- What is a Pension Plan?

- Pension Plans in India 2026

- Why Do I Need to Plan for My Retirement?

- Types of Pension Plans in India

-

- How Does a Pension Plan Work?

- What is a Pension Plan or Retirement Plan?

- Retirement Plans in India 2026

- Types of Pension Plans in India

- How Does a Pension Plan Work?

- Eligibility Criteria to Buy Pension Plan

- Advantages of Pension Plans

- Pension Plan Buying Guide

- What is Retirement Planning

- How to Buy a Retirement Plan Online in 2026

- Why Should You Buy a Pension Plan from Policybazaar

- Pension Plans Vs. PPF Vs. NPS Vs. Saral Pension Yojana

- Frequently Asked Questions

-

Page Progress

Pension and Retirement Plans in India

Pension plans or retirement plans help you create a fund for retirement that you can use for daily expenses, paying medical bills, and maintaining the desired lifestyle after you stop earning. Investments made through a retirement plan grow with help from the power of compounding, which ensures that you don’t outlive your savings. Buying a pension plan is, therefore, a sure-shot way to safeguard your finances for your golden years.

-

Peaceful Post-Retirement Life

-

Tax-Free* Regular Income

-

Wealth Generation to beat Inflation

- 4.8++ Rated

- 12.02 Crore Registered Consumer

- 51 Partners Insurance Partners

- 5.9 Crore Policies Sold

What are Pension and Retirement Plans?

Pension plans, or retirement plans, are investment products for generating wealth. They help you create a fund for your expenses after retirement. By investing in a pension plan, you can lead a carefree life while saving for your dream retirement. Pension plans give you the critical protection from the threat of outliving your savings, a risk common in countries like ours. Besides, these plan enable you to live the desired life even when your regular income has stopped. That means you no longer need to worry about retirement expenses such as pursuing your hobbies and paying your medical bills. You can choose from government-backed schemes or insurance-linked pension plans in India. While NPS is the most popular government scheme, you can also compare top private pension plans and buy the one you think is the best.

For instance, you can either invest in market-linked pension plans or guaranteed return plans. Market-linked plans offer usually offer higher returns and are suitable for long-term accumulation. Guaranteed return plans are more suitable for risk-averse investors. With disciplined investments, you can build a corpus that would be enough to support a comfortable retirement.

Why Should You Plan for Retirement?

Planning for retirement helps you live your golden years with comfort, dignity, and financial security. You must prioritize retirement planning so that you can approach retirement with peace of mind, knowing that you’ve ensured financial stability. Here are some of the factors that make a strong case for retirement planning.

-

Living Costs After Retirement

The best retirement plan helps you build a corpus that you can use as a source of regular income in your later years. Even after retirement, you want to sustain the lifestyle that your lifetime habits have shaped. Retirement should not force you to give up things that are important to you. By choosing options like a lifetime-income annuity plan, you can keep your finances smooth and live the life you desire.

-

Covering Medical Bills

Your healthcare needs and the associated costs will only increase as you age. Additionally, higher medical inflation will contribute to this issue, causing your medical costs to increase more rapidly than your savings can keep up with. By investing in one of the best pension plans, you will protect yourself from dealing with such distressing financial situations.

-

Preparing for Uncertainties

A well-thought-out retirement plan protects you from uncertainties like an economic downturn, a pandemic, or a job loss. It helps you lead your life without stress in a global economy constantly in a flux. Factors like unpredictable geopolitical situations, war between countries, and public health risks like a pandemic make uncertainty an inherent feature of our time.

-

Rise in Nuclear Families

Most of us no longer live with extended families, a trend seen across the country. That means ensuring financial independence in our later years is more important than ever before. As we, as a society, move toward more urban and nuclear-family arrangements, planning for retirement is no longer an option but a must-do for ensuring financial stability.

-

Insufficient Social Security

Unfortunately, countries like ours still don’t have the desired social security. That means you’re the one responsible for creating a financial safety net during your retirement years. It takes planning ahead and securing a steady income for yourself after you stop working. The best retirement plan in India helps you fill this gap by giving you a guaranteed source of income for your retirement years.

-

Living Your Dream Retirement

Many of us have dreamed of a good retirement life, a phase of life with freedom to do the things you love. If you wish to lead a life of leisure and joy after retirement, a retirement plan lets you create the financial freedom to live those dreams. Whether it's pursuing your hobbies or spending time with loved ones, a pension plan lets you focus on what truly matters.

How Much Corpus Do You Need to Retire in India?

For an average investor, it’s difficult to calculate exactly how much money one would need to retire. And that’s why you need to rely on retirement planning experts to arrive at a realistic figure for your retirement corpus . This fund is different for every retiree and depends on factors such as your lifestyle, current age, healthcare needs, etc.

- Your Lifestyle: Your lifestyle today and the one after retirement play a crucial role in calculating your corpus. That means you need to consider your current expenses and how those expenses would look like after retirement.

- Inflation Rate: With an average inflation rate of 5 to 6%, your expenses will most likely double in every 12 to 14 years. So when you calculate the retirement corpus, keep in mind that you are saving for future expenses that are much higher than today.

- Current age and retirement age: There's this iron rule about retirement planning: the earlier you start, the better. Its due to the central role compounding plays in growing your money. If you start in your early 30s, for example, you get more benefits of the power of compounding, versus, say, if you start in your late 40s.

- Medical care costs: Your medical bills will only increase as you get older, which means you have to spend much more on healthcare than you are doing today. Since healthcare cost is something you cannot adjust or cut back, you need to factor this in while estimating your retirement corpus.

- Major life events: For most people life events like kids education and marriage usually occur before their retirement. If you don't factor these likely events in, you risk these future expenses eating into your retirement savings and investments.

- Returns on investments: And finally, all the above factors rely on how much ROI you get from your investments. By thorough research and comparison of the best pension plans in India, you should choose a product that ensures high returns while meeting your unique needs.

Finding the Best Retirement Plan in India≈

Here's a list of investment options to find the best pension plan in India. This comparison lets you consider the investment amount, policy term, maturity age, etc.

| Pension Plans in India | Maturity Age | Policy Term (PT) | Minimum amount to Invest (yearly) | |

| Bajaj Allianz Life LongLife Goal | 99 years | 99 years minus Entry age | Rs. 25,000 p.a. | Get Details |

| Canara Promise4Growth - Life | 18 - 80 years | 10-30 years | Rs. 12,000 p.a. | Get Details |

| Edelweiss Life Tokio Wealth Secure Plus | 18 - 70 years | 5-25 years | Rs. 24,000 p.a. | Get Details |

| HDFC Life Click 2 Wealth | 18 - 99 years of age | 20 - 64 years | Rs. 12,000 p.a. | Get Details |

| HDFC Life Smart Pension Plan | 40 - 80 years | 10 - 55 years | Rs. 30,000 p.a. | Get Details |

| ICICI Prudential Life Signature | 18 - 75 years | 10-30 years | Rs. 30,000 p.a. | Get Details |

| ICICI Prudential Signature Pension | 40 - 80 years | 20 - 55 years | Rs. 60,000 p.a. | Get Details |

| Kotak E-invent - Retire Rich Plan | 28 - 60 years | 10/ 12/ 15/ 20 years | Rs. 24,000 p.a. | Get Details |

| Max Flexi Wealth Advantage Plan | 18 - 75 years | 10 - 40 years | Rs. 24,000 p.a. | Get Details |

| Max Life Online Savings Plan | 85 years | 5 - 52 years | Rs. 12,000 p.a. | Get Details |

| Max Life SWP - Long Term Income Plan | 60 - 85 years | 60 - 80 years minus Entry Age | Rs. 11,000 p.a. | Get Details |

| PNB Goal Ensuring Multiplier | 99 years | 39 - 99 years | Rs. 18,000 p.a. | Get Details |

| Tata AIA Fortune Guarantee Pension | 40 - 85 years | 5 - 15 years | Rs. 12,000 p.a. | Get Details |

| Tata AIA Fortune Maxima | 100 years | 100 minus issue age | Single: Rs. 25,000; Limited: Rs. 12,000 p.a. | Get Details |

Disclaimer: ≈ Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. The sorting is done in alphabetical order (Fund Data Source: Value Research). For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

Following are the details of the best pension plans by insurance companies:

Bajaj Allianz Life LongLife Goal

Key Features

The Bajaj Allianz Life LongLife Goal is a non-participating Unit-Linked Pension Plan (ULPP) with guaranteed life cover and annuity payout.

Benefits

- Choose between LongLife Goal without Waiver of Premium and LongLife Goal with Waiver of Premium.

- Benefit from the periodic return of Waiver of Premium charges and the option to reduce your premium.

- Enjoy life insurance coverage until age 99 with Retired Life Income and Return Enhancer

Canara HSBC Promise4Growth

Key Features

Canara HSBC Promise4Growth is a retirement plan that helps you achieve your long-term financial goals while providing life insurance coverage for your family.

Benefits

- Choose from three plans - Promise4Wealth, Promise4Care, or Promise4Life - based on your life stage needs.

- Mortality Charges deducted during the policy term are added back to the Fund Value at maturity.

- Receive Loyalty Additions every 5 years starting from the 5th policy year, and Wealth Boosters every 5 years starting from the 10th policy year.

Edelweiss Life Tokio Wealth Secure Plus

Key Features

Edelweiss Life Tokio Wealth Secure Plus is a non-participating unit-linked best pension plan in India with guaranteed life cover and maturity benefits.

Benefits

- Ensure continued policy coverage for your child in the event of your unfortunate demise.

- Choose from a selection of 7 funds and enjoy unlimited switches if you opt for the Self-Managed Strategy.

- Start your savings journey with premiums as low as Rs. 1,000 per month.

HDFC Life Click 2 Wealth

Key Features

The HDFC Life Click 2 Wealth is a participating Unit-Linked Pension Plan (ULPP) with guaranteed life cover and loyalty additions.

Benefits

- Receive a special addition of 1% of annualized premium for the first 5 years.

- Get Mortality Charges back on maturity.

- Choose from 13 fund options with unlimited free switching if you opt for the Premium Waiver.

HDFC Life Smart Pension Plan

Key Features

HDFC Life Smart Pension Plan is a Unit Linked Pension Plan (ULPP) that helps you build a retirement corpus. It ensures regular income post-retirement and financial security during your golden years.

Benefits

- Offers coverage up to 105% of all premiums paid, including top-ups.

- Allows altering the vesting date and premium payment term as per your needs.

- Rewards you with additional units to enhance your retirement savings over time.

