1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

Why Should You Buy A Health Cover With A High Sum Insured?

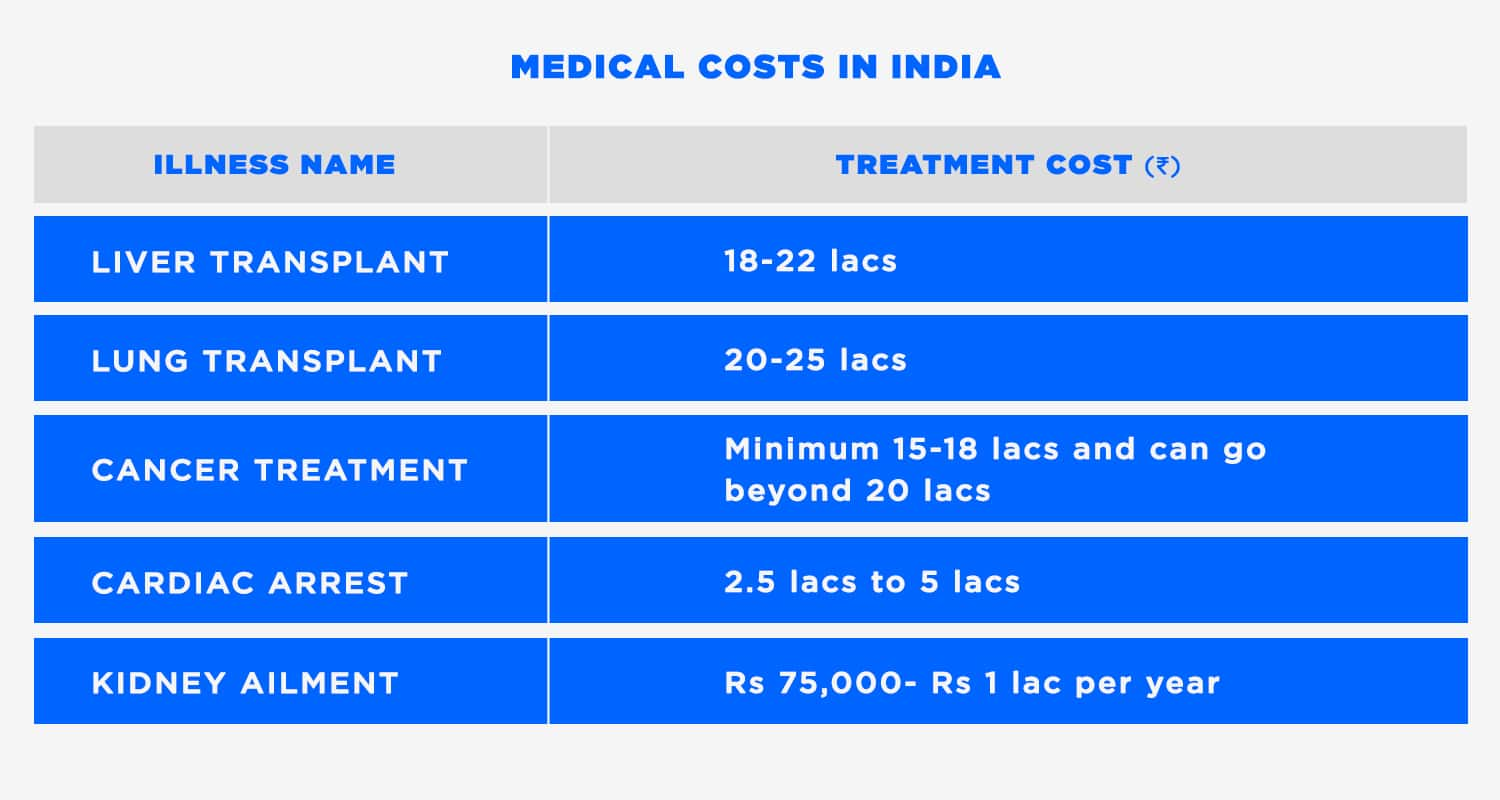

The Indian healthcare sector is growing at a brisk pace due to its strong coverage, services, and increasing expenditure by public as well as private players. Hospitals in India now provide specialized care like high-end cardiac surgeries, including pediatric cardiac surgery, cancer treatments, neurosurgery, spine surgery, transplants, trauma-related orthopedic surgery, and IVF. With this, the medical bills have also risen. India’s healthcare inflation has been rising steadily and alarmingly. It is increasing at double the rate of overall inflation in India. Medical inflation stands at 7.14% for FY 19, according to The Economic Survey.

