1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

Guaranteed Return Products: The Safest Bet For Investment

Have you planned how you will give down-payment to buy a house? Do you have personal goals like financing your child’s education, their marriage expenses, or planning your and your wife’s retirement corpus? Along with these expenses, there is also a burden of any uncertainty happening in your life.

If that is the case, then you need to definitely start investing wisely in good financial products that give you better returns to achieve these goals as well as provide financial protection to your family to meet tomorrow’s requirements. Investing in products that offer a guaranteed return upfront, have a higher interest amount, the returns must be tax-free, and creates a guaranteed source of alternate income makes sense. An example of such products is guaranteed return non-participating products.

((relatedarticle_1))

Let us understand how these products work.

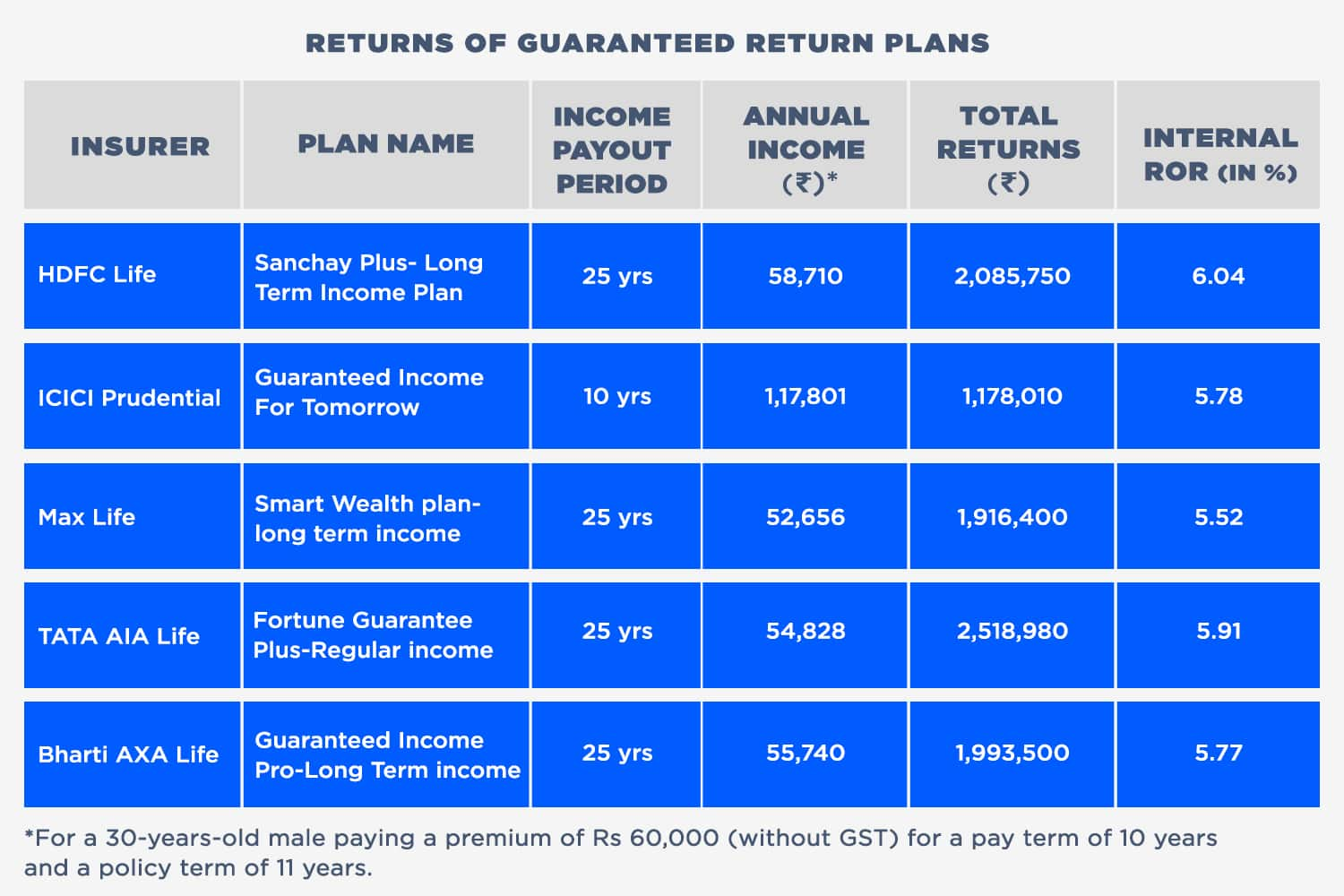

In such products, you invest a certain amount up front and the returns are guaranteed on the investment. For example, if an individual aged 30 years invests Rs 5,000 per month in HDFC Life Sanchay Plus for 10 years, he/she will get Rs 4,470 per month as income from the 12th year for 25 years, so in total, he/she will get Rs 19.6 lacs.

In guaranteed income plans, you can invest between Rs 1,000 and 2,00,000 monthly and between Rs 12,000 and 24,00,000 yearly. You can choose to invest for one time or a term of 5, 7, or 10 years. You also have the flexibility to choose the income period and choice to receive the income monthly or annually. The annual rate of growth investment is expected to generate ranges between 5.3- 5.8% for these plans.

You can also enhance your protection with optional riders such as critical illness riders or accidental disability riders by paying an extra premium. Moreover, you also have the flexibility to choose the kind of income you want depending on your life stage and the priority in your life. There are three options- Guaranteed income, long-term income, and lifelong income.

In the guaranteed income option, you have to pay the premium for 10-12 years and you get a guaranteed payout for the next 12 years. Long-term income creates a legacy for your family through guaranteed payouts for 25 or 30 years and the return of premiums is paid at the end of the Payout Period. Lifelong income helps generate guaranteed retirement income for the whole of life. In this option, the return of premiums is paid at the end of the payout period.