ICICI Prudential Life Signature Plan

Key Features

A participating Unit-Linked Insurnace Plan (ULIP) with guaranteed life cover and loyalty additions.

Benefits

- Enjoy benefits until 99 years of age with the Whole Life policy option.

- Get back Mortality and Policy Administration Charges at maturity.

- Choose from 4 portfolio strategies and a variety of funds across equity, balanced, and debt to suit your savings needs.

ICICI Prudential Signature Pension Plan

Key Features

ICICI Pru Signature Pension Plan is a Unit-Linked Pension Plan that helps you plan for a financially secure retirement. It combines market returns with flexibility to suit your retirement needs.

Benefits

- Enjoy low charges, with premiums, policy fees, and mortality charges returned at vesting.

- Add top-ups to increase your savings for future needs.

- Access funds during emergencies like major life events or illnesses.

- Delay your pension start date up to 80 years to grow your savings further.

Kotak e-Invest Retire Rich Plan

Key Features

The Kotak e-Invest Retire Rich Plan is a type of investment plan that combines investing your money in the market with some life insurance protection.

Benefits

- Enjoy 100% allocation of your premiums.

- Gain additional fund value from 25% to 200% of Life Cover charges deducted.

- Opt for the Rising Star option for Triple Protection Benefit on the parent's death.

- Ensure post-retirement expenses are covered with Retirement Income and Income Booster.

Axis Max Life Flexi Wealth Advantage Plan

Key Features

Axis Max Life Flexi Wealth Advantage is a ULIP plan designed to help you build a wealth portfolio for you and your loved ones for regular income during retirement.

Benefits

- Guaranteed loyalty additions to your fund from the 8th year.

- Choose between Wealth and Whole Life plans, various premium and policy terms, 5 investment strategies, and 12 funds.

- Change your investment style anytime with unlimited free switches and premium redirections.

Axis Max Life Online Savings Plan

Key Features

Axis Max Life Online Savings Plan is a unit-linked, non-participating traditional investment plan that provides both life cover and wealth creation benefits.

Benefits

- Death benefit of the highest of Sum Assured, 105% of premiums paid, or Fund Value on death under Variant 1.

- Under Variant 2 Immediate lump sum, Family Income Benefit, total Fund Value at term end, and company-funded premiums after death. Higher death benefits, lower returns.

- Unlimited free fund switches, no Premium Allocation or Policy Administration charges. Only Mortality and Fund Management charges apply.

Axis Max Life SWP – Long Term Income Plan

Key Features

Axis Max Life SWP, which stands for Smart Wealth Plan is a whole-life insurance based retirement plan in India that is designed to provide income for a long period.

Benefits

- Choose from Early Income, Early Income with Guaranteed Money Back, or Deferred Income Plans, all offering guarantees and cash bonuses.

- Accrue and withdraw survival benefits as needed, with flexible withdrawal options.

- Select an income period, including Whole Life Income, up to ages 100, 85, 75, 70, 65, or 60.

PNB Goal Ensuring Multiplier Plan

Key Features

PNB Goal Ensuring Multiplier (GEM) is a Unit Linked Insurance Plan (ULIP) that combines life insurance coverage with investment options, aiming to help you achieve your long-term financial goals.

Benefits

- Get back Fund Management, Premium Allocation, and Mortality Charges.

- Exclusive feature for child-related benefits.

- Adaptable premium payment options.

- Premiums waived on death or critical illness.

Tata AIA Fortune Guarantee Pension Plan

Key Features

Tata Fortune Guarantee Retirement Plan is an individual, non-linked, non-participating pension plan designed to provide you with a guaranteed income after retirement, along with life insurance coverage.

Benefits

- Choose from 3 flexible plans: My Pension, Partner Pension, and Partner Pension Plus.

- Enjoy a boost to your retirement corpus with guaranteed additions of 6% of the sum assured on vesting.

- Special discounts for women, transgenders, and customers under 35 years of age.

Tata AIA Fortune Maxima

Key features

The Tata AIA Fortune Maxima is a participating Unit-Linked Pension Plan (ULPP) offering life insurance cover and market-linked returns.

Benefits

- Get life insurance coverage up to age 100 for your family's security.

- Choose from multiple funds or the Enhanced SMART strategy for your investments.

- Add optional riders to your ULIP policy for greater protection.

How Do Pension Plans Work?

Your money invested in a pension plan grows over the investment period, benefits compounding. This period is called the accumulation phase, since the contributions build up the retirement corpus.

And at the end of this phase, when you reach retirement, the fund is available for withdrawal as regular income (annuity) or as a lump sum. You can also choose a combination of lum sum and annuity. The second stage is known as the vesting phase, as you’re now eligible to withdraw your accumulated fund.

Let’s understand the workings of a pension plan using the example of a private pension plan.

