E-Verification of ITR

As a responsible taxpayer, it is essential for an individual to file Income Tax Return (ITR). Once the ITR is filed, the next step that he/she should take is to verify the filed returns. This step is essential because the Income Tax Department processes the application only after verification of the ITR. Generally, the verification of ITR is done through the download of the ‘Income Tax Return – Verification' form, signing it, and sending it to the ‘Central Processing Centre (CPC)’ of Income Tax Department.

However, in an attempt of paperless income tax filing, the Government of India has introduced e-verification of ITR process.

There are different methods of e-verification ITR, which are mentioned below:

Different Methods to E-Verify the ITR

There are six ways through which an individual will be able to verify his/her ITR at the Online Income Tax Department’s e-filing portal. These ways are:

-

Net Banking Login

-

Mobile Phone Number and Email Id

-

Aadhar Card

-

Demat Account

-

Details of Bank Account

-

ATM Card (of some specific Banks)

In each of these methods, one needs to generate Electronic Verification Code (EVC). This generated code is utilized for verifying the return online.

EVC or Electronic Verification Code is an alphanumeric code of 10 digitals that is produced by the Income Tax Department to verify the identity of the person who is filing the ITR. In addition to this, EVC is effective for 72 hours from its generation time and is unique for every PAN card.

However, before verifying your ITR with EVC, it is recommended to note the below-mentioned points:

Points to Remember

-

The main objective of the Electronic Verification Code is to verify an individual’s identity who is filing the ITR.

-

One can utilize the EVC to verify ITR – 1 to ITR – 4.

-

The eligibility criteria to verify through the mobile phone number and email id are:

-

An individual has not requested for refund.

-

When the total income of an individual is not more than 5Lakh.

-

-

Electronic Verification Code is unique for PAN, thus there is only one EVC for one PAN card.

-

In this way, an individual can use only one EVC for validating one Tax Return only be it for revised return or for the original.

E-Verification of ITR through Net Banking

The list of banks that fall under the eligible banks for the purpose of e-verification of ITR is:

-

SBI Bank

-

ICICI Bank

-

HDFC Bank

-

IDBI Bank

-

AXIS Bank

If an individual has an account and activated net banking in any of the above-mentioned banks, then he/she can follow the below steps for e-verification ITR:

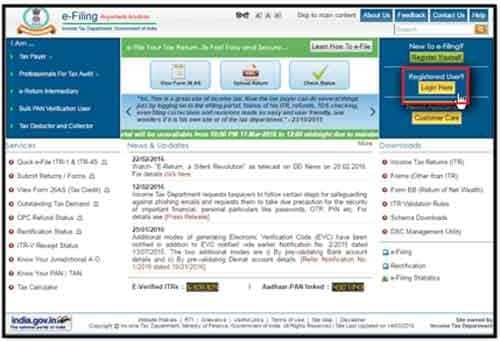

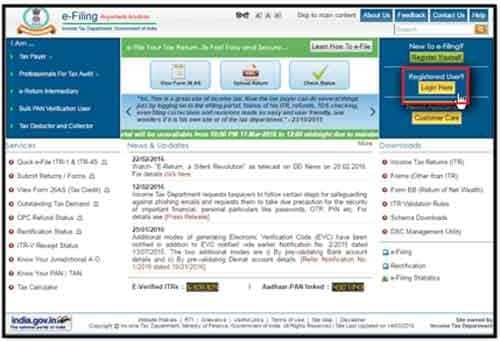

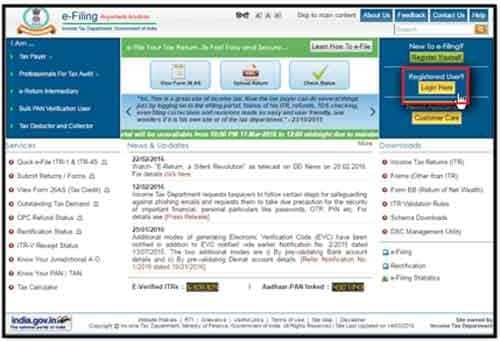

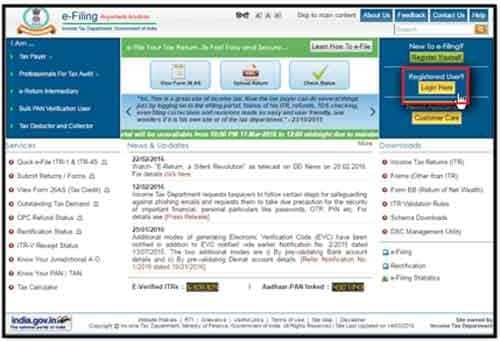

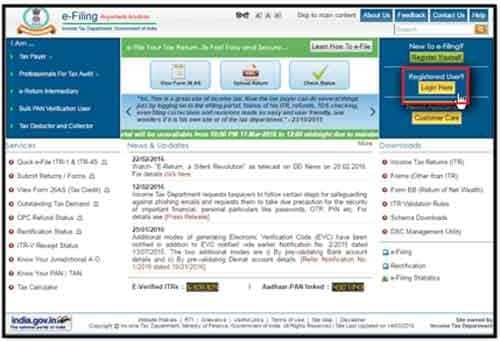

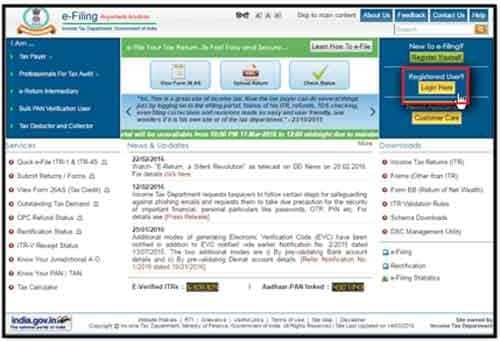

Step 1: Login to the official website of Income Tax Department for e filing income tax online and click the login here option present there.

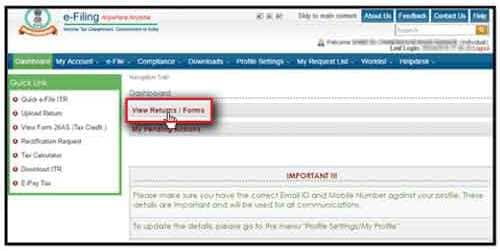

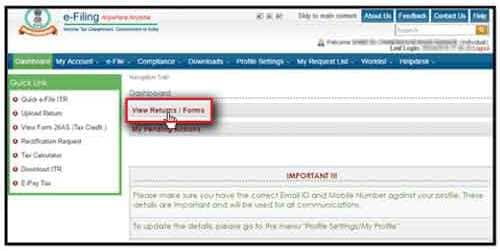

Step 2: Here on the ‘Dashboard’ section, choose ‘View Forms/ Returns’

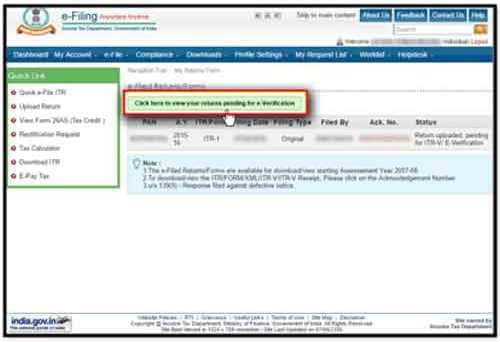

Step 3: Select the option that says to click to view the returns that are waiting for e-verification.

Step 4: Clicking this option gives the pending e-verification returns list. Select the ITR for which e-verification is required and click ‘e-Verification’ link to e-Verify the ITR.

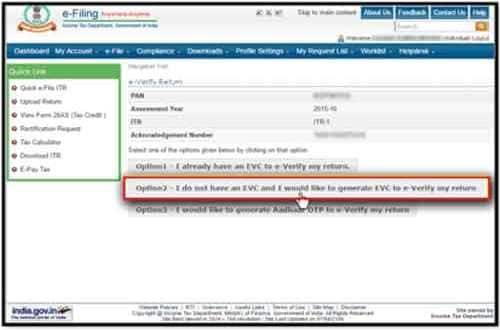

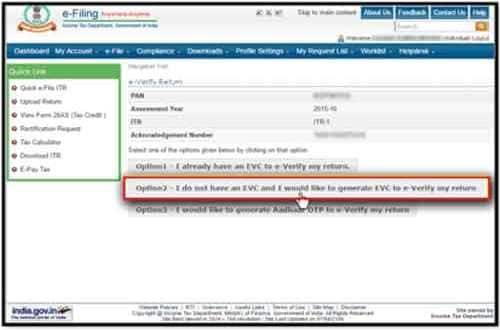

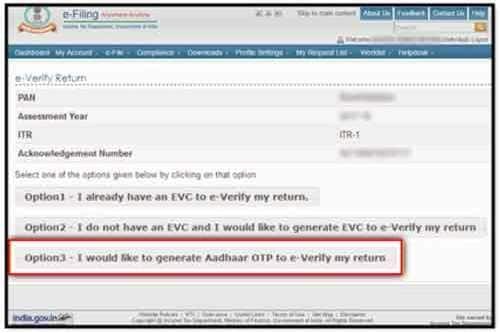

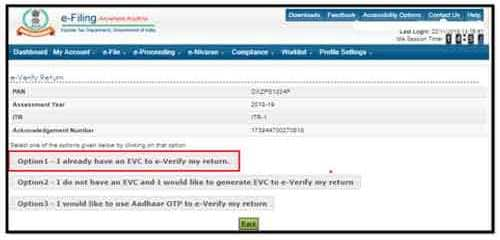

Step 5: This redirects to the page with three options, ‘Option 1’, ‘Option 2’, and ‘Option 3’. Select ‘Option 2’ that says one does not have EVC and wants to generate it for e-Verification of ITR.