Moreover, India has one of the highest levels of out-of-pocket expenditures contributing directly to the high incidence of catastrophic expenditures and poverty, as per the Economic Survey. Therefore, having a health cover with a high sum insured is a must especially if you are living in a metro city where the cost of treatment is higher. All these factors led insurers to launch health insurance plans offering Rs 1 crore coverage at affordable premiums.

((calculator))

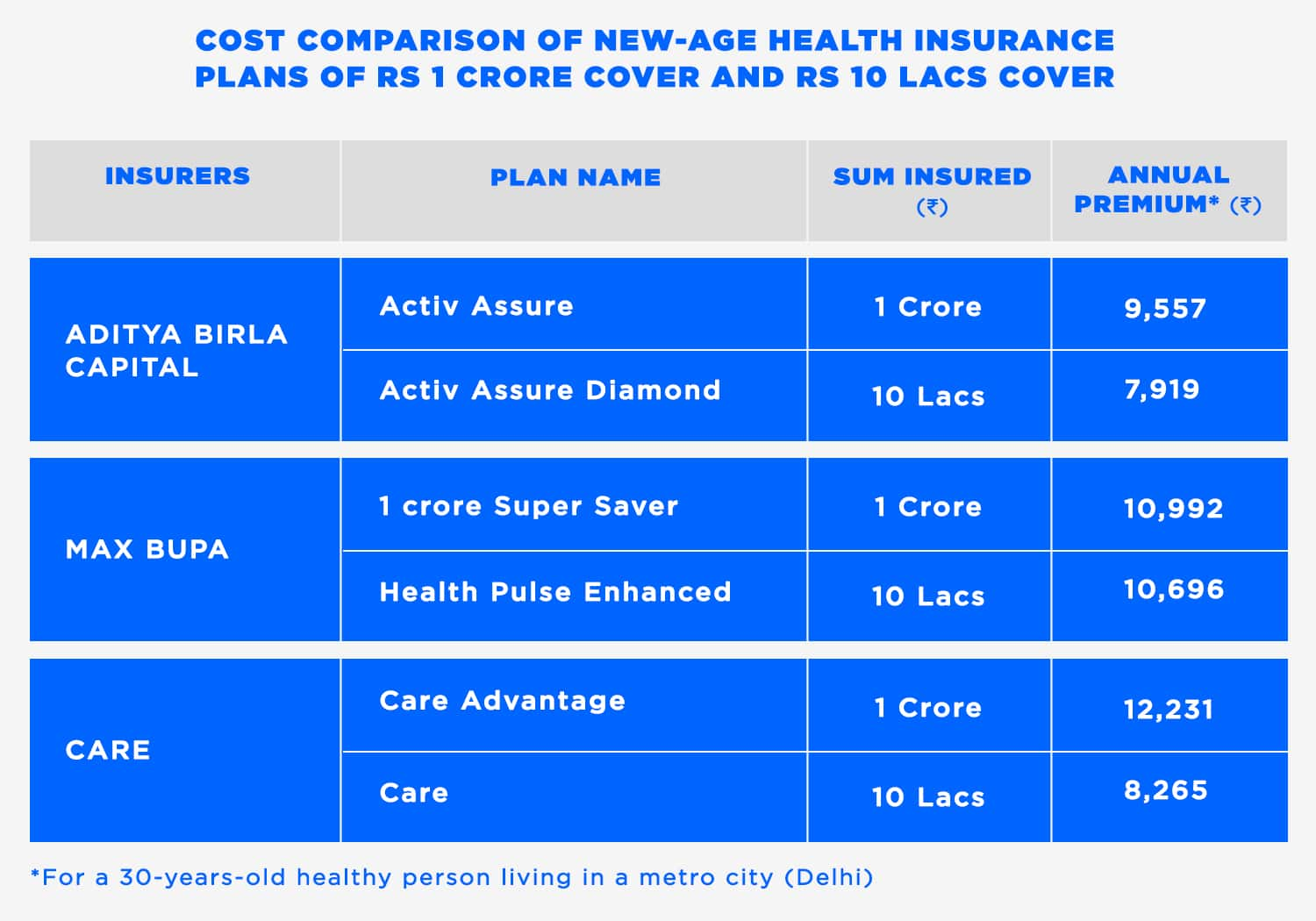

There are plans offered by Care, Max Bupa, Star Health Insurance, Aditya Birla, etc which offer Rs 1 crore coverage. These plans come very affordable. For a 30-years-old individual living in Delhi, Max Bupa’s 1 crore Super Saver health insurance plan will cost Rs 916 per month only. In the United States, you get unlimited coverage for health insurance which is highly expensive but in India, we have Rs 1 crore health insurance plans which are very affordable and as good as unlimited coverage.