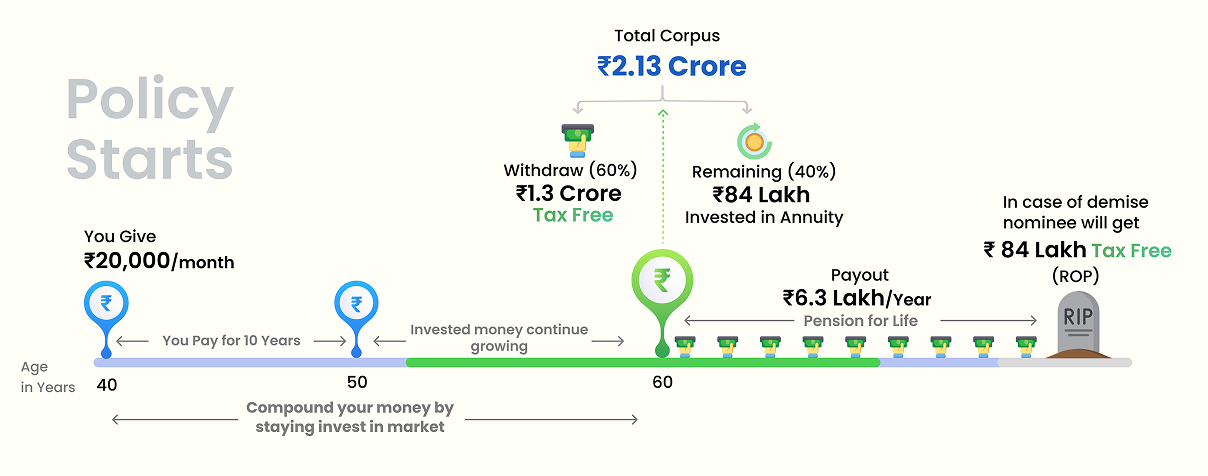

Private Pension Plans

You can buy a ULIP-based pension plan through one of several flexible premium payment options. You could choose from monthly, half-yearly, or annual premium options and decide your accumulation phase. At maturity, you can withdraw 60% of your total corpus as a lump sum. The remaining 40% of the corpus will be available as lifetime monthly pension payments. Here's how it works:

-

Accumulation Phase

You pay premiums as per your preferred payment mode, like monthly, yearly, or a single lump sum. You can choose from regular pay, limited pay, and one-time pay options. During the accumulation phase, the insurance company invests your money for long-term growth. Growth may come from guaranteed or market-linked returns, depending on the kind of Indian pension plan you select.

-

Vesting Age

At vesting age, you start receiving your pension amount. For retirement plans in India, vesting age usually ranges from 40 to 70 years. Vesting age means your accumulation phase has ended and the corpus is now available for withdrawal. It marks the start of your retirement income.

How Your Retirement Income Works

When you reach the vesting age, a portion of your corpus becomes available for withdrawal immediately. The other part is reinvested to fund your retirement income. You can think of this procedure as splitting your larger fund into two funds to give you financial stability and guaranteed lifetime income.

- 60% Lump sum withdrawal: This portion is now available as a lump-sum payout, which you can use to meet major expenses at retirement.

- 40% Invested in annuity: The remaining part of your pension plan is invested in annuity. It converts your retirement savings into a guaranteed lifelong pension. You can choose to receive this pension at your convenience, with options for monthly, yearly, or quarterly payments.

Lets understand how a pension plan in India works with the example of Raghu, a 40-year-old working professional. Raghu plans to buy a ULIP-based pension plan as part of his retirement planning. The following illustration shows how he can build a retirement corpus:

- Raghu's age at pension plan purchase: 40 years

- Investment tenure: 10 years

- Investment amount: ₹20,000 per month

- Total amount invested: ₹20,000 × 12 × 10 = ₹24,00,000

- Lock-in period: until Raghu turns 60

- Total corpus at age 60: ₹2.13 crore

Corpus Utilisation at Retirement:

- 60% lump sum (₹2.13 crore) = ₹1.28 crore (tax-free)

- 40% annuity purchase = ₹85.2 lakh to be invested in an annuity plan

With the annuity plan, Raghu may receive a pension of around ₹6.3 lakh per year (taxable as per his income tax slab).

In the event of Raghu's untimely demise, the nominee will receive the entire annuity amount (₹85.2 lakh) as a tax-free lump sum.

Your Retirement Income

Once the annuity purchase is done, the plan starts paying out pensions as per the option you selected. These options include lifetime monthly income and joint-life income (continues for spouses after your death).

What Is an Annuity?

Annuity plans are savings products that help you secure your retirement by providing a guaranteed lifelong pension and life cover to financially protect your loved ones. Technically, an annuity plan is an insurance contract where the insurance company promises you regular income after retirement, giving you a financial safety net. A customer who buys an annuity plan is called an annuitant. As an annuitant, you can choose to pay for the plan either through a lump sum or regular premiums.

Types of Annuity Plans

Annuity plans are categorized in several ways, including based on payout options, payout duration, and beneficiaries of the plan. If you need income immediately after investing, you can choose immediate annuity plans, whereas deferred annuities are plans where payout begins after a defined accumulation period. Below are the most popular categories of annuity plans.

-

Single Life Annuity

A single life annuity plan covers only one individual, the annuitant. Payments are guaranteed to last for the annuitants entire life. This type usually offers the highest initial income rate.

-

Joint Life Annuity

Joint life annuities protect two people, often the annuitant and their spouse. The income continues as long as either person is still alive. The payment amount might decrease after the first death.

-

Return of Purchase Price (ROP) Annuity

An ROP plan comes with a capital guarantee feature. You receive regular, assured income for your whole life. After the annuitant passes away, the plan ends. Your nominee will then receive the original purchase price back.

How Annuity Plans Work

An annuity plan works in two well-defined stages: accumulation phase and payout (or vesting) phase.

