1

Feeling Inadequately Insured? 3 Ways To Extend Your Health Insurance CoverDecoding Insurance

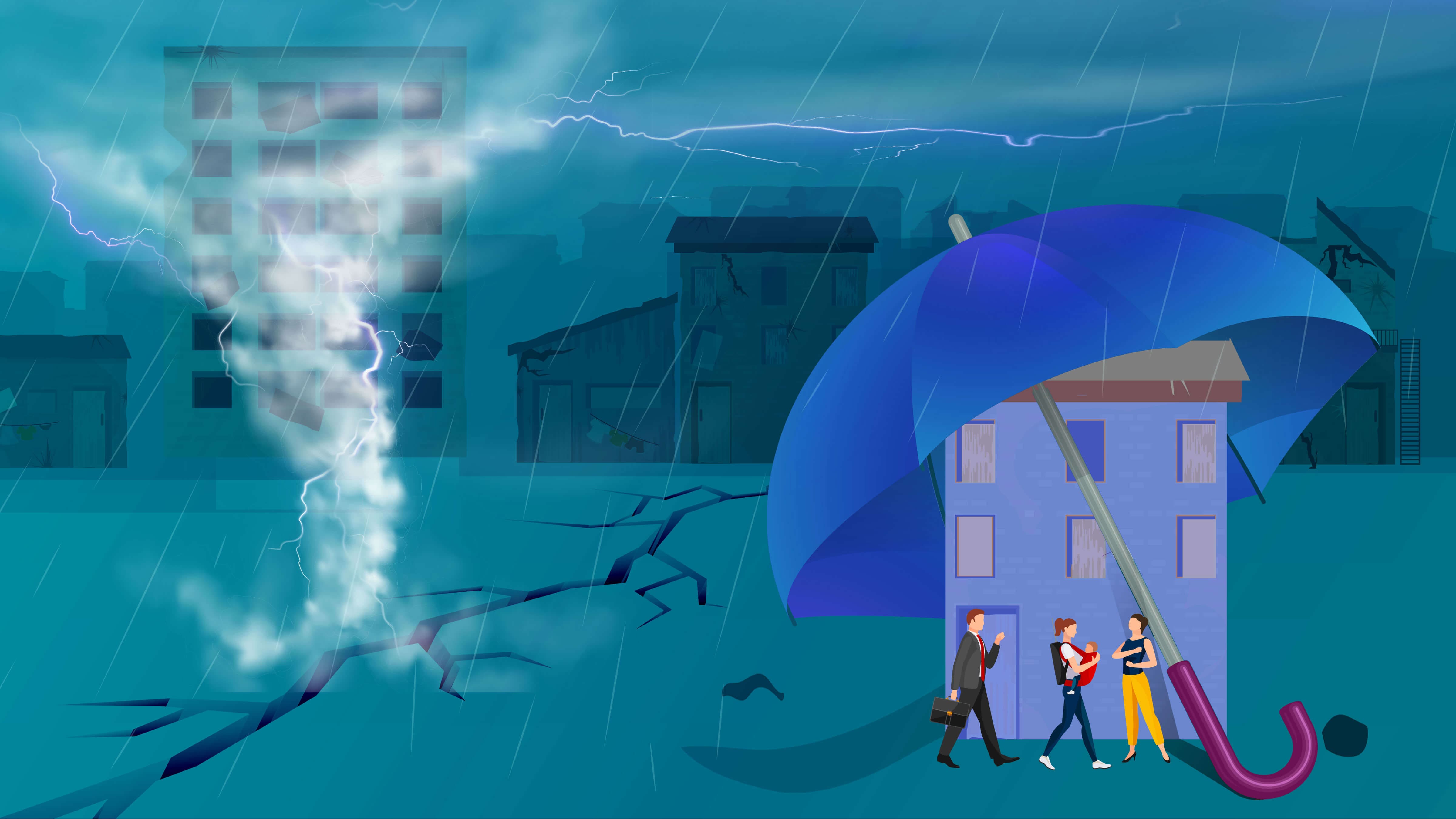

Catastrophes And Their Impact on Insurance Industry

In this era of technological revolution, human beings have achieved incredible advancements in the area of modern technology. We have just completed another decade, and the new will likely be the decade of Artificial Intelligence. Despite the tremendous advancement, what human beings haven't been able to surpass is the supremacy of nature. Nature has always proved itself more powerful than any kind of technological progress. That's why, after all this time; we still depend on Mother Nature to lead our basic life. Probably this is the cause, that even after so many scientific advancements and weather predictions; we failed to prevent catastrophes most of the time.

Let's put some light on what a catastrophe is! Basically, it is an event (natural or human-made), causing severe damage to property and lives.

