurance of Rs 1 crore sum assured for a non-smoker, 30-year-old man who earns between Rs 5 to 7 lakh annually. The duration of the term is 30 years and the payout method is a lump sum.

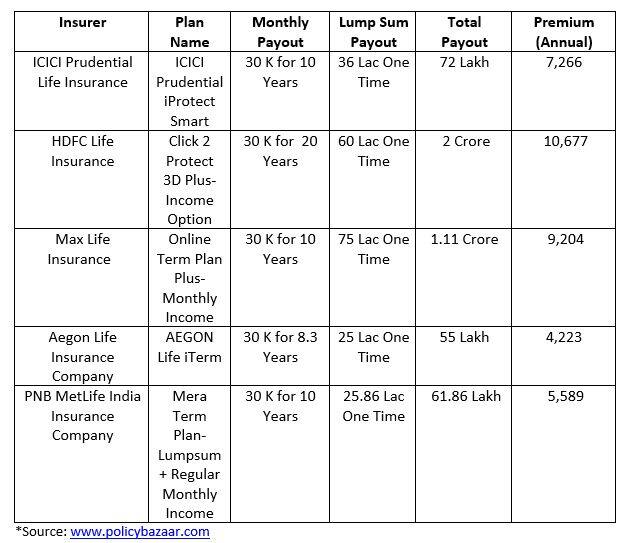

The following is a comparative table of 5 leading insurance companies providing term insurance of INR 1 Crore sum assured for a non-smoker, 30-year-old man who earns between INR 5 to 7 lakh annually. The duration of term is 30 years and the payout method is lump sum + monthly income.

Conclusion

A term plan is no doubt a must-have for any breadwinner of the family and both these payout options have their own set of benefits. All you need to do is analyse your family’s needs and requirements, and choose the most appropriate option for you.

It is suggested that where ever liabilities are required to be paid off, it is advisable to go with the lump sum payout, however, if you wish to get your regular income ensured, staggered payout plan fits the bill.

The writer is Associate Director and Cluster Head- Life Insurance, Policybazaar.com.

((newsletter))