1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

Why You Should Buy Rs 1 crore Health Insurance Plan

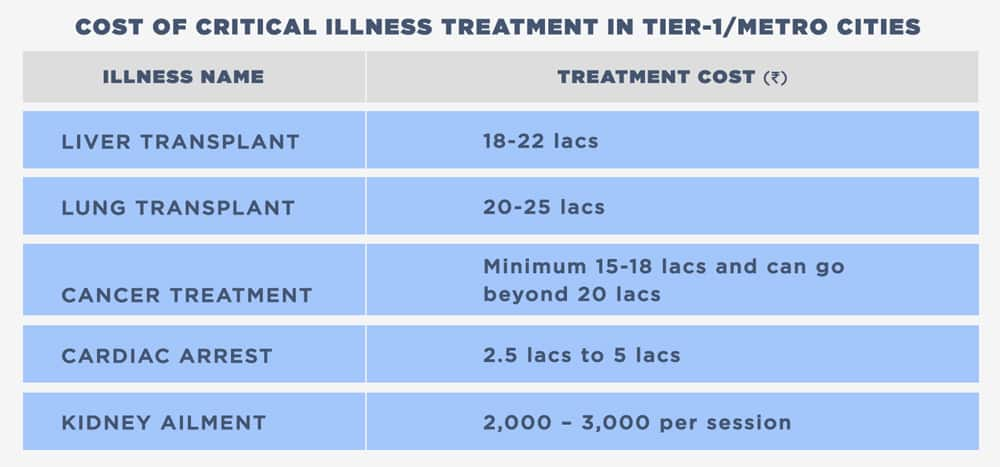

The standard of living of people in India has improved in the last two decades. India is the third-largest economy in the world in terms of purchasing power parity. However, as the spending ability of people increased, the standard of hospital capabilities also went up and so is the insurance coverage. Earlier having a health insurance cover of Rs 1-2 lacs was enough but now even Rs 10 lacs cover isn’t enough for adequate protection. Hospitals in India now provide specialized care like high-end cardiac surgeries, including pediatric cardiac surgery, cancer treatments, neurosurgery, spine surgery, transplants, trauma-related orthopedic surgery, and IVF. With this, the medical bills have also risen. India’s health care inflation has been rising alarmingly at double the rate of overall retail inflation. The average retail healthcare inflation for India was 7.14 percent for 2018-19, witnessing a steep rise from 4.39 percent in the previous fiscal, according to the Economic Survey 2019.

In addition to it, out of pocket health expenses drove 55 million Indians into poverty in 2017. This is more than the population of South Korea, Spain, or Kenya. Of these 55 million Indians, 38 million (69%) were impoverished by expenditure on medicines alone, as per a study by the Public Health Foundation of India. All these factors led insurance companies to introduce health insurance plans offering Rs 1 crore coverage at affordable premiums.

((relatedarticle_1))

“It has been 7-8 years since Rs 1 crore insurance coverage was introduced. At that point in time, Rs 1 crore was a hugely sufficient amount of insurance coverage. High Networth Individual categories always wanted to have a wholesome kind of insurance and didn’t have any issue with paying a higher premium. Those were the categories around which these products were pitched earlier,” said Anika Aggarwal, Director, and Head, Marketing, Digital, and Direct Sales, Max Bupa.

“From then till now, times have changed rapidly especially in the medical industry. Earlier, having a Rs 1 crore health insurance coverage was a luxury, but slowly it's becoming a necessity. In a few cases, Rs 20-25 lacs would be a sufficient amount of cover. But there are also cases in which more than Rs 50-60 lacs of hospitalization bills have been generated especially in the metro cities like Delhi, Mumbai, etc,” she added.

“From the past half a decade, the number of cases are on a rise with higher claim amounts. So, it becomes very important that a sufficient amount of coverage is taken. Earlier, our claims behavior data for higher amounts were very less, now we have sufficient data of higher claims to predict the future and do pricing accordingly,” said Aggarwal.

As affordability has expanded and more financing options come into play, it gives the middle-class population a chance to invest more in insurance. People are also becoming more aware of protecting themselves against unforeseen circumstances by buying an insurance cover. “We keep on sharing our data insights with our insurance partners and that helps in coming up with plans which are better suited for customer needs. We have been sharing this data for the last few years,” said Amit Chhabra, Business Head, Health Insurance.