No country in the world is an exception to the rule of nature. So is India. India is a country that is highly vulnerable to major catastrophes. In the past, this nation has witnessed several major disasters, no matter caused by humans or nature. These catastrophes have had a severe impact on the entire economy and social lives.

Statistics would likely make the image clearer for you. A 2019 report by AON, a UK-based global professional services firm that sells a range of financial risk-mitigation products, including insurance, says that the world lost as much as $232 billion due to natural disasters in 2019, with India leading in casualties with 1,750 deaths. There were a total of 409 natural disaster events in 2019, and the monsoon floods in India were the deadliest among them.

Cyclone Fani was another major calamity in the global top 10 disasters list last year that affected Andhra Pradesh and Odisha, apart from Bangladesh. About 72 people reportedly died in the severe cyclonic storm, which lashed between the last week of April and early May.

The country witnessed economic damage worth $10 billion estimated, due to the destructive monsoon of 2019. On the whole, Cyclone Fani resulted in a cumulative loss of $8.1 billion to India and Bangladesh, the report said. Here we need to remember that being a third-world lower-middle-income country, a large number of people of those affected areas did have poorly built houses with minimal insurance coverage. That's why the post-cyclonic period resulted in severe humanitarian crises in those regions.

There is another drawback for India of being a lower-middle-income country. Here in rural areas, people are so busy earning their daily life that they hardly care about investing in proper housing, and insurance is a kind of daydream in India's rural life.

So now, let's discuss what this insurance we're talking about is! Here, we are trying to talk about home insurance. Basically, it is a form of property insurance that covers losses to an individual's residence against natural and human-made disasters like storm, floods, earthquake, fire, etc. Sadly, the penetration of home insurance in India is barely 1%. The reason behind it, we've told you earlier.

As per industry estimates, unfortunately, only 10% of the total economic losses due to natural calamities since the 2001 Gujarat earthquake, were insured.

A ray of hope emerged for property insurance companies after the Nepal earthquake in 2015. A week after the disaster, general insurance companies in India were flooded with inquiries about protection against natural calamities. Customers were keen to know whether their house can be insured against earthquakes and how much it would cost. However, insurance companies said that the number of inquiries after a natural disaster shoots up, but they rarely convert into actual sales.

According to another recent report by Swiss Re, Asia witnessed a total of $52 billion of economic damage in 2014 due to natural and human-made calamities. But shockingly, only 10% of the whole was covered by insurance. Floods damaged property worth nearly Rs 27,000 crore in India, but a tiny proportion of this loss was insured.

In the first half of the year 2019, cyclones Idai and Kenneth in Mozambique and neighbouring countries, and Cyclone Fani in India, left trails of destruction and suffering to local communities. And lack of property insurance caused in severe humanitarian crises everywhere.

Sadly, the events claimed around 1400 victims. Insured claims were very low because of low insurance penetration in the impacted regions. Essential learning for people residing in or around disaster-prone areas is to get their homes insured.

CATASTROPHES IN THE US

In the US insurance industry, a catastrophe always makes insurance claims higher and expected to exceed a certain dollar threshold. Currently, it is $25 million in direct insured losses to property and affects a significant number of both policyholders and insurance companies.

There have been many catastrophes in the US in the past. But the widespread tendency of insurance prevented all humanitarian crises.

According to the Insurance Information Institute, catastrophes involving tornadoes, including other wind, hail, and flood losses associated with storms that occurred between 1997-2016 made up for 39.9% of total catastrophe insured losses, adjusted for inflation.

Hurricanes and tropical storms were the second largest cause of catastrophe losses, accounting for 38.2% of losses, followed by other wind, hail, flood 7.1%, and winter storms 6.7%. Terrorism and fires, including wildland fires, accounted for 5.9% and 2% of catastrophe losses, respectively. Civil disorders, water damage, and utility services disruption combined represented about 0.2% of economic damage.

Human-made disasters like the attack on the World Trade Centre also caused huge losses. The attack led the US Congress to pass the Terrorism Risk Insurance Act (TRIA) in November 2002. It requires insurers to make available terrorism risk insurance concerning commercial property/casualty losses. It provides a mechanism for the federal government to share the risk of damage from terrorist attacks.

The act has been revised and extended thrice since its inception. The most recent extension is the Terrorism Risk Insurance Program Reauthorization Act of 2015 (TRIPRA), which ensures its continuation until December 31, 2020.

Disaster losses are likely to escalate because of rapid industrialization and development in the future. Let's take a look at the top 10 costliest catastrophes in the US:

MEGA CATASTROPHES AND IMPACT ON INSURANCE BUSINESS

The insurance industry tracks catastrophes to monitor their claim costs. It helps in tabulating the total industry-wide losses. The term catastrophe is often used in the property insurance industry to mean a catastrophic event that exceeds a dollar threshold in claims payouts. This figure has changed with days due to inflation and increased the development in areas subject to natural disasters. Starting in 1997, the catastrophe definition raised from $5 million to $25 million in insured damage.

There have been five mega catastrophes in the US that have exceeded $25 million insured damage.

HURRICANE ANDREW (1992)

Hurricane Andrew, which hit the Bahamas and Southern Florida August 23-24, 1992, and then moved across the Gulf of Mexico to strike portions of Louisiana and other southeastern states on August 25-26, was the costliest natural disaster in US history before Hurricane Katrina. More than 250,000 people were left homeless, 82,000 businesses were destroyed or damaged, and about 100,000 residents of south Dade County (where it hit especially hard) permanently left the area in Andrew's wake. Eleven property/casualty insurers became insolvent due to Hurricane Andrew (10 in Florida and one in Louisiana), and others were financially impaired. Some of the state's largest homeowners insurance companies had to be rescued by their parent companies, and others had to dig deep into their surplus to pay Hurricane Andrew claims.

THE NORTHRIDGE EARTHQUAKE (1994)

A 6.7 magnitude quake jolted the San Fernando Valley, a densely populated area of Los Angeles located 20 miles northwest of the city's downtown on January 17, 1994. The damage was widespread, as buildings, shopping centers, parking lots and portions of major freeways, all collapsed. There were at least 57 casualties, while thousands more were injured. In both these natural disasters, Hurricane Andrew and the Northridge earthquake, householders accounted for the bulk of claims and claim dollars. Following the Northridge Earthquake, which was responsible for damages exceeding $25, the majority of insurers severely restricted new policies because the law mandated them to offer earthquake coverage also.

WORLD TRADE CENTER ATTACK

On September 11, 2001, 19 militants associated with Al Qaeda hijacked four planes carried out suicide attacks against targets in the United States. Two of the aircraft were flown into the twin towers of the World Trade Center in New York City, a third plane hit the Pentagon just outside Washington, DC, and the fourth plane crashed in a field in Shanksville, Pennsylvania. Almost 3,000 people were killed during the 9/11 terrorist attacks. The disaster impacted many insurance companies.

According to the New York Department of Insurance, more than 35,000 claims were filed in New York State alone. Of these, two-thirds were commercial claims and one-third personal, mostly property claims. More than one-quarter of the insured payout was for lost income and extra expense claims for the cost of getting the business back on track, which was part of property insurance. More than 5,600 workers' compensation claims were filed. Insurance companies paid for other applications for companies that suffered indirect losses in other parts of the country. Though, these were not reported to the New York Insurance Department.

HURRICANE KATRINA

The tropical cyclone that struck the southeastern United States in late August 2005 snatched more than 1,800 lives, and it ranked as one the costliest natural disaster in US history. The storm made landfall first in Florida on August 25, 2005, as a Category 1 storm, then gathered strength as it crossed the warm waters of the Gulf of Mexico, ultimately hitting Louisiana on August 29 as a strong Category 3 storm. The hurricane generated more than 1.7 million claims, more than half of the total in Louisiana. The bulk of the claims, 1.2 million, were for personal property. There were 346,000 claims for damaged vehicles and some 156,000 commercial applications. Claims payments to businesses accounted for half of the $41.1 billion bills for insured losses when the hurricane occurred.

The disaster exposed many weaknesses in the US's preparedness for mega-disasters. For example, many people in flood zones had failed to buy flood insurance. Many small businesses that suffered severe damage from the storms went unable to reopen. Because they hadn't bought business income (also known as business interruption) and extra expense insurance, which would have helped them to cover the revenue lost when the business got shut down and the expense of getting back on track after the reconstruction period.

HURRICANE SANDY

Hurricane Sandy was the deadliest hurricane of 2012 and one of the most destructive hurricanes in history to hit the United States. Toward the end of October 2012, Hurricane Sandy stormed through the Caribbean, killing 75 people before heading north. As it approached the East Coast, it produced the highest waves ever recorded in the western Atlantic, causing devastating storm surge and floods throughout coastal New York and New Jersey. At one point, Sandy engulfed a swath of 800 miles between the East Coast and the Great Lakes region.

Also called Superstorm Sandy, it caused $70.2 billion worth of damage, destroyed 650,000 homes. Although the storm inflicted massive damage over a wide area, in part because it collided with another storm, when it hit land, it was no longer officially categorized as a hurricane but as a post-tropical cyclone. Hurricane deductibles, which require homeowners to pay a percentage share of the storm damage, therefore, did not apply. Hurricane Sandy prompted a re-evaluation of how the New York metropolitan area prepares for and deals with major disasters.

((newsletter))