Money Back Policy

A money back policy is a type of investment plan that provides you with a regular income throughout the policy term, as well as a lump sum amount at maturity. The primary objective of a money back policy is to provide financial security and liquidity at various stages of life.

-

Save upto ₹46,800 in tax under Sec 80C^

-

Inbuilt Life Cover

-

Tax Free Returns^

Fully Tax-Free*, Life Cover Included

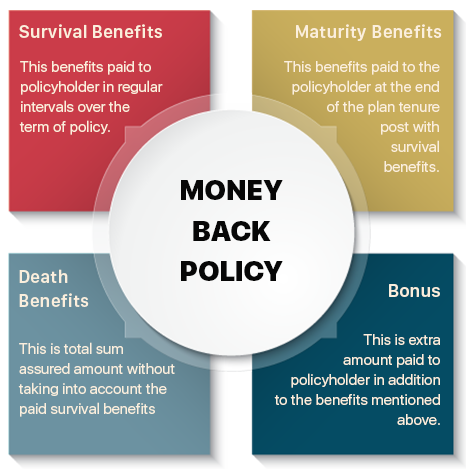

What is a Money Back Policy?

A money back policy is an investment plan offered by an insurance company. These plans pay you a predetermined percentage of the sum assured at specific intervals, which are also called "survival benefits." These survival benefits are paid out irrespective of whether you are alive or not.

A money back insurance policy offers you the dual benefits of life coverage and periodic payouts. You can utilize these payouts for various purposes such as education, marriage, purchasing a house, or meeting other financial goals.

How Does a Money Back Plan Work?

A Money Back Plan is an investment option that combines investment and insurance benefits. These plans provide you payouts at predefined intervals throughout the policy term. These payouts are a portion of the sum assured and act like a return on investment.

You can understand the further working from below:

-

Premium Payment: You pay regular premiums to keep the policy active.

-

Survival Benefits: At specific intervals, you receive a portion of the sum assured as survival benefits. These payouts are usually a fixed percentage of the total sum assured.

-

Maturity Benefit: At the end of the policy term, you receive the remaining sum assured, along with any bonuses, if applicable.

-

Death Benefit: If the policyholder dies during the policy term, the nominee receives the full sum assured, regardless of the survival benefits already paid.

In essence, a Money Back Plan offers both insurance coverage and periodic returns, providing financial security and liquidity during the policy term.

Illustration of Money Back Policy

If Mr Ram buys a money back insurance policy that guarantees money back at different stages. Let us learn how it will work:

Policy Details:

-

Policy Term (PT): 20 years

-

Sum Assured: Rs. 20 lakhs

-

Predetermined Survival Benefit: 20% of the Sum Assured every 5 years

-

Survival Benefits:

-

After 5th Policy Year: Rs. 4 lakhs

-

After the 10th Policy Year: Rs. 4 lakhs

-

After the 15th Policy Year: Rs. 4 lakhs

If he completes the full 20-year term, he will receive maturity benefits-

-

-

Maturity Benefit:

-

At the End of 20th Policy Year: Rs. 6 lakhs + Bonus (if any)

In case something happens to Mr. Ram during this time, his nominee will receive the full sum assured as a death benefit:

-

-

Death Benefit:

-

Death Benefit to Nominee in Your Absence: Rs. 20 lakhs

-

Money Back Policy Benefits

Money back policies offer a combination of features that can be beneficial for many people. Some of the key advantages are listed below:

-

Annual Profits as Revisionary Bonus:

Money back plans often share a portion of the investment profits with you each year. This increases your total payout over time and can be a great way to outpace inflation.

-

Terminal Bonus at Maturity:

This is a bonus prize for staying invested throughout the policy term. The insurance company may offer an additional bonus on top of your maturity benefit, depending on the plan's performance and how long you have been enrolled.

-

Maturity Benefit:

You will receive a lump sum payout at the end of the policy term, regardless of market conditions, as long as you survive the term. This provides peace of mind, knowing you will have a set amount of money to reach your goals.

-

Steady Income Throughout:

Money back plans provide regular payouts throughout the policy term, acting like a reliable source of extra income. This can be helpful for managing monthly bills, funding vacations, or any other short-term financial needs.

-

Security Through Death Benefit:

In case of your unfortunate passing, your beneficiary receives the sum assured in the policy. This can help secure their financial future and provide them with peace of mind during a difficult time.

-

Tax Benefits:

The premiums you pay towards your money back plan can be deductible under Section 80C up to ₹1.5 lakhs. The sum assured you receive at the policy's maturity is generally tax-free under Section 10(10D) of the Income Tax Act, 1961.

All savings are provided by the insurer as per the IRDAI approved insurance plan. Standard T&C Apply

List of Money Back Policies in India 2025≈

If you invest Rs. 10,000 per month at the age of 30 years for a period of 5 years with a policy term of 10 years, the maturity returns will be as follows:

-

For Maturity Benefit Payout in Lump Sum

Money-Back Plans Entry Age Policy Term (PT) Premium Payment Term (PPT) Life Cover Maturity Amount (on 10th Year) ABSLI Assured Savings Plan 18 – 65 years 10 – 35 years 5 – 12 years Rs. 14.7 lakhs Rs. 8.26 lakhs Bajaj Allianz Life Assured Wealth Goal 18 – 50 years 99 years minus Entry Age 7/ 8/ 10/ 12 years Rs. 15 lakhs Rs. 8.32 lakhs Bandhan Life iGuarantee Max Savings 18 – 50 years 10/ 12/ 14/ 15/ 20 years 5/ 7/ 10 years Rs. 12.6 lakhs Rs. 9.2 lakhs Bharti AXA Guaranteed Wealth Pro 18 – 60 years 36/ 38 years 5/ 10/ 12 years Rs. 12.1 lakhs Rs. 8.04 lakhs Canara HSBC Life iSelect Guaranteed Future - iAchieve 18 – 65 years 10 / 12/ 14/ 15/ 20 years 5/ 7/ 10/ 12 years Rs. 12.2 lakhs Rs. 9.09 lakhs Edelweiss Tokio Life Guaranteed Growth Plan 18 – 60 years 10 – 30 years 5/ 7/ 10 years Rs. 12 lakhs Rs. 10.2 lakhs ICICI Pru Guarantee Income for Tomorrow 18 – 45 years 5/ 6/ 7/ 8/ 10/ 12 years 10/ 12/ 15/ 16/ 20 years Rs. 12 lakhs Rs. 8.16 lakhs Max Life Smart Fixed Return Digital - Titanium 18 – 50 years 5/ 10 years 5 years Rs. 12.8 lakhs Rs. 10.2 lakhs TATA AIA Guaranteed Return Insurance Plan 18 – 65 years 6 – 40 years Single Pay/ 5 – 12 years Rs. 18.1 lakhs Rs. 7.81 lakhs Disclaimer: ≈ Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. The sorting is done in alphabetical order (Fund Data Source: Value Research). For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

-

For Monthly Payouts as Long-Term Income

Money-Back Plans Entry Age Policy Term (PT) Premium Payment Term (PPT) Life Cover Total Sum of Monthly Payouts (Between 13th - 42nd Policy Year) Lump Sum Payout (on 42nd Policy Year) Max Life SWP- Long Term Income 18 – 60 years 7 - 11 years 6/ 10 years Rs. 12.8 lakhs Rs. 51.5 lakhs Rs. 11.7 lakhs ICICI Pru Life GIFT- Pro Increasing Income with ROP 18 – 60 years 8 -17 years 5 – 12 years Rs. 12.3 lakhs Rs. 54.7 lakhs Rs. 11.8 lakhs ABSLI Assured Income Plus- Income with Lump Sum Benefit 18 – 60 years 5 - 17 years 5/ 6/ 8/ 10/ 12 years Rs. 15.1 lakhs Rs. 49.2 lakhs Rs. 15.1 lakhs TATA AIA Fortune Guarantee Plus- Regular Income 18 – 60 years 5 - 17 years 5 - 12 years Rs. 14.2 lakhs Rs. 44.7 lakhs Rs. 11.3 lakhs Bajaj Allianz AWG- Second Income with ROP 18 – 60 years 99 - Entry Age 7/ 8/ 10/ 12 years Rs. 15 lakhs Rs. 46.5 lakhs Rs. 12 lakhs

*Traditional plans with a premium above ₹5 lakhs would be taxed as per applicable tax slabs post 31st March 2023.

**All savings are provided by the insurer as per the IRDAI-approved insurance plan. Standard T&C Apply.

*All savings are provided by the insurer as per the IRDAI approved insurance plan. Standard T&C Apply

Features of a Money Back Policy

The key features of a Money Back Policy are as follows:

-

Life Cover: Provides financial security to your loved ones in case of your death during the policy term. The full sum assured is paid to the nominee.

-

Regular Payouts: Periodic payments at set intervals during the policy term, based on a percentage of the sum assured.

-

Riders: You can customize your policy with additional riders for benefits like accidental death coverage, critical illness cover, or waiver of premium payment in case of disability.

-

Flexibility: Various premium payment options, including limited payment, allow for shorter durations with extended benefits.

-

Savings for Specific Goals: Plan for a house down payment or child's education with structured payouts.

-

Guaranteed Returns and Stability: Assured returns regardless of market fluctuations.

-

Comprehensive Financial Security: Life insurance, periodic benefits, and maturity lump sum for financial stability.

-

Tax Benefits: Premiums eligible for tax deductions under Section 80C. Maturity and death benefits are tax-exempt under Section 10(10D) of the Income Tax Act, enhancing savings.

Who Should Buy a Money Back Plan?

-

Young Families: Ensure financial security for loved ones in case of unexpected events.

-

Savers & Investors: Seek guaranteed returns with added life cover benefits.

-

Risk-Averse Individuals: Prefer low-risk investments with assured returns.

-

Retirees: Secure steady income post-retirement without market fluctuations.

-

Long-term Planners: Ensure financial goals are met with disciplined savings.

-

Tax Savers: Enjoy tax benefits under applicable sections of the Income Tax Act.

-

Peace of Mind Seekers: Protect against financial uncertainties with a safety net.

How to Choose the Right Money Back Policy for You?

Choosing the right money back policy involves understanding your needs and the features of the policy. Read below the key points for consideration:

-

Assess Financial Goals: Define your financial objectives like savings or income generation.

-

Understand Policy Terms: Read and comprehend policy details, including tenure and payouts.

-

Compare Benefits: Compare various policies for features like payout frequency and maturity benefits.

-

Evaluate Risk Factors: Assess the insurer's reputation and financial stability.

-

Consider Premiums: Analyze affordability and ensure premiums fit your budget.

-

Check Flexibility: Look for options to alter policy terms if needed.

-

Review Claim Settlement: Research claim settlement ratio and customer reviews.

Fixed Deposits Vs. Money Back Policy

A quick comparison of Fixed Deposit (FD) schemes against the best money back policy is as follows:

| Feature | Fixed Deposits | Money Back Plans |

| Risk | Low | Medium |

| Returns on Investment | Fixed rate of interest for a fixed term | Periodic money back benefits and maturity benefit |

| Returns | Low | High |

| Maturity Value | Guaranteed Upfront | Guaranteed Upfront |

| Liquidity | -- Limited flexibility -- Premature withdrawals may attract penalties |

-- Liquidity through periodic money back benefits -- Surrendering may have restrictions |

| Insurance Coverage | No life insurance coverage | Life insurance coverage provided |

| Tax benefits* | -- Interest earned is taxable -- Tax benefits only on Tax Saver FDs u/Section 80C |

-- Tax deductions on premiums paid under Section 80C of the IT Act, 1961 -- Tax benefits on maturity and death benefit under Section 10(10D)* |

| Flexibility | Low | High |

| Term | 1-5 years | 10-30 years |

| Payouts | Lump sum at maturity | -- Regular payouts during the policy term -- Lump sum payout at maturity |

| Death benefit | No | Yes |

*As per prevailing tax laws.

Steps to Buy a Money Back Plan from Policybazaar

-

Visit Policybazaar Website: Go to Policybazaar homepage.

-

Select Money Back Plan: Find and choose Money Back Plans under the investment section and fill in the basic information like place, age, and salary range.

-

Compare Plans: Compare different money back plans based on premiums, coverage, and benefits.

-

Choose a Plan: Select the best money back policy that best suits your needs.

-

Fill Details and Purchase: Enter personal information, pay online, and complete the purchase.

-

Review Policy Documents: Check and download your policy documents for accuracy and clarity.

˜Top 5 plans based on annualized premium, for bookings made in the first 6 months of FY 24-25. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. This list of plans listed here comprise of insurance products offered by all the insurance partners of Policybazaar. For a complete list of insurers in India refer to the Insurance Regulatory and Development Authority of India website, www.irdai.gov.in

*All savings are provided by the insurer as per the IRDAI approved

insurance plan.

+ Trad plans with a premium above 5 lakhs would be taxed as per

applicable tax slabs post 31st march 2023

#Discount offered by insurance company. Standard T&C Apply

*The Guaranteed Returns are dependent on the policy term and premium term availed along with the other variable factors. 7.1% rate of return is for an 18 years old, healthy male for a policy term of 20 years and premium term of 10 years with Rs.10,000 monthly installment premium. All plans listed here are of insurance companies’ funds.

^Section 80C allows annual deductions of up to ₹1.5 lacs from the taxable income. Section 10(10D) provides tax-free maturity benefits for investments of up to ₹2.5 Lacs/ year, on policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator

Investment plans articles

Explore the popular searches and stay informed

- ULIP Calculator

- ULIP Plan

- 50k Pension Per Month

- Annuity Plan

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- Best SIP Plans

- Child Investment Plan

- Child Plan

- Deferred Annuity Plans

- Government Schemes for Girl Child

- HDFC SIP Calculator

- Immediate Annuity Plans

- Investment Plan

- LIC

- NPS Interest Rate

- Pension Plan

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Retirement Planning

- SBI Annuity Deposit Scheme Calculator

- SBI SIP Calculator

- SBI SIP

- SIP Calculator

- SIP

- Sukanya Samriddhi Yojana Interest Rate

- Sukanya Samriddhi Yojana

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance