1

FY24: 34% Revenue growth, PAT improved from a loss of 488 Cr to a profit of 64 Cr, improvement of 552 CrDecoding Insurance

How to Check Car Policy Status

With the digital presence of insurance companies, customers can easily keep everything at their fingertips. From buying car insurance to checking details of their policy everything can be done online. As car insurance is mandatory in India (at least a third-party insurance), one may not forget that it is also necessary to keep a tab on it. Every insurance policy has an expiration date and most of which needs to be renewed annually. Furthermore, if your car insurance policy has expired, you might end up paying heavy fines. Therefore, it is necessary to check the status of your car insurance policy, the policy period, whether your car is still covered, or any other important details you may require in the future. One may also need policy details in case their policy document is misplaced or if the policyholder meets with an accident and the car in question needs to be tracked down.

There are several methods for checking the status of a car insurance policy, both online and offline:

1. Policybazaar

- Visit the official website of Policybazaar

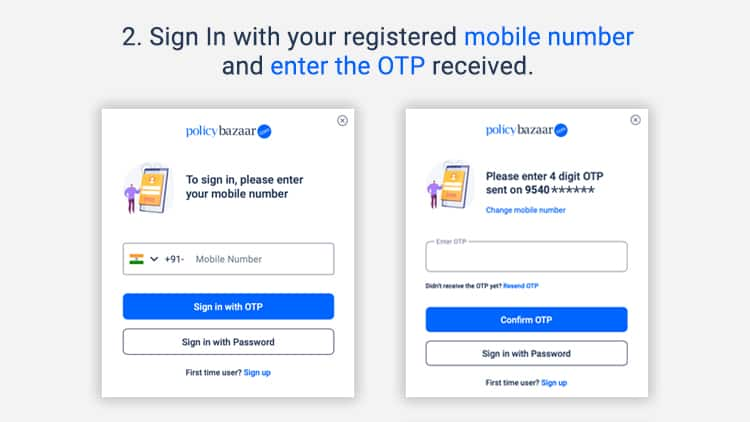

- Log In with your registered mobile number and enter the OTP received.

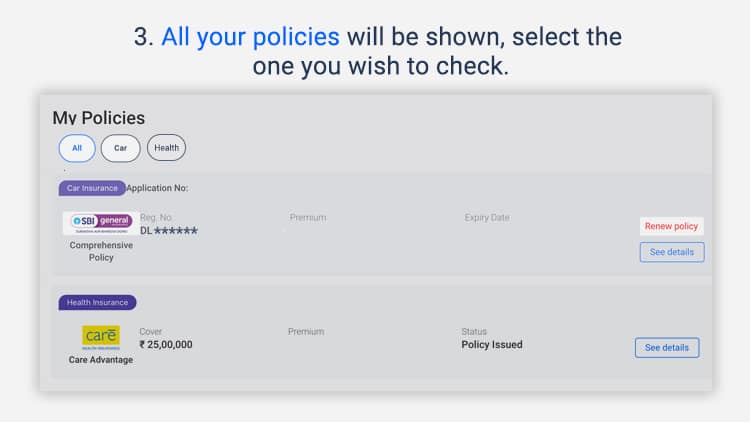

- All your policies will be shown, select the one you wish to check.

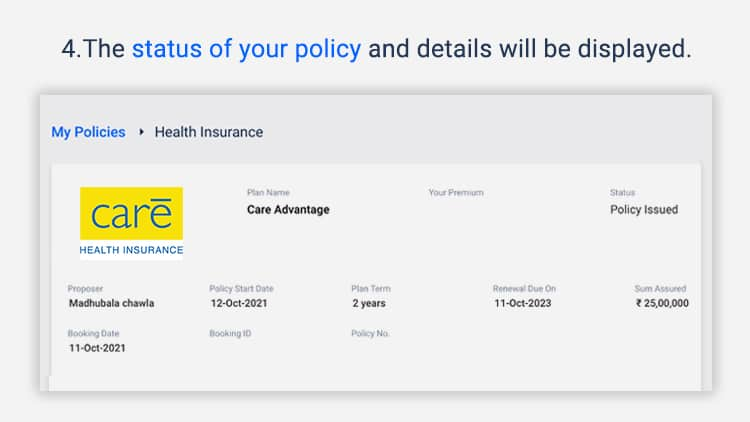

- The status of your policy and details will be displayed.

2. Insurance Information Bureau (IIB) Web Portal

- Go to the IIB's website.

- When requested, enter the data of your car.

- Select the "SUBMIT" button.

- Now you can check your policy status and review the policy details. If there is no current relevant policy, the information of the prior applicable policy will be displayed.

- If you are unable to access any information, try searching by the car engine or chassis number.

Some crucial information to remember while checking the status of your insurance policy with IIB:

- The available details on the platform will only include insurance policy details from April 1, 2010.

- To appear on the IIB online platform, a policy must be at least two months old.

- Only the vehicle engine number and chassis number are provided to IIB by insurance providers for new cars.

3. Vahan E-Services

- Visit the VAHAN e-services page and click on ‘know your vehicle details’.

- Input the car's registration number and the verification code.

- Select Search Vehicle.

- Your insurance information will be available.

4. QR Code

The simplest method is to check your car insurance status by QR code. The Insurance Regulatory and Development Authority (IRDA) has mandated that every automobile insurance policy should have a matching QR code with the relevant information. You may scan the QR code with your smartphone to access all of the information about your insurance coverage.

5. Offline

You can try offline alternatives if you can't find the insurance information using the above online methods. You can go to the Regional Transport Office with your car's information. You may also contact your insurance company to inquire about the status of your policy.

It is quite common to miss important dates in our bustling and fast-paced lives, therefore, insurance companies provide their clients with a grace period. You have 90 days grace period after the expiration date to renew your insurance. However, if any further delays happen after this, the coverage will immediately terminate and all collected NCB will be canceled. You cannot renew the insurance after this and have to buy new insurance and go through the assessment process all over again. So, it’s better to keep an eye on your car policy status and avoid any unnecessary hassle.