“One of the things that our insurance partners think through while preparing a plan is the data shared by us. Since our digital platform is strong among data capabilities, our inputs are valuable,” he added. There is also an increased risk of critical illness among Indians due to factors like sedentary lifestyles, pollution as well as old-age. One in 10 Indians will develop cancer during their lifetime and one in 15 will die from the disease, according to a report released by the World Health Organization (WHO) in February 2020.

There are an estimated 1.16 million new cancer cases registered each year in India and around 7,84,800 people die from it each year. Cardiac ailments caused more deaths in 2016 (28%) in India compared to other non-communicable diseases, as per a study by health journal The Lancet published in 2018. These are double the numbers reported in 1990 when heart disease caused 15% of deaths in India.

Ashutosh Shrotriya, Head Products, and Business Process, Care Health Insurance said that when buying an insurance cover, we need to keep in mind not just the average cost of hospitalization today but what it is going to be after 10, 20, or 30 years. “Because the person who is buying health insurance today, will probably need this more once he is of progressed age and if in that age, he is inflicted of some chronic condition like diabetes or hypertension, it is going to be even more difficult for that person to increase his health insurance cover,” he said.

“It is always a safe bet and a good strategy to have more than adequate health insurance cover today so that it can not just pay for your claims today but can also take care of you as you grow older,” he added. Moreover, a lot of private hospitals are charging exorbitant prices to treat Covid-19 patients. Covid-19 treatment in private super-specialty hospital rooms would cost Rs 7 lakh in tier 2 state capital cities and Rs 8 lakh in metros. In private super-specialty hospitals with ICU and ventilators, the cost would be Rs 9 lakh in tier 2 state capital cities and Rs 12.5 lakh in metros.

Treatment bills in a super specialty hospital in a metro city for a really complicated case (like someone who is a senior citizen having pre-existing disease like diabetes, BP, Cardiac, or with Chest-related disease history) can be as high as Rs 12 lakh. This is also a major reason to reevaluate whether your current health cover provides adequate protection against diseases like Covid-19.

