1

Q3 FY24: PB Fintech posts strong numbers, PAT positive with 43% revenue growthDecoding Insurance

All You Need To Know About No Claim Bonus

In simple terms, no claim bonus, commonly referred to as NCB, is the reward given by an insurance company to a policyholder for driving safely and making no claims during a policy term. It is given in the form of discounts on car premiums. It’s a unique benefit through which your premiums can reduce over a period of time.

NCB is applicable only on own damage (OD) premium, which basically covers your car for damages caused due to accidents, collisions, natural calamities, fires, and thefts, etc.

((calculator))

How Does It Work?

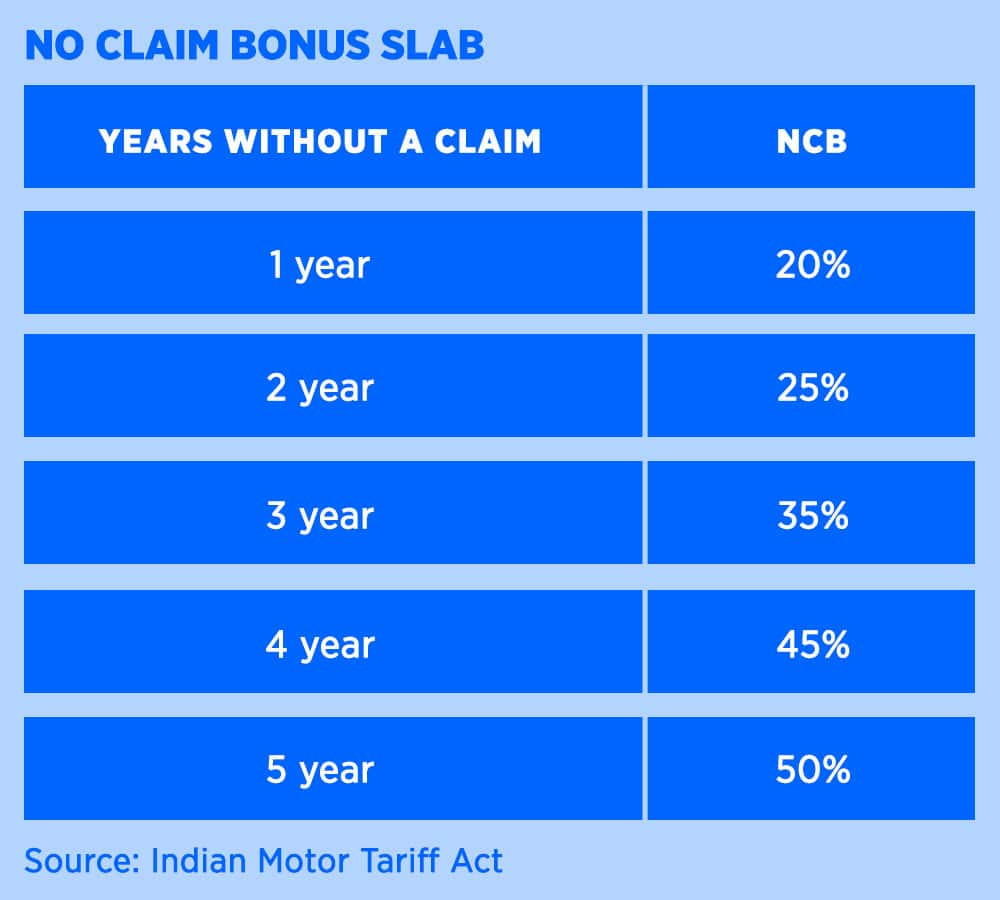

According to the Indian Motor Tariff Act, an insured becomes entitled to NCB only at the renewal of the policy term after a period of 12 months. At the time of the purchase of your car’s insurance policy, NCB stands at 0. With every subsequent claim-free year, a discount on your OD premium will increase on an annual basis if there are no claims. NCB ranges between 20-50%.

Let’s run you through some situations in which you don’t lose your NCB.

A. Timely Renewals Of Car Insurance Policy

A. Timely Renewals Of Car Insurance Policy

It is very important to renew your car insurance policy on time. For the continued benefits of NCB, you must renew your car insurance policy within 90 days of its expiry date. If you renew it after 90 days from the expiry, NCB will become zero and the cycle will start again.

B. When You Buy a New Car

B. When You Buy a New Car

Another benefit of NCB is that it is associated with the policyholder and not the vehicle. This means it is transferable to any other car that you purchase. It can also be transferred to a new insurer.

C. In Case of Third-Party Claims

C. In Case of Third-Party Claims

You don’t lose the benefits of NCB if there is a third party claim (loss of property or life of someone else due to an accident). But, if there is an OD claim, NCB will become zero and again start from the lowest slab.

(Inputs and editing by: Sunny Lamba)