- Accumulation Phase: In this phase you build your corpus, especially in a deferred annuity plan. You invest a lump sum or make regular premium payments into the plan. This money grows over time, benefiting from compounding interest. This growth is generally tax-deferred until you start receiving income. The accumulation phase lasts until you choose to activate your pension, which marks the vesting phase.

- Payout Phase: You start getting your income in the vesting phase. The insurance company converts your accumulated corpus into guaranteed income. They start sending you regular payments, known as the annuity income. You choose how long these payments last. This could be a fixed number of years or your entire life, as in lifetime income annuity plans.

Types of Pension Plans in India

Saving for retirement is a crucial financial decision, and with thorough research, you can find the plan that checks all the boxes. Comparing government pension schemes, such as NPS, and insurance-based plans will provide you with helpful insights.

Government Pension Schemes

Schemes like NPS are popular among investors who prefer schemes regulated by a government agency. These schemes are accessible to investors from different income categories. Below are some of the most popular government pension schemes.

-

National Pension Scheme (NPS)

With its “plan early, retire happily” slogan and the government’s consistent endorsement, NPS is perhaps the most popular pension scheme in India today. It’s a market-linked voluntary contribution scheme managed by the Pension Fund Regulatory & Development Authority (PFRDA). What makes NPS so popular is its simple structure, flexible investment options, and the government’s explicit assurance of a guaranteed retirement income. You can choose from monthly, annual, or lump-sum contribution options. Your contributions to NPS can be invested in debt or equity for long-term growth and returns. The scheme helps you build a retirement corpus during working years and ensures a guaranteed pension with a 40% mandatory annuity amount. The remaining 60% available for lump-sum withdrawal at the age of 60. Additionally, it offers attractive tax benefits under Section 80C and Section 80CCD(1B), which are available exclusively to NPS subscribers.

-

Atal Pension Yojana (APY)

APY ensures a guaranteed fixed pension after retirement. Investors from the age of 18 to 40 years can make contributions and choose a monthly pension from ₹1,000 to ₹5,000. The government introduced APY to enhance financial security among workers in the informal sector. It plays a key role in India’s labor market, particularly in a sprawling gig economy that includes jobs such as food delivery services. The subscriber’s spouse gets the same pension in case of the former’s death.

-

Employees’ Provident Fund (EPF)

EPF is a mandatory savings scheme for most salaried employees. You earn fixed returns (8.25% in FY 2024) on your monthly contributions. A part of your savings provides a small pension. This suits workers seeking basic retirement income security. However, relying solely on EPF for your retirement income may not be a wise decision.

-

Public Provident Fund (PPF)

PPF is one of the major government-backed long-term savings schemes for retirement. It offers fixed returns for long-term goals, making it suitable for risk-averse investors looking for wealth generation over a longer horizon. It has a mandatory fifteen-year lock-in period. PPF is an ideal choice for secure and tax-free savings. It offers EEE tax benefits, meaning returns are completely tax-exempt. And investors get tax deductions under Section 80C.

-

Atal Pension Yojana (APY)

APY ensures a guaranteed fixed pension after retirement. The government established this scheme with the goal of enhancing financial security among workers in the informal sector. APY plays a significant role in India’s labor market, particularly in a sprawling gig economy that includes jobs such as food delivery services. APY subscribers can choose a pension from ₹1,000 to ₹5,000. People aged 18 to 40 are eligible to join.

-

Senior Citizen Savings Scheme (SCSS)

Senior Citizen Savings Scheme (SCSS) offers a guaranteed regular income for senior citizens. With an interest rate as high as 8.2% per annum, SCSS offers the most lucrative returns among small savings schemes. You can invest between ₹1,000 and ₹30 lakhs. Contributions to the scheme qualify for tax benefits under Section 80C.

-

Pradhan Mantri Shram Yogi Maan-Dhan (PM-SYM)

The PM-SYM scheme was launched to create a financial safety net for workers in the unorganized sector. s It guarantees a monthly pension of ₹3,000 after age 60. In case of the untimely death of the subscriber, the spouse receives 50% of the assured pension amount. This provides a vital safety net for low-income earners. Eligible workers can register through the Common Service Center or the Maandhan portal.

Private Pension Plans

While government schemes offer safety pension plans, insurance companies offer customizability and market-linked returns, among other benefits. You can choose from a variety of products to suit your goals. Here are two popular types of pension plans for your retirement.

-

Unit Linked Pension Plans (ULPPs)

These market-linked plans help you build a retirement fund over the long term. You can make partial withdrawals after the lock-in period ends (usually 5 years for ULIPs). When your policy matures, you can take a portion as a lump sum, and the remaining will fund your guaranteed retirement income. Most ULIP-based pension plans offer a guaranteed income for life. These plans include life cover to protect your family's future.

-

Guaranteed Return Plans

Also known as traditional insurance plans, these products can be either participating or non-participating. Traditional plans put your money in very safe and stable instruments. This ensures moderate but steady growth for your savings. You usually get guaranteed or assured returns on your investment. Typically, the life insurance coverage amount is minimal, allowing you to focus on your retirement fund.

Key Features of Retirement Plans in India

Understanding the key features of a retirement plan is essential, as these advantages help ensure financial security, regular income, and a stress-free life after retirement:

- Sum Assured: The best pension plans are the ones that ensure financial protection through guaranteed payout. It could be either at the time of maturity or to the nominee upon the untimely demise of the policyholder during the policy tenure. The amount is decided at the time of buying the plan.

