1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

What you must know about travel insurance

As the skies opened two months back, many of us planned our travels internationally. Now, in order to get a visa to certain countries, buying travel insurance is mandatory. But even where it isn't mandatory, what makes travel insurance indubitably useful? The answer is"Life is full of uncertainty, and travel insurance can give you just the kind of certainty you need to travel worry-free."

It’s always best to be prepared in advance, especially since we all know how the pandemic affected all of us emotionally and financially. Unexpected situations, especially when going overseas and away from home, can be quite tough. Moreover, with the sudden surge in the covid cases yet again around the world, it's necessary to have your travel insurance in place while you plan your next trip. Thankfully, COVID-19 in all of its variants, is now being treated as any other medical emergency by travel insurance policies. Travel insurance has always been essential to cover all kinds of travel-related risks, including delayed flights, lost luggage, accidents or illnesses abroad, loss of travel documentation, damage caused by weather-related risks, and now Covid treatment.

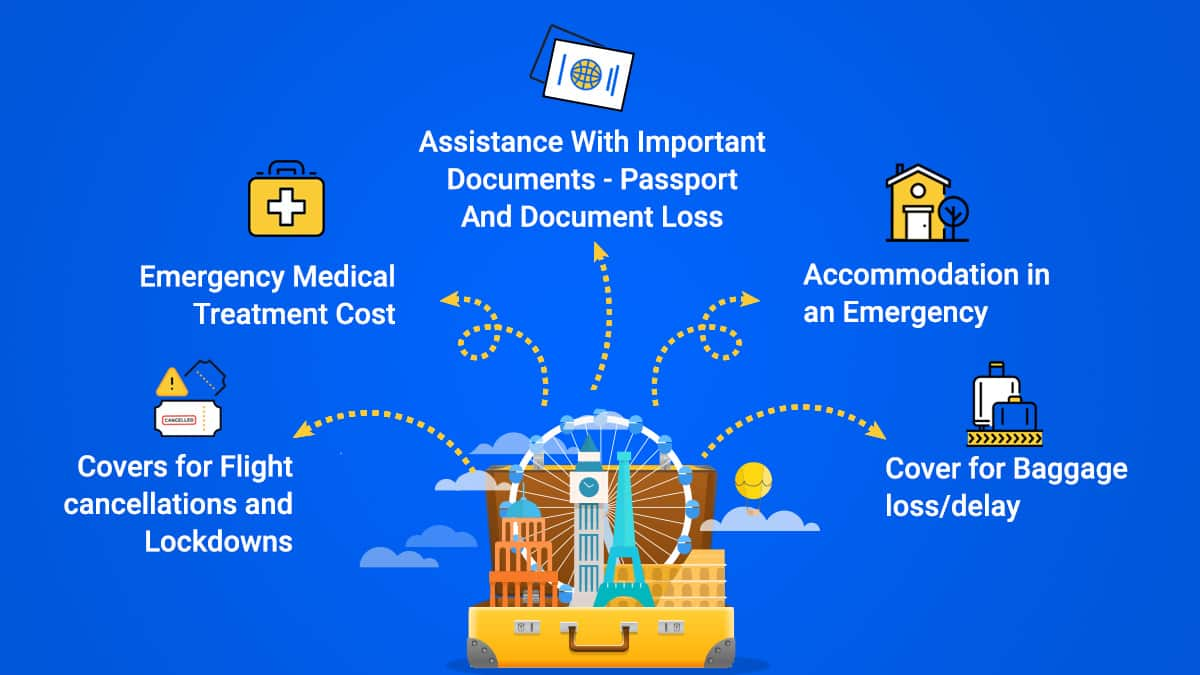

Here’s a list of all the things you must know that travel insurance covers you for.

1. Covers for Flight cancellations and Lockdowns

Even though international flights have reopened, you never know when these countries will return to lockdown and prohibit people from entering. What if your airline tickets go to waste, or, what if your connecting flight is canceled owing to a lockdown? Or suppose you’ve reached your destination, however, before you were scheduled to return, your host location sees a dramatic increase in infections, forcing the authorities of that area to ban all travel activities in and out. In such a case, you will be stranded in that nation until the Indian government can arrange for your return. In such a scenario, a comprehensive travel insurance plan will be your only source of assistance. It will reimburse all of your additional expenses incurred during the lockdown.

2. Emergency Medical Treatment Cost

During these COVID times, multiple variants are being found in different countries. And, although COVID-19 vaccinations can protect you against specific variants, you are not immune to all coronavirus variants. Now, suppose if you contract COVID or any other medical emergency occurs while you are traveling, then travel insurance will cover the emergency medical treatment cost abroad. This includes doctor and hospital fees, as well as lab testing and medication, up to the limits of your plan. Moreover, the treatment expenses abroad can certainly burn a hole in your pocket, putting you in a financially difficult situation. Thus, make sure to invest in a comprehensive travel plan which covers Covid-related expenses as well as other illnesses. It is very important to read through the policy carefully to understand the policy inclusions and exclusions.

3. Cover for Baggage loss/delay

Have you ever wondered how disappointed you would be if your checked luggage does not arrive at the baggage belt? Although airlines are growing better at tracking your luggage these days, there is still a chance that you will lose your luggage or that it will be momentarily forgotten while traveling. Having proper travel insurance, on the other hand, can save your money by reimbursing you for reasonable additional purchases made for essential things. Travel insurance also covers the loss or damage of luggage, as well as the repair or replacement of lost or damaged items, or the actual monetary value, whichever is lower. It is crucial to note, however, that the compensation is entirely dependent on the limitations of your vacation.

4. Accommodation in an Emergency

Natural disasters such as fire, explosion, earthquake, storm, and hurricane may force you to seek emergency shelter. However, arranging housing in a new location can be made easier if you have travel insurance, since it will help save you extra out of pocket expenses.

5. Assistance With Important Documents - Passport And Document Loss

It can be very upsetting to lose your passport or other important documents in a strange location. It's because replacing it is both time-consuming and expensive. Travel insurance covers fees incurred in obtaining fresh or duplicate documents, up to the maximum limit mentioned in the Policy Terms and conditions. However, any deductibles will be your responsibility.