1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

The Story Behind Introduction of Capital Guarantee Solutions

The pandemic has caused havoc for not just public health but also economic health across the globe. There has been a lot of volatility in the market owing to the pandemic. Sensex crashed last year to 27,590 base points during the first wave of Covid-19 but increased by 82% post the first wave. It again dropped to 48,000 points during the second wave.

Policybazaar has always been a customer centric brand and leveraged technology to come up with personalized products owing to the individual needs of the customers. During interactions with our contact centre executives, call transcriptions, customer feedback and focus group discussions, we came to know that the biggest fear among consumers was investing in market-linked products. They feared that they wouldn't get their investments back if the market went down. Their hard-earned money would be washed out.

((relatedarticle_1))

Hence, we identified the needs of our customers and thought of a product that provides capital guarantee for the amount invested to investors, simultaneously, they can enjoy the market upside. So, we came up with Capital Guarantee Solutions- a unique plan which gives a 100% capital guarantee to investors.

What are Capital Guarantee Solution Plans?

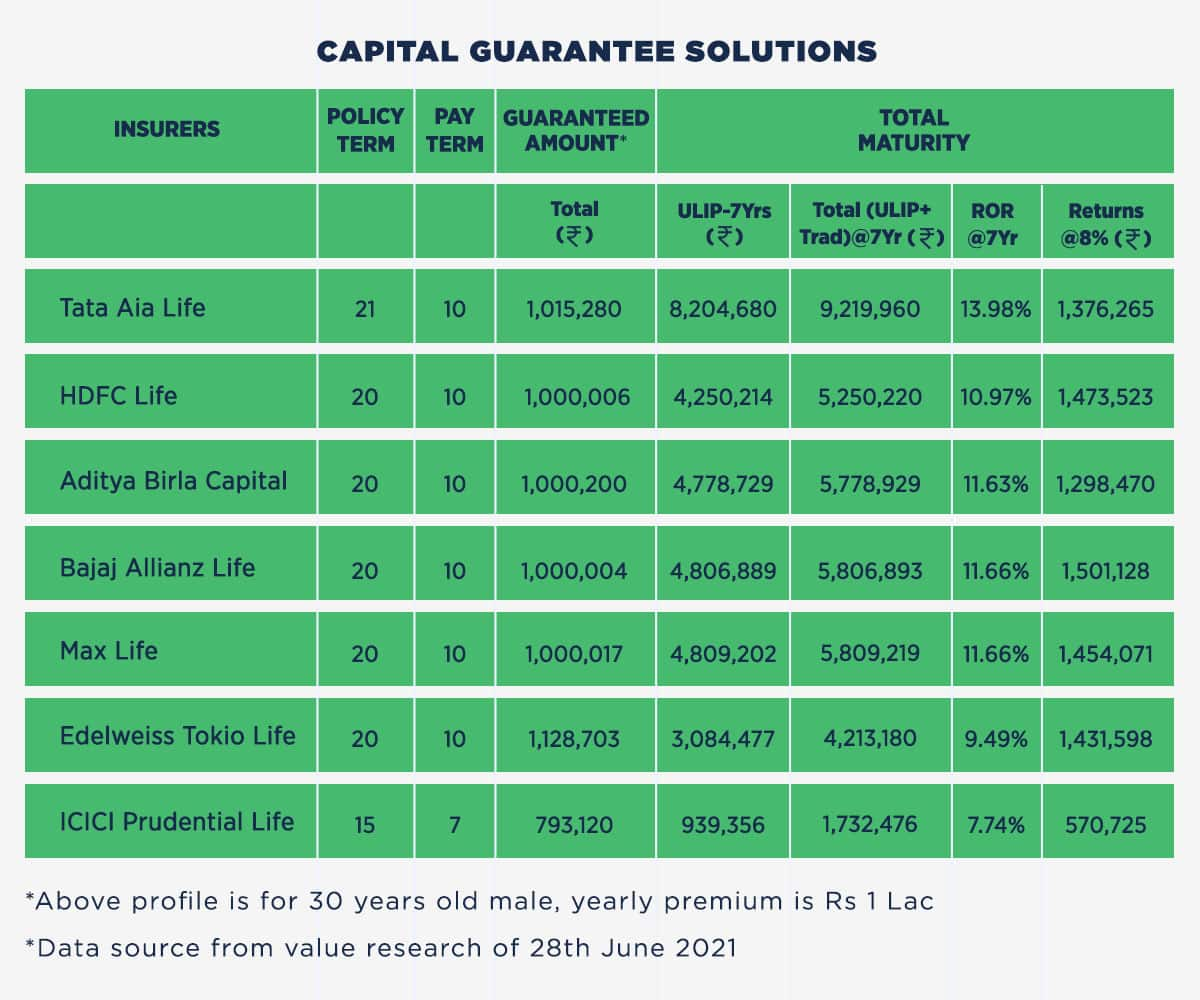

Capital Guarantee Solution plans are a combination of Unit Linked Investment Plans (ULIPs) and guaranteed return plans. Under these plans, the capital invested by the customer over the years is completely guaranteed and secured and they even enjoy the upside of the market through money invested in equity funds. Around 50-60% of invested amount goes into guaranteed return products and the rest goes into ULIPs. You get maturity value based on upside on market-linked return from the ULIP component as well as returns on the traditional guarantee plan when your policy tenure ends.

The biggest advantage of these plans is that the premium you pay throughout the policy term is 100% guaranteed. This means, no matter how bad the market performs, your entire invested amount will be safe. Given the present low rates of interest and no expectation of a rise in the coming few years, it is advised to better lock in your money in long-tenure plans such as Capital Guarantee Solution on the present charges.

Pricing engine

Policybazaar team specially made a pricing engine on their backend which identifies the split of how much invested money goes into traditional products and how much goes into market-linked ones. Logic is automated at the backend which is calculated dynamically for every insurer.

Benefits

In these plans, investors also get a life cover which is up to 10 times of their annual premium. The product gives better returns: 10-12% (assuming that the equity portion gives 12-15% over a policy term) compared to FD (5-6%) and debt mutual funds (7-8% over 7 yr fund performance). Moreover, unlike mutual funds and FD, investors can save tax on premium under Section 80 C and tax on returns under section 10(10D) in Capital Guarantee Solutions. There are no Long Term Capital Gains (LTCG) in Capital Guarantee Solutions (If total premium Invested in ULIPs purchased after 1st Feb'21 doesn't exceed Rs 2.5 Lacs) whereas there is 10% LTCG on mutual funds.

Have a long term horizon

You can choose any policy term in these plans which varies between 10-40 years and premium paying term varies between 5, 7, 10, 12 years. You can choose the policy term and pay term depending on your purpose for investment. You should have an investment horizon of 10-15 years as equity markets give a good return in long-term investment.

Initially, Policybazaar started off with just one insurer-HDFC Life, followed by Bajaj Allianz and TATA AIA. Seeing the success of the product, more insurers are keen to have it onboard. The product was non-existent in the market 15 months back, and now it comprises 50% of the company’s sales.

((newsletter))