- Tax Benefits: Premiums paid qualify for tax deductions under Sections 80C and 80CCD(1B), and maturity proceeds can avail of tax exemption under Section 10(10D).

- Lifelong Income: You can also include an annuity in your retirement plan. In an annuity plan you pay once or over time, and in return, you get a steady income for a few years or even for the rest of your life. You can choose from immediate annuity and deferred annuity options based on your income needs.

- Surrender Value: The surrender value of a retirement plan is the amount the insurance company will pay you if you terminate the policy before maturity. This amount receivable is low compared to the maturity amount, and hence, it is advisable not to surrender the policy.

- Flexibility in Payment: The best pension plans provide various options for premium payment (lump sum or periodic) and annuity payouts (monthly, quarterly, or annually).

- Risk Coverage: When choosing a retirement plan, you can go with market-linked ULIPs or guaranteed return plans based on your risk profile. While ULIPs offer higher returns over a long investment period, traditional plans protect you from market volatility.

Eligibility Criteria for Pension Plans

If you are 18 years old or older, most insurance companies have a pension plan for you. Along with the entry age, you should also know the premium payment terms and the vesting age before buying a pension plan in India.

- Entry Age:

In most cases, the minimum age for a retirement plan is 18 years, but some plans require an entry age of 30 years. The maximum entry age is usually around 75 years. - Premium:

Premiums, in general, are the regular amounts paid throughout the policy period by the policyholder. The premium amount and payment frequency depend on the specific pension plan you choose. - Vesting Age:

Vesting age is the age at which you begin receiving your pension. It's usually set at 40 years but can vary depending on the retirement plan and insurance provider.

Who Should Buy a Pension Plan?

Virtually every earning individual should consider investing in a pension plan. Planning for retirement is crucial to your financial security, whether you are a young professional, self-employed, or in senior management.

-

Young Professionals:

Start early to benefit from compounding interest and build a secure retirement fund.

Example: A 25-year-old begins a pension plan with a modest monthly premium. Over 35-40 years, the accumulated corpus grows substantially, providing a comfortable monthly pension after retirement.

-

Self-Employed Individuals:

control of your retirement savings, as there are no employer-sponsored plans available.

Example: A freelance consultant invests in a pension plan, making flexible premium payments. Upon retirement, they receive a steady monthly pension, ensuring financial independence.

-

Employees Without Pension Benefits:

Don't rely solely on government schemes; secure your retirement with your own pension plan.

Example: An employee in a private company without a pension scheme starts a pension plan to build a retirement corpus, ensuring a monthly pension after retirement.

-

Those with Irregular Income:

Ensure financial stability in your non-earning years by building a reliable corpus.

Example: A small business owner with irregular cash flow invests in a pension plan, paying premiums when income is good, and still secures guaranteed pension benefits later.

-

People Aiming for FIRE (Financial Independence, Retire Early):

Plan your early retirement; follow the trending FIRE retirement path.

Example: A professional in their early 30s, aiming to retire by 45, channels a significant portion of their income into a pension plan. By the time they reach their FIRE target, they have built a sizable corpus that provides a steady pension, allowing them to cover living expenses and enjoy financial freedom decades before the standard retirement age.

-

Anyone Planning for Inflation-Protected Income:

Protect yourself against rising costs of living with plans offering increasing annuities.

Example: A retiree opts for a pension plan with a built-in inflation rider, ensuring their monthly pension increases by a fixed percentage every year to match rising living costs.

-

Individuals Seeking Tax Benefits:

Maximize tax savings under Section 80C and Section 10(10D).

Example: A salaried individual invests in a pension plan and claims a deduction of up to ₹1.5 lakh under Section 80C every year, effectively lowering their tax liability while securing a pension for the future.

When Is the Right Time to Start Retirement Planning?

The right time to start retirement planning is now! Although that might sound like a cliche, the earlier you start, the better the chances of building a desired corpus. Having said that, you should also understand that at what life stage you plan for your retirement greatly impacts the outcomes. Below is an overview of how retirement planning works for different age groups.

Importance of Retirement Planning for Different Ages

The importance of planning changes with different stages of life. Knowing these stages can help you make smart financial decisions for a comfortable retirement.

Let us have a look at the significance of retirement planning based on age and life stages:

Tax Benefits on Pension and Retirement Plans in India

Tax benefits make pension plans highly attractive in India. Investing in these plans helps you save for your future while reducing your current tax liability. Here are the key tax advantages:

- Section 80C: Section 80C benefits cover premiums paid toward retirement savings that qualify for a tax deduction. You can claim up to 1.5 lakh in a financial year.

- Section 80CCC: Under 80CCC This applies to contributions made to specific annuity pension funds. The deduction limit is part of the overall 1.5 lakh ceiling.

- Tax-Free Maturity: Up to 60% of the corpus received at maturity can be withdrawn tax-free (usually under Section 10(10A)). The remaining amount must be used to purchase an annuity.

- Taxable Annuity Income: The regular pension income you receive after retirement is taxable. It is added to your income and taxed per your slab rate.

Factors to Consider Before Buying a Pension Plan

Consider the following factors before buying a pension plan:

- Retirement Age and Goals: Determine your desired retirement age and lifestyle you want post-retirement.

- Financial Needs: Assess future expenses like healthcare, inflation, and daily living costs to estimate your required retirement corpus.

- Plan Type: Choose between traditional pension plans, market-linked plans (ULIPs), or annuity-based plans based on your risk appetite.

- Premium Affordability: Ensure the premium amount fits within your current budget.

- Tax Benefits: Evaluate tax deductions on premiums and exemptions on maturity.

- Annuity Options: Check for flexibility in annuity payouts—lump sum, monthly, or increasing annuities to combat inflation.

- Life Cover: Look for plans that provide life insurance coverage along with retirement benefits.

- Flexibility and Add-Ons: Opt for plans that offer withdrawal options, top-ups, or riders for critical illness or disability.

- Plan Performance: Analyze historical returns for market-linked plans and the financial strength of the insurer.

- Loan Facility: Check if the plan allows borrowing against the policy in case of emergencies.

- Inflation Adjustments: Ensure the plan offers features to keep up with rising costs, such as increasing annuities.

- Current Debts and Loans: Consider your current debts and loans and plan to minimize or eliminate them before retirement to avoid financial burdens in your post-retirement years.

Charges Applicable in Pension Plans

Buying a pension plan may involve some charges, like fund management charges and fund switching charges. You can also consider adding riders to make your plan more beneficial.

-

Fund Switching Charges

ULIP plans usually allow you to switch between different investment funds based on their changing investment preferences or market conditions. Usually, a minimum of two and a maximum of unlimited free switches are allowed each year, based on the selected product's terms and conditions. However, subsequent switches may incur charges.

-

Add-ons/Riders

ULIP-based pension plans offer additional riders or add-ons for enhanced coverage and additional benefits. You can choose from common riders, including accidental death benefit, critical illness rider, disability rider, and waiver of premium rider. These riders come at an extra cost.

-

Other Charges Associated with ULIPs

ULIP-based retirement plans have various charges, such as fund management charges, premium allocation charges, policy administration charges, mortality charges, and surrender charges. These charges are usually minuscule and don't affect your return in the long run.

How to Calculate Returns on Pension Plans?

For calculating returns on pension plans and how much you need to invest, you need to consider your current age, the desired retirement age, current income, and monthly expenses. Then you need to factor in annual inflation and your expected returns on investments.

Lets understand this with the example of Priyanshu, a 40-year-old IT professional, who wants to retire at 60.

How Much Priyanshu Needs to Retire

- Age: 40

- Annual income: ₹25 lakh

- Current monthly expenses: ₹120,000

- Planned retirement age: 60 (20 years until retirement)

- Assumed inflation rate: 6% per year

- Expected return on investments: 11% per year

Step 1: Estimate monthly expenses at retirement

The formula for calculating the future value is: Future Value = Present Value × (1 + inflation rate) raised to the power of n.

Here:

- Present value = ₹1,20,000 per month

- Inflation = 6%

- n = 20 years

Future monthly expenses at 60: ₹1,20,000 × (1.06)²⁰ ≈ ₹3,85,000 per month

Annual expenses at retirement: ₹3,85,000 × 12 ≈ ₹46.2 lakh per year

Step 2: Calculate the required retirement corpus.

A widely used approach is the 4% rule, which assumes that Priyanshu can withdraw 4% of his retirement corpus every year (adjusted for inflation) without running out of money.

Required corpus = Annual expenses ÷ 4%

= ₹46.2 lakh ÷ 0.04

≈ ₹11.55 crore

Priyanshu will need a retirement corpus of approx. ₹11.6 crore at age 60. Therefore, he needs to save and invest in retirement plans while keeping this number as the target. Please note that the corpus will vary based on the assumed rate of return (which is 11% in this case).

Retirement & Pension Calculator

Use the retirement and pension calculator to estimate how much you need to invest monthly, quarterly, or annually. You need to input details like your age, current monthly expenses, and your desired retirement age.

you need to invest

Steps to Buy a Retirement Plan Online

Step 1: Check and compare retirement plans on Policybazaar.

Step 2: Understand the features and premiums of different plans to find the best fit for you.

Step 3: Choose the most suitable plan that aligns with your goals and needs, like your retirement lifestyle and hobbies you want to pursue.

Step 4: Consider adding riders to enhance and customer your pension plan features or adjusting coverage if needed to modify the plan according to your situation.

Step 5: Make your payment online and receive confirmation about your retirement plan.

Documents Required for Buying Pension Plans

Below is a list of documents needed to buy a pension plan.

-

Proof of Identity (POI)

- PAN Card is mandatory for all transactions.

- You can also use your Passport or Voter's ID.

- A valid Aadhaar Card copy works as well.

-

Proof of Address (POA)

- You must submit documents showing your current address.

- A valid Aadhaar Card copy is commonly accepted.

- Your Passport or Drivers License works too.

- You can also use recent utility bills, like electricity or gas.

-

Proof of Age

- This confirms your date of birth.

- The insurance company requires accurate age proof.

- You can use your Passport or Birth Certificate.

- A School Leaving Certificate is also acceptable.

-

Bank Details

- A cancelled cheque leaf is needed for bank proof.

- This links your bank account for premium payment.

- It also ensures your future annuity payout is correct.

- Provide a recent bank statement or passbook copy.

-

Other Documents

- The fully completed and signed proposal form.

- One or two recent passport-size photographs.

