1

Q3 FY24: PB Fintech posts strong numbers, PAT positive with 43% revenue growthDecoding Insurance

Why Health Insurance Is Important For Senior Citizens

Old age opens doors to a number of health complications and vulnerabilities. It is associated with a gradual decrease in physical and mental strength and loss of immunity. This lowering of immunity makes the elderly more susceptible to chronic illnesses and even Covid-19.

A recent report by the Ministry of Health and Family Welfare shows that 50% of deaths due to COVID-19 have happened in the age group of 60 years and above; 37% deaths belong to the 45-60 years age group; while 11% deaths belong to the 26-44 years, age group. These numbers highlight that people above the age of 45 belong to the high-risk group.

According to the Center for Disease Control and Prevention, those aged above 65 are at a higher risk of severe illness. With increasing age, infection-fighting cells, otherwise known white blood cells reduce. The body’s reduced immunity makes it difficult to fight against viruses like the coronavirus, and that with diseases such as cancer, renal failure, and diabetes.

When it comes to healthcare expenses, senior citizens face a double whammy. While post-retirement their income drops substantially, the inflation in healthcare costs proves to be a big drain on their retirement savings. And, during the current pandemic, lack of health insurance for the elderly can be disastrous.

To put into perspective, treatment cost at a super specialty hospital in a metro city for a complicated case (like someone who is a senior citizen having a pre-existing disease such as diabetes, BP or with chest-related disease history) can go upwards of Rs 15-20 lakh.

Health Insurance For The Elderly

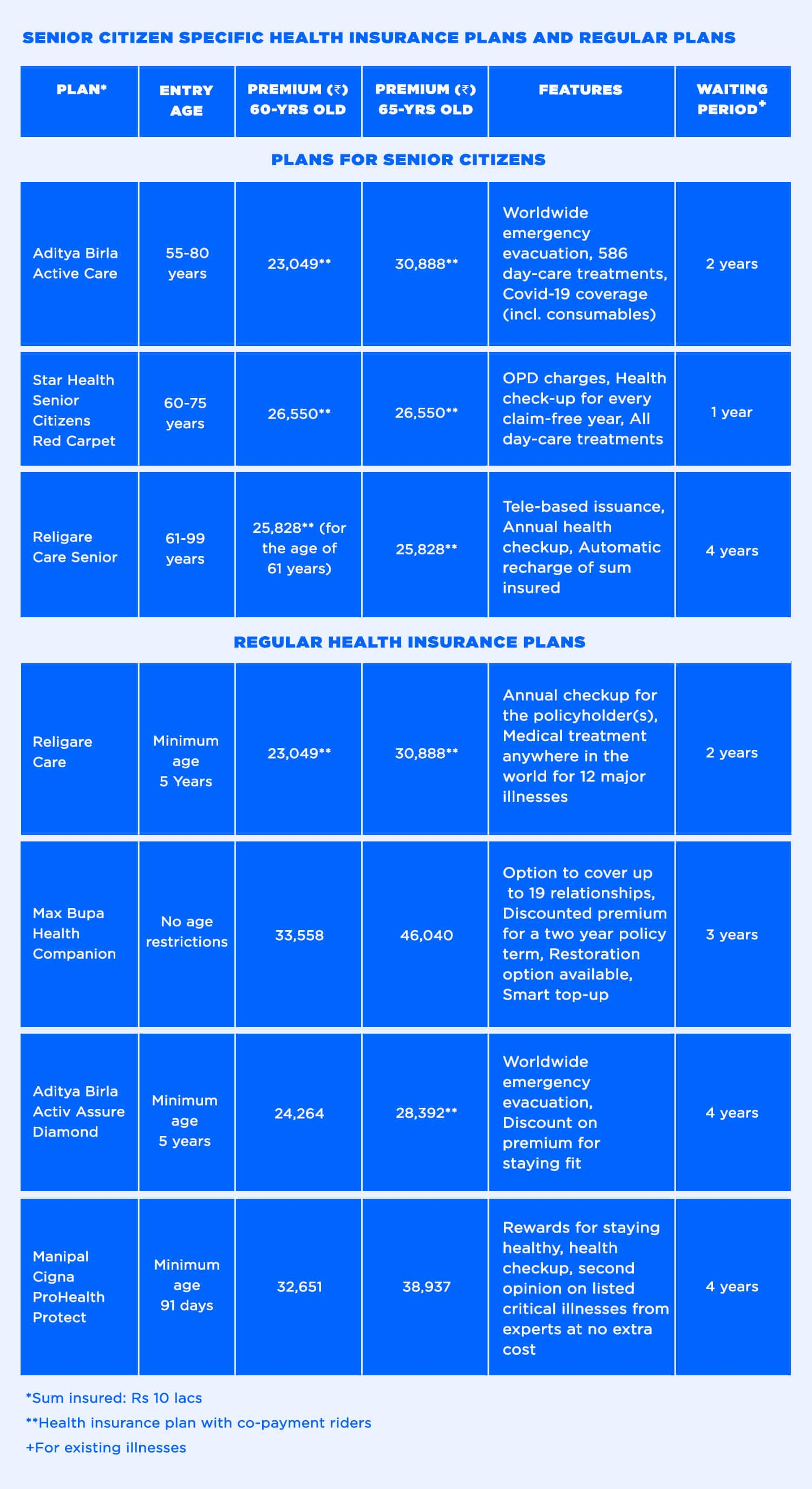

Today, there are a range of health insurance products available for the elderly. If you have dependent parents, buying a good cover for them makes for a sound financial decision. It is advisable that if the person’s age is under 60 years, they should opt for a regular health insurance plan because they are rich in features. The minimum sum insured that senior citizens must opt for is Rs 10 lakh.

Though, regular health insurance plans are a little expensive as compared to senior citizen specific plans, but they don’t have co-payments or lesser co-payments; and sub-limits as compared to senior citizen specific health insurance plans.

For example, Religare Care health insurance plan provides a wide range of sum with the sum assured going all the way up to Rs 75 lakh. It also provides cover for alternative therapies such as Ayurveda, Homeopathy, Unani and Siddha. It covers more than 500 daycare treatments.

((calculator))

However, if the age of the individual is above 60 years and they are not eligible for a normal health insurance plan, then they should opt for a senior citizen specific plan. Senior citizen specific plans are comparatively cheaper than regular health insurance plans but have co-payments and sub-limits which are compulsory. They also have a lesser waiting period on existing illnesses as compared to regular health insurance plans.

Co-payment means sharing medical expenses with the insurer. They are applicable for: specified ailments, specified hospital charges, and hospital treatment. Sub-limits are certain caps placed by health insurance companies in the form of a limit that is pre-determined, on the claim amount for a specific disease and/or treatment procedure.

Specific Plans For Senior Citizens

Let’s look at some senior citizen specific plans that you can choose from. Aditya Birla Health Insurance’s Activ Care Senior Citizens Plan is available in three variants — Standard, Classic, Premier — with sum assured ranging between Rs 10-25 lakh. The plan covers those between 55-80 years of age.

Star Health’s Senior Citizens Red Carpet Plan gives an option of no pre-insurance medical test before buying the plan. It also offers a discount of 10% on premium if certain medical records of a customer is submitted, such as stress thallium report, BP report, sugar (blood & urine)-fasting/postprandial, blood urea and creatinine.

Similarly, Religare’s Care Senior plan offers 10% increase in sum assured every policy year in case of claim-free year. It also provides coverage for an annual health checkup to the policyholder.

Making Health Insurance Pocket Friendly For The Elderly

Amit Chhabra, Business Head, Health Insurance, Policybazaar says, we are trying to get all types of health insurance plans for senior citizens on our platform, which are both cheap and expensive.

((quote_1))

In fact, recently Insurance Regulatory and Development Authority of India had asked Insurers to offer a monthly premium payment option to consumers, which is also now available on Policybazaar. “This is a good step, especially for senior citizens because usually, the ticket size of the premium is high. This move will help them in opting for health covers of a higher sum assured since they don't have to pay the premium on an annual basis,” Chhabra adds.

((quote_2))

Evolution of Health Insurance For Senior Citizens

Over the years, various features have been introduced in health insurance plans in order to enable greater access for senior citizens.

Till a few years ago, those above the age of 65 years were not eligible to buy a health insurance plan. However, now, they can easily buy one. In the last 2-3 years, there are various options that have been introduced for senior citizens to buy a health insurance plan as per their needs.

Chhabra says, “there are health insurance plans available which provide coverage for domiciliary treatment. Earlier, it wasn’t a component of health insurance policies but was introduced in the last 4-5 years especially for senior citizens.”

Today, there are plans available that cover a lot of day-care treatments including cataract, radiotherapy, chemotherapy, dialysis and angiography. If you have an elder at home, there’s absolutely no reason to delay buying a good health cover for them right away.

(Inputs and editing by: Sunny Lamba)