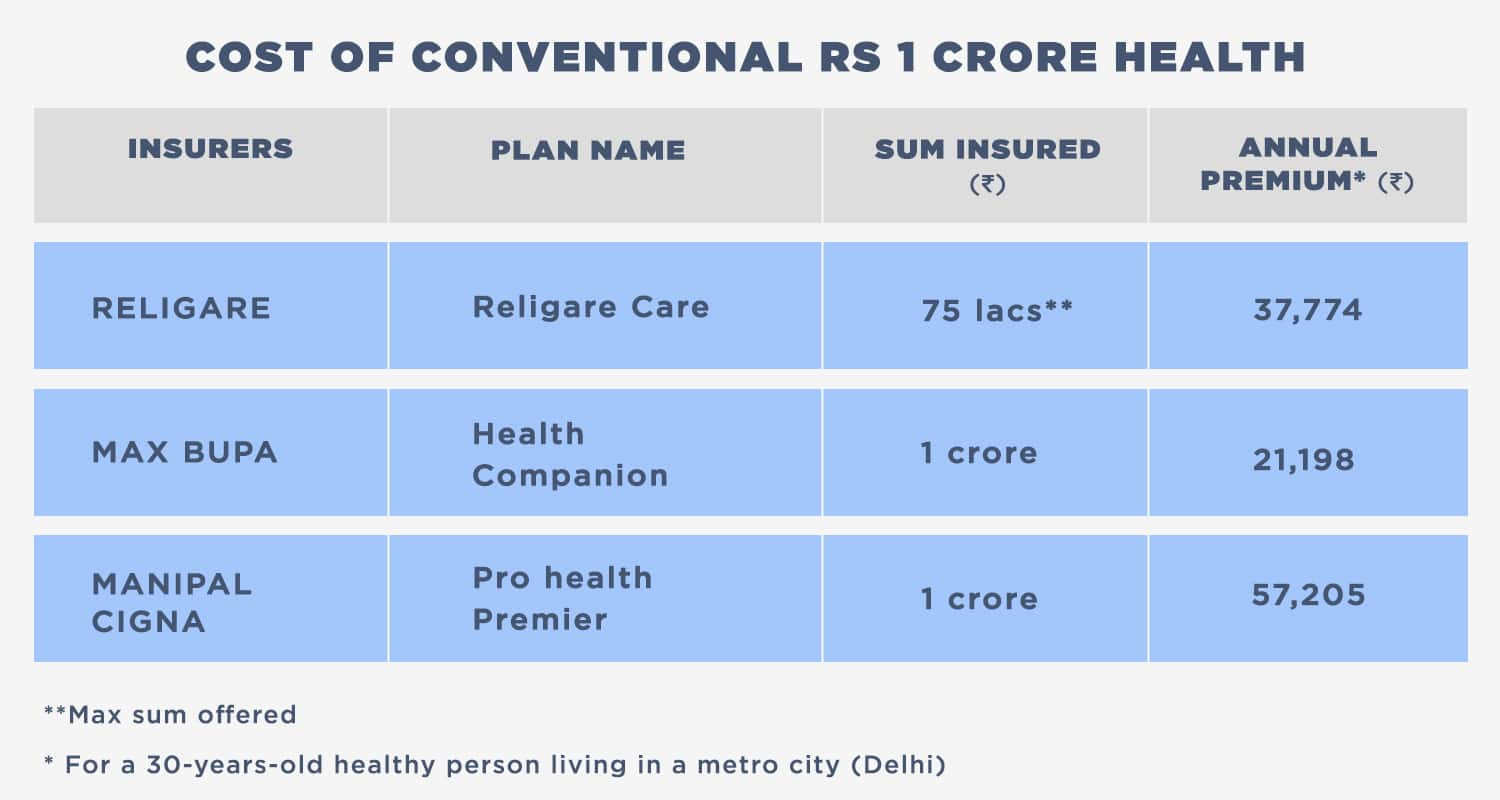

Comparison of conventional Rs 1 crore plans and new-age plans

Many insurers have been offering Rs 1 crore health insurance plans including Care Health Insurance, Max Bupa, Royal Sundaram, Manipal Cigna earlier. Earlier, health insurance plans of Rs 1 crore offered sufficient coverage but at a premium that wasn’t affordable to the middle class. Those policies didn’t have a top-up plan in combination. However, now we have health insurance plans offering Rs 1 crore sum insured but at affordable premiums, almost one-third of what was being charged earlier.