There can be a situation when more than one member of your family gets hospitalized in the same year. In this case, having a low-sum insured cover won’t help and you will have to shell out money from your own pocket. For e.g. Mr. Rohit Gupta and his wife Monica have a family floater health insurance policy of Rs 5 lacs. Mr. Rohit had a cardiac arrest and was hospitalized. His surgery cost was around Rs 5 lacs. The entire sum insured gets utilized for his treatment. After a few months, his wife gets dengue and has to be hospitalized where the treatment cost amounts to Rs 50,000. Mr. Gupta had to shell out money from his own pocket for the treatment of his wife because the health cover got exhausted. Therefore, it is imperative to have a high sum insured cover that can cover the treatment for all members of the family.

((relatedarticle_1))

((quote_1))

“The affordability has all the more increased for buying health insurance with the introduction of EMI option. You can easily buy a health cover for Rs 900-1000 per month which is very affordable,” he added.

The rise in the number of people suffering from critical illnesses

The stressful lives that we live coupled with unhealthy and sedentary lifestyles, along with the pollution in metro cities have made us susceptible to health disorders and critical illnesses. The occurrence of critical illnesses is on the rise in India. One in 10 Indians will develop cancer during their lifetime and one in 15 will die from the disease, according to a report released by the World Health Organization (WHO) in February 2020.

[[Also, check out our podcast on 'How health insurance has evolved in the last one year of Covid-19']]

There are an estimated 1.16 million new cancer cases registered each year in India and around 7,84,800 people die from it each year. Cardiac ailments caused more deaths in 2016 (28%) in India compared to other non-communicable diseases, as per a study by health journal The Lancet published in 2018. These are double the numbers reported in 1990 when heart disease caused 15% of deaths in India. Moreover, the cost of treatment of critical illness is also high. Cancer treatment in metro cities can cost as high as 15 lacs.

Conventional Rs 1 crore health insurance plans vs new age plans

Though, the introduction of high-sum insured covers isn’t new. “It has been 7-8 years since Rs 1 crore insurance coverage was introduced. At that point in time, Rs 1 crore was a hugely sufficient amount of insurance coverage. High Networth Individual categories always wanted to have a wholesome kind of insurance and didn’t have any issue with paying a higher premium. Those were the categories around which these products were pitched earlier,” said an expert from the insurance industry.

“From then till now, times have changed rapidly especially in the medical industry. Earlier, having Rs 1 crore health insurance coverage was a luxury, but slowly it's becoming a necessity. In a few cases, Rs 20-25 lacs would be a sufficient amount of cover. But there are also cases in which more than Rs 50-60 lacs of hospitalization bills have been generated especially in the metro cities like Delhi, Mumbai, etc,” she added.

Earlier, health insurance plans of Rs 1 crore offered sufficient coverage but at a premium that wasn’t affordable to the middle class. Those policies didn’t have a top-up plan in combination. However, now we have health insurance plans offering Rs 1 crore sum insured but at affordable premiums, almost one-third of what was being charged earlier. The price of Rs 1 crore plans is almost the same as a Rs 10 lacs cover. So, it is always better to buy a higher sum insured so that you and your family are adequately covered in case a health emergency strikes.

The new age Rs 1 crore health insurance plans are comprehensive and have a lot of features. For example, Aditya Birla Health Insurance’s Active Assure Diamond Plan comes with a Rs 5 lacs base cover plan and Rs 95 lacs health cover as a Super Health Top-up. In total, the plan offers a sum insured up to Rs 1 crore. It also offers free health checkups, no room rent capping, health returns discounts on renewal, bonus on no claim, restoration of cover, hospitalization at home, etc.

Who should buy a high-sum insured cover?

All individuals should buy a high-sum insured cover keeping in mind, not just current medical inflation but also the rise in medical costs in the future. Before choosing the sum insured of your health cover, you should keep in mind that it covers the claims not just today but also in the future when medical costs will further rise. People above the age of 40 years are more vulnerable to life-threatening diseases, so it is advisable for them to buy a high-sum insured health insurance policy that covers critical illness as well. It is always advisable to buy a health cover at an early age. “The person who is buying health insurance today will probably need it more once he gets old. If he is inflicted with a chronic illness like diabetes or hypertension, then it would be difficult for that person to increase his health insurance cover,” said Ashutosh Shrotriya, Head, Products and Business Process, Care Health Insurance.

Those who are sole earning members of the family should definitely buy a high sum insured cover so that their savings aren’t drained out whenever a health emergency comes up. Moreover, people working in stressful jobs that involve a lot of mental and physical work should also go for a high sum insured plan because they have higher chances of lifestyle diseases.

((newsletter))