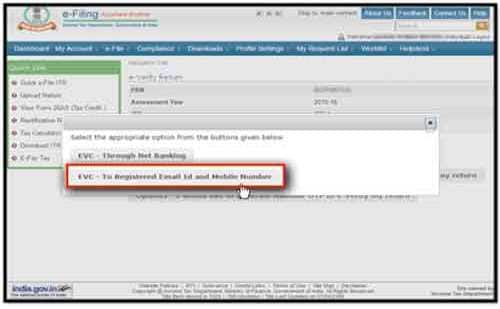

Step 6: This opens a ‘pop-up’ that has three options, select the option that says to generate EVC through Net Banking.

Clicking on this option opens the ‘Net-Banking’ page of the bank, wherein login with net banking credentials. Submit the required items and e-verification is completed automatically.

Note: For the e-verification of ITR with net-banking, it is necessary to link the PAN card with the bank account and it should be registered with the e-filing portal. The generated EVC is valid for 72 hours only, so after Step 6, the e-verification of ITR must be performed in 72 hours.

The e-Verification of ITR is completed successfully.

E-Verification of ITR through Mobile Number and E-mail ID

This way of e-verification of ITR is recommended to the taxpayers who fulfill the following requirements:

-

The income must be less than Rs.5 Lakh

-

There is no refund for an individual.

If a taxpayer fulfills both the requirements, then he/she can generate the EVC on the government's website for e-filing directly. This EVC will be sent to the mobile phone number and email id of the taxpayer. Follow the below steps to do the same:

Step 1: Go to Income Tax Department’s website for e-filing.

Step 2: Search the ‘Login Here’ button and click for login to the account.

Step 3: On login, select ‘View Returns/Forms’ option.

Step 4: On selecting ‘View Returns/Forms’ a new page opens with an option saying to click to view the returns that are waiting for e-verification. Select this option for viewing all the pending verifications.

Step 5: Now all the pending e-verification ITR are shown, click ‘e-Verify’ button for the e-verification of ITR.

Step 6: On the page that opens, select ‘Option 2’ saying that the taxpayer does not have EVC and likes to generate one for electronically verifying his/her return.

Step 7: Selecting this option, opens a pop-up with two options from which select ‘EVC – To Register Mobile Phone Number and Email Id’. After this, EVC on registered email id and mobile number is received.

Note: This way to generate EVC should be followed by those who have income less than Rs.5 Lakh and don’t have any refund.

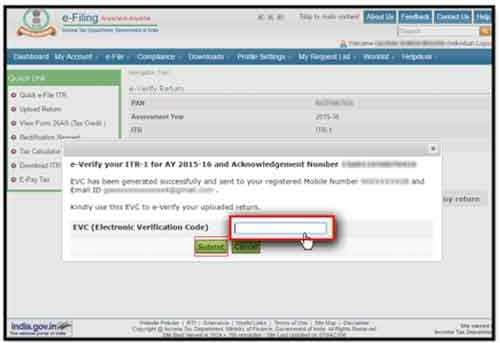

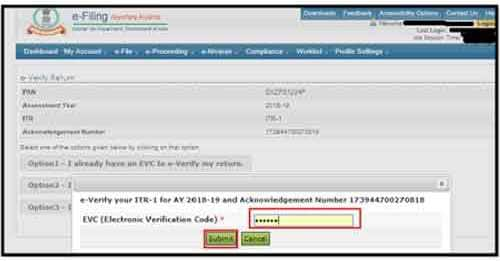

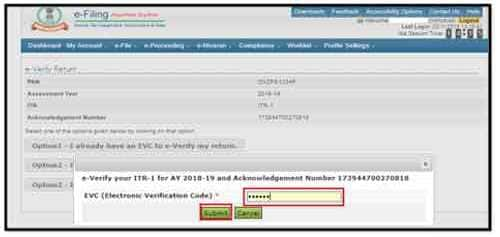

Step 8: For verification of ITR enter 10-digit EVC at the provided space and press ‘Submit’.

The e-Verification of ITR is completed successfully.

E-Verification of ITR through Aadhar Card

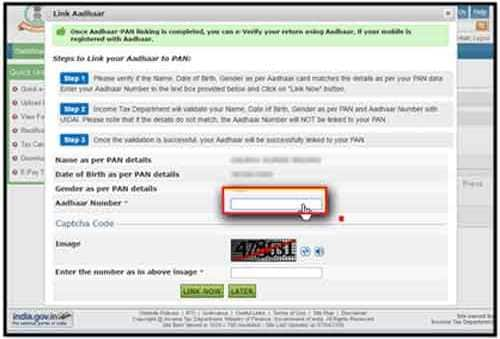

This method is used to generate EVC and receive it on the registered number (mobile) if the