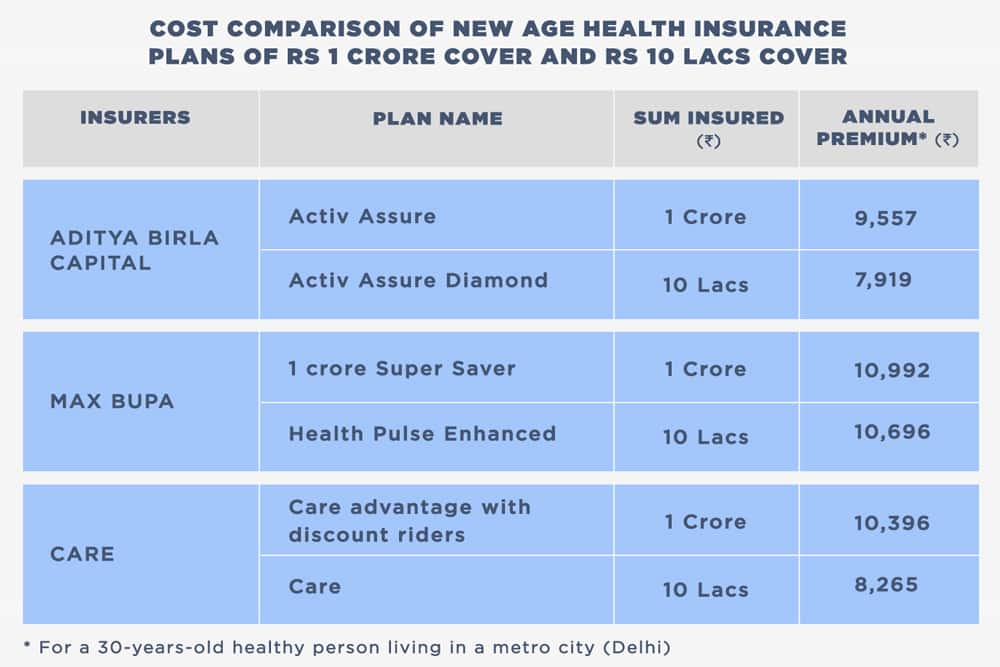

People are usually ignorant of insuring themselves for their health and buy a Rs 10 lacs cover in order to save money. However, insurers have addressed this problem and came up with new-age Rs 1 crore plans which offer adequate coverage, benefits along with affordable rates. “Rs 1 crore covers maybe just 30% more expensive than what a Rs 10 lacs health insurance cover would cost and that should be a very good option for the customer to have a health insurance cover which is good enough for today as well as for tomorrow,” said Shrotriya.

Almost all new age Rs 1 crore health insurance covers are variants of Rs 10 lac covers and by paying 20-30% more, you get the same features of the base plan and additional coverage. Care is the latest addition to the Rs 1 crore category and one of the most evolved plans on the offering.

Insurers offering Rs 1 crore health insurance plan: Cost and their features

Aditya Birla Health Insurance’s Active Assure Diamond Plan comes with a Rs 5 lacs base cover plan and Rs 95 lacs health cover as a Super Health Top-up. In total, the plan offers a sum insured up to Rs 1 crore. In a top-up or a super top-up plan, there is a deductible component and a sum insured component. The deductible amount is a predefined amount that customers will bear, through their own finances or from the base health insurance or any other income source in order to pay for hospitalization. Any amount over and above this deductible amount will be borne by the insurer. Higher the deductible amount, lower is the premium for the top-up or super top-up policy. The age eligibility for this plan is between the age of 18- 45 years.

Under this plan, there is usually a four-year waiting period in the case of pre-existing disease. It offers a no claim bonus of upto Rs 50,000 per annum, maximum upto Rs 2.5 lacs. It also offers 150% reload of your sum insured if it gets exhausted.

It covers medical expenses not only during hospitalization but also from 30 days before and 60 days after hospitalization. It also covers 586 day-care procedures, Ayush medical treatments, e-opinion of medical practitioners for the diagnosis of listed major critical illnesses.

Max Bupa also offers a Rs 1 crore Super Saver plan. Any individual between the age of 18-65 years can buy this product. This plan also has a Rs 5 lacs base cover and Rs 95 lacs super-top up. There is a waiting period of 4 years on existing illnesses declared at the time of purchase. Key features include a bonus of Rs 1 Lac for every claim-free year ( maximum up to Rs 10 lacs, reinstatement of Rs 7.5 Lacs for a non-related illness if the original sum insured gets exhausted in a year), hospitalization at home, daycare procedures, alternative medicines such as Ayurveda and Unani, full claim paid by the insurer, family floater option up to 2 adults and 4 children.

Care Advantage is another plan in this category. The minimum entry age for this product is 5 years while the maximum entry age is lifelong. Unlike the two plans quoted above which have a base cover and a top-up, Care Advantage is a pure base cover of Rs 1 crore. The product also offers a family floater option for up to 2 adults and 4 children. In the family floater option, the minimum entry age is 91 Days with at least 1 insured person of age 18 years or above.

The plan has a waiting period of 4 years for pre-existing diseases. It offers a bonus on no claim in which your health cover will increase by 10% for every claim-free year and up to a maximum of 50%. This means a Rs 100 lacs health cover will increase to 150 lacs in just 5 years. It also offers instant addition of 100% Sum Insured on the utilization of Sum Insured which can be used again for the same illness and the same member also. This is practically double the sum insured at no extra cost. It also covers 6500+ network hospitals offering cashless hospitalization.

Who should buy a Rs 1 crore health insurance plan?

People who have a genetic history of critical illnesses are at a higher risk than others. As a proactive measure, it is advisable that they should get themselves insured with a large cover. Individuals above the age of 40 years are more vulnerable to life-threatening illnesses and it will be advisable to buy a health insurance policy with an adequate critical illness insurance policy.

Those who are sole earning members of the family should buy a Rs 1 crore health plan if they don’t want their family members to go through financial distress or emotional turmoil. People working in a stressful environment or profession should buy this plan because they have a higher risk of having illnesses.

((newsletter))