You also don’t have to pay surrender charges in TATA AIA Fortune Guarantee Plus - regular income plan. If you choose a one-time investment option under this plan and within the first 5 years, you want to withdraw money, there will be no surrender charges.

Why should you invest in guaranteed return products?

There are a number of reasons to invest in guaranteed return products among the flurry of products in the market. One of them is that the interest rates have fallen across the board and they might go lower in the future due to the current economic uncertainty. The interest rate on bank fixed deposits has fallen from around 8.5% in 2012 to around 5%. Globally, the Term Deposit rates have come down significantly, including India and in the future, FD rates in India will reach similar levels.

So, in this volatile market, customers are looking for safe guaranteed products. Investing in guaranteed return products gives safety of capital as the lock-in period is longer which is for 5-25 years. So, there is no impact of interest changes and there isn’t any reinvestment risk involved.

Nowadays, investing in mutual funds isn’t safe too. Last year, Franklin Templeton, the US-based investment firm had shut 6 debt funds due to a lack of liquidity in the bond market. However, 100% Guaranteed Return Plans declare the amount of money you will get at the end of the policy term upfront on bond paper. So, it is always safer to enter a legally binding contract.

There are tax benefits of investing in guaranteed return products too. These are provided under Section 80 C on the amount invested and benefit under 10 (10D) on the returns. Customers even get a life cover 10 times of annual premium throughout the policy period.

Why are guaranteed return products better than FD?

In guaranteed return products, the rate of return is 5.85% whereas the rate of return for FD is 5.4%. The returns for guaranteed return products are tax-free whereas it is taxable for fixed deposit. Moreover, guaranteed return products protect the family of the policyholder in case of his/her death as it provides life cover equal to 10 times the annual premium throughout the policy term.

So, if you want to ensure financial security for key life stages such as your child’s marriage, parenthood, retirement, you should definitely go for these plans. These plans help you plan towards your future needs as well as ensure financial protection for your loved ones.

((newsletter))