Term Plans

Life Insurance For Women

Life insurance for women is a life insurance policy designed keeping specifically women in mind. These plans offer coverage and benefits suited to fit their needs like cover against women specific cancers, lower premiums than men, and special health management services.

Explore the popular searches and stay informed

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance

- Home Loan Insurance Calculator

- FIRE Calculator

- EMI Calculator

- LIC

- Investment Plan

- Annuity Plan

- Child Plan

- Pension Plan

- ULIP Plan

- Child Investment Plan

- SIP

- LIC Calculator

- SIP Calculator

- SBI SIP

- ULIP Calculator

- Sukanya Samriddhi Yojana

- Best SIP Plans

- Retirement Planning

- SBI SIP Calculator

- HDFC SIP Calculator

- Sukanya Samriddhi Yojana Interest Rate

- NPS Interest Rate

- Deferred Annuity Plans

- SBI Annuity Deposit Scheme Calculator

- Immediate Annuity Plans

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Government Schemes for Girl Child

- 50k Pension Per Month

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- CIBIL Score

˜The insurers/plans mentioned are arranged in order of highest to lowest Sum Assured(SA) offered by Policybazaar’s insurer partners offering term insurance plans on our platform, as per ‘first year premium of life insurers as at 31.03.2025 report’ published by IRDAI.

Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. For complete list of insurers in India refer to the IRDAI website www.irdai.gov.in

Rs. 400/month is starting price for a 1 crore term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age, rounded off to nearest 10.

Rs. 400/month (Rs.13/day) is starting price for a 1 crore term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. 230 is starting price for a 50 lakhs term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age, rounded off to nearest 10.

+Rs. 8/day is starting price for a 50 lakhs term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age, rounded off to nearest 10.

+Rs. 12/day is starting price for a 75 lakhs term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age, rounded off to nearest 10.

+Rs. 497/month is starting price for a 1.5 crore term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. 487/month is starting price for a 2 crore term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. 626/month is starting price for a 3 crore term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. 905/month is starting price for a 5 crore term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. ₹361/month is the starting price for a ₹1 crore loan cover with an 8% interest rate for an 18-year-old male, non-smoker, with no pre-existing diseases, loan tenure up to 20 years, rounded off to the nearest 10

+Rs. 1,267/month is starting price for a 7 crore term life insurance for an 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

*The full refund of premium is available on availing the one-time option of refund of premium. Total premium paid for policy (paid for add-ons) will be the special exit value, payable on availing the one-time option of refund of premium if you wish to completely exit the policy.

+Rs. 447/month is starting price for a 1 crore term life insurance for an (NRI) 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs.679/month is starting price for a 2 crore term life insurance for an (NRI) 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. 910/month is starting price for a 3 crore term life insurance for an (NRI) 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. 1,374/month is starting price for a 5 crore term life insurance for an (NRI) 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

+Rs. 1,924month is starting price for a 7 crore term life insurance for an (NRI) 18 year-old male, non-smoker, with no pre-existing diseases, cover upto 30 years of age.

Women

+Rs. 400/month is Starting price for a 1 crore term life insurance for an 18 year-old Female, non-smoker, with no pre-existing diseases, cover upto 30 years of age, rounded off to nearest 10.

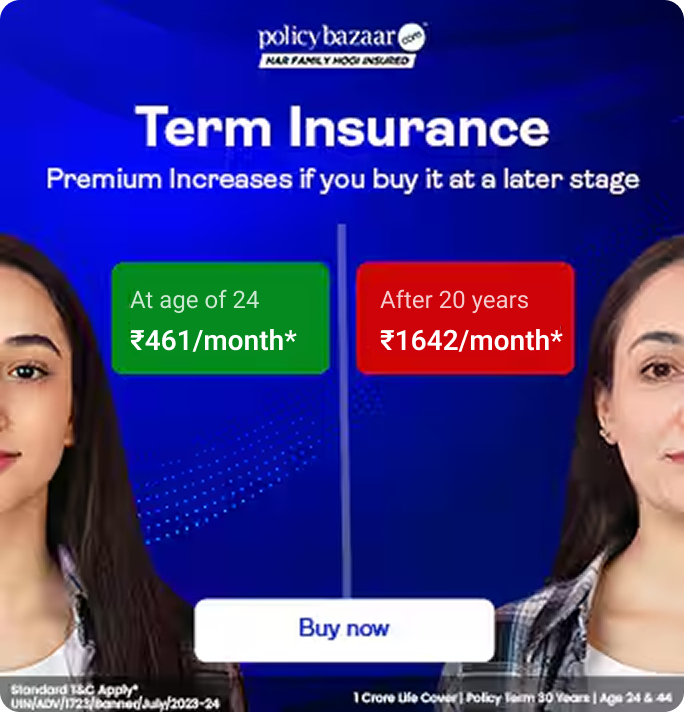

Rs. 461/month is the starting price for a 1 crore term life insurance for an 24 year-old female, non-smoker, with no pre-existing diseases, cover upto 54 years of age.

1,642/month is the starting price for a 1 crore term life insurance for an 44 year-old female, non-smoker, with no pre-existing diseases, cover upto 74 years of age.

Prices offered by the insurer are as per the approved insurance plans | #All savings and online discounts are provided by insurers as per IRDAI approved insurance plans | Standard Terms and Conditions Apply | **Tax Benefits are subject to changes in tax laws.| Policybazaar Insurance Brokers Private Limited

We will respond in the first instance within 30 minutes of the customers contacting us. 30-minute claim support service is for the purpose of giving reasonable assistance to the policyholder in pursuance of the claim. Settlement of claim (including cashless claim) is the responsibility of the insurer as per policy terms and conditions. The 30-minute claim support is subject to our operations not being impacted by a system failure or force majeure event or for reasons beyond our control. For further details, 24x7 Claims Support Helpline can be reached out at 1800-258-5881

For more details on risk factors, terms and conditions, please read the sales brochure carefully before concluding a sale

Policybazaar Insurance Brokers Private Limited | CIN: U74999HR2014PTC053454 | Registered Office - Plot No.119, Sector - 44, Gurgaon, Haryana – 122001 | Registration No. 742, Valid till 09/06/2027, License category- Composite Broker Visitors are hereby informed that their information submitted on the website may be shared with insurers. Product information is authentic and solely based on the information received from the insurers.

© Copyright 2008-2026 policybazaar.com. All Rights Reserved

˜ Policybazaar Promise reflects the guarantee offered by insurers. Price assurance is based on certifications shared by insurers with us.