1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

Term Insurance: Payout Options Decoded

When it comes to financial planning for your family, the first and foremost element is having term life insurance. It acts as an umbrella in the absence of the sole breadwinner of the family. Term life insurance aids in protecting one’s income and helps in legacy planning. Online term insurance plans are one of the cheapest financial instruments available. A Rs. 1 crore term insurance cover that provides coverage for 100 years for a 30-year-old individual can cost between Rs. 1,000-3,000 per month only.

When you buy a term insurance plan, your nominee receives the death benefit which is the total amount received in case of the death of the policyholder. This death benefit or payout can be received in many ways. Before buying your plan, you can choose the payout option depending on your financial needs. These payout options are listed below:

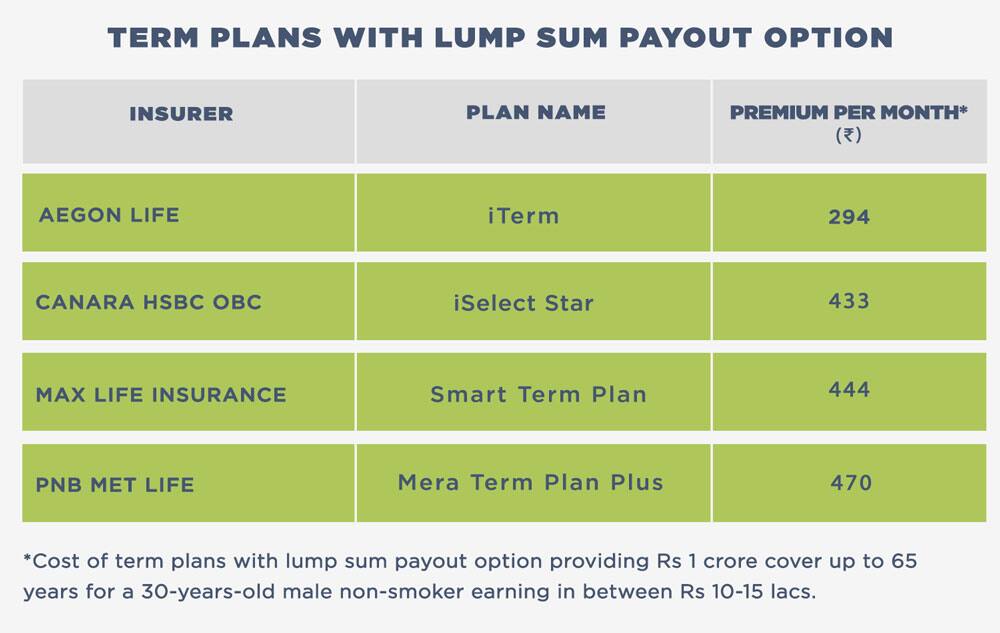

Lump-Sum Payout

In this option, the policyholder pays an annual premium for a fixed period, usually, 30-50 years against a total sum assured. If the policyholder dies, the nominee/beneficiary gets a lump sum amount that is equal to the sum assured. For example, Mr. Deepak bought a Rs 1 crore term cover at an annual premium of Rs 10,000. The policy tenure was 35 years. In the case of his absence during the policy tenure, his family will get Rs 1 crore lump sum amount in one go.

((calculator))

Staggered Payout

Due to the limited financial knowledge, your family members may not know how to use the lump sum amount wisely. Hence, despite buying a policy that you think will protect your family, there could still be a case where the basic purpose of buying insurance is not met.

Therefore, in the last 5-6 years, insurers came out with staggered payout options wherein the nominee gets periodic funds as per their requirements. Instead of a lump sum amount, your nominee will get 10% of the insured amount and the rest would be paid as monthly installments over the next 15-20 years. You can choose from any of these staggered payout options based on your requirements:

Monthly income: In this option, the nominee receives the total sum assured in monthly installments.

Lump-sum with monthly income: Under this plan, the beneficiary/ nominee receives around 50% to 70% of the total sum assured just after the death of the insured, and the rest of the amount is paid through monthly installments to support the family’s financial requirements.

Lump-sum with increasing monthly: In this option, the beneficiary receives a portion of the total sum assured as a lump sum and the remaining sum assured as monthly installments with an annual increase of 10-20%. This option helps family members deal with inflation.

Increasing monthly: In this option, the beneficiaries receive the total sum assured in increasing monthly installments. The installments increase at a rate of 10% to 20% in order to help the dependents fight inflation.

((newsletter))