1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

Smoking Is Injurious To Health And Your Life Insurance Premium Too

Life insurance is an important part of your financial planning. And, it is important to understand a few key points before buying a cover, especially if you are a smoker.

Smoking is injurious to health is a known fact. But, do you know you could end up paying a significantly higher premium when buying a life insurance policy? Let’s understand how your smoking habits impact your plan.

Definition of a Smoker for Life Insurance Companies

All forms of nicotine consumption is considered as smoking by life insurance companies. This can be in the form of cigarettes, bidi, gutkha, khaini, flavoured pan masala, cigars, pipes, hookahs, chewing tobacco, nicotine replacement therapies (lozenges, gums, inhalers), heated tobacco products, marijuana.

There is no fixed frequency for someone to be considered as a smoker. It's always a ‘Yes’ or ‘No’ option that the customer has to select while applying for a life insurance cover. Even if you have smoked one cigarette in the last one year, you will fall in the definition of a smoker.

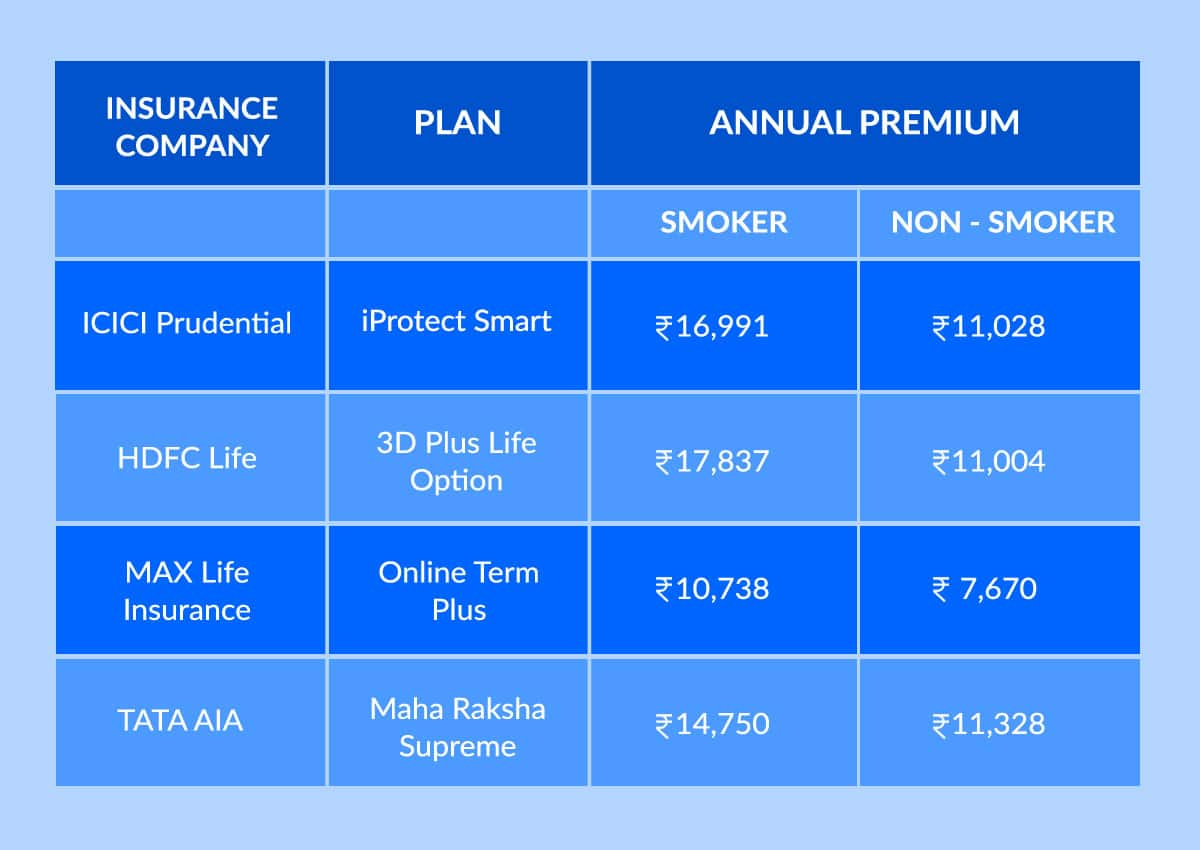

Life Insurance Rates for Smokers vs Non-Smokers

Life insurance rates are higher for a smoker vs a non-smoker. For instance, a 30-year old non-smoker, earning between Rs 10-15 lacs, the annual premium for a Rs 1 crore life cover would be Rs 11,028. Whereas, the annual premium for a smoker would be 54.07% more than a non-smoker i.e. Rs 16,991.

Why Does Life Insurance Cost More For a Smoker?

How do insurers decide the premium one has to pay? A lot depends on your current health condition.

Smoking and smokeless tobacco use can cause many forms of cancer, heart disease, stroke, lung diseases, diabetes, and chronic obstructive pulmonary diseases (COPDs), which includes emphysema and chronic bronchitis. Smoking also increases risk for tuberculosis, certain eye diseases, and problems of the immune system, including rheumatoid arthritis.

Certainly, your life expectancy/mortality depends upon your current health status and this is the basis for deciding the premiums of a life insurance policy by an insurer. Life insurance companies protect themselves from higher risk by increasing rates for tobacco users. However, it won’t prevent you from buying a policy.

((calculator))

How Do Insurers Find Out If You Are a Smoker?

When you apply for a life insurance policy, you will be inquired about your usage of tobacco products in the last 12 months. While it may be easy for you to lie about it, insurers find out using medical or nicotine tests through which nicotine can be found in your blood or urine samples.

What if You Lied About Your Smoking Habits to Insurers?

Smoking is a self-disclosure and you should be honest about it when applying for a life insurance policy otherwise it will be considered as a fraud. Non-disclosure of smoking will lead to claim rejection at the time of death. Moreover, insurers do not issue policies without a medical test for a certain limit of sum insured.

How Long Do You Have to Quit Smoking to be Considered a Non-Smoker for Life Insurance?

You should refrain from smoking for at least 12 months to qualify for non-smoker insurance rates from most companies. However, this 12 months duration can differ across insurers.

What if I wasn’t a Smoker But Started After the Policy Was Issued? Will My Premium Change?

No, the premium will remain the same. However, in the life insurance segment, it is good to give a declaration that you have started smoking, the insurer can then again conduct your medical test and revise rates if nicotine is found.

What If I Quit Smoking Later? Will My Premium Change?

No, the premium will remain the same. However, some insurers offer discounts to policyholders for quitting smoking at the time of renewal from second year onwards. The policyholder will have to undergo medical tests after which the insurer will decide the applicability of this benefit.

Do Premiums Differ On the Frequency of Smoking?

The premium rates do not differ at the time of payment when you declare yourself as a smoker. However, if a customer receives a counter offer the price might be higher for a customer who has a higher nicotine level.

According to the World Health Organization, smoking kills over 1 million people in India annually and it is the fourth leading cause of non-communicable diseases such as cancer and heart ailments, which are responsible for 53% of all deaths in India. In India, 34.6% of adults are smokers.