- Specific medical reports, if requested by the insurer.

Pension Plans vs PPF vs NPS vs Saral Pension Scheme

| Aspect | Pension Plans | PPF | NPS |

| Type of Scheme | Insurer pension plans | Government savings | Government pension |

| Purpose | Retirement savings with life insurance. | Retirement savings. | Retirement savings. |

| Returns | Market-linked returns | The fixed interest rate set by the government. | Market-linked returns based on investments. |

| Tax Benefits | Tax benefits under Section 80C and 10(10D) on premiums and returns. | Tax exemption on investments, interest, and withdrawals. | Tax benefits on contributions, returns, and withdrawals. |

| Lock-in Period | 5 years | 15 years, partial withdrawals after 6 years. | Until retirement age (60 years), partial withdrawals are allowed. |

| Flexibility | High flexibility. | Partial withdrawals, loans available. | Flexible contributions, investment options, partial withdrawals. |

| Annuity Options | Various annuity options are available. | No annuity, lump-sum withdrawal, or extension. | Choice of annuities upon retirement. |

| Regulation | Regulated by IRDAI. | Governed by the Ministry of Finance. | Regulated by PFRDA. |

Why Buy a Pension Plan from Policybazaar?

Policybazaar lets you compare the best pension plans in India and buy the one that meets all your unique needs. Here are some of the key benefits you get when you buy your pension plan from us.

- Compare Top Pension Plans Policybazaar is a one-stop shop for comparing the best pension plans available in the market. You can then make a truly informed purchase decision.

- Hassle-Free Purchase Here, you can do a detailed comparison of features, benefits, and premiums of different plans and buy the one you like without any hassle.

- Customizable Plans Whether you want to choose a specific add-on or need to select a convenient premium payment frequency, everything is just a few clicks away.

- No Hidden ChargesWe don’t give you any unwanted surprises with hidden charges. All kinds of charges and fees are transparently presented before your purchase.

- Expert Assistance A team of seasoned experts is always at your disposal to guide you through the buying process should you need any assistance while choosing the best retirement plan.

- 24/7 Customer Support We know that we’re in a critical domain of insurance and investments. Our round-the-clock assistance for purchase, claim, and other queries means you don’t have to worry about anything.

Common Mistakes to Avoid in Retirement Planning

While planning for retirement, you need to be careful about avoiding a few pitfalls. Whether its not starting your retirement plan early enough or not understanding future expenses, these mistakes, if not avoided, will affect your plan.

- Starting Your Retirement Planning Late: If you wait too long to plan for retirement, you won't be able to build up a strong corpus. If you start early, your assets will have more time to grow through compounding.

- Not considering medical bills & emergencies: As you become older, medical costs tend to go up. Not preparing for health-related costs or emergencies can put a strain on your finances that you didn't foresee.

- Not accounting for future costs and inflation: Many people don't know how much money they'll need after they retire. If you don't plan for rising costs and inflation, they can swiftly eat away at your funds.

- Investing in limited categories of financial instruments: Putting all your money into one form of investment makes it riskier. Diversifying your investments will help them stay stable and expand over time.

- Not reviewing and adjusting the plan periodically: You need to change your retirement plan from time to time. You need to reassess your plans regularly to stay on track because life changes and the market changes.

Conclusion

Investing in a pension plan is a crucial decision for ensuring your financial security and peace of mind. To find the best retirement plan in India, you must compare the best plans. While you are at it, check expected returns, premium amount, and payout options to select the right plan. You can use an online pension calculator to estimate the investment amount and the expected value of the retirement corpus. Finally, you could talk to an expert and ask for a quote as per your requirements. And now you are ready to compare the top pension plans and buy the one that meets your needs!

˜The insurers/plans mentioned are arranged in order of highest to lowest first year premium (sum of individual single premium and individual non-single premium) offered by Policybazaar’s insurer partners offering life insurance investment plans on our platform, as per ‘first year premium of life insurers as at 31.03.2025 report’ published by IRDAI. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. For complete list of insurers in India refer to the IRDAI website www.irdai.gov.in

*All savings are provided by the insurer as per the IRDAI approved

insurance plan.

^The tax benefits under Section 80C allow a deduction of up to ₹1.5 lakhs from the taxable income per year and 10(10D) tax benefits are for investments made up to ₹2.5 Lakhs/ year for policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

¶Long-term capital gains (LTCG) tax (12.5%) is exempted on annual premiums up to 2.5 lacs.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

**Returns are based on past 10 years’ fund performance data (Fund Data Source: Value Research).

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator

Explore the popular searches and stay informed

- 50k Pension Per Month

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- Annuity Plan

- Best SIP Plans

- Child Investment Plan

- Child Plan

- CIBIL Score

- Deferred Annuity Plans

- Government Schemes for Girl Child

- HDFC SIP Calculator

- Immediate Annuity Plans

- Investment Plan

- LIC Calculator

- LIC

- NPS Interest Rate

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Retirement Planning

- SBI Annuity Deposit Scheme Calculator

- SBI SIP Calculator

- SBI SIP

- SIP Calculator

- SIP

- Sukanya Samriddhi Yojana Interest Rate

- Sukanya Samriddhi Yojana

- ULIP Calculator

- ULIP Plan

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance

- Home Loan Insurance Calculator

- FIRE Calculator

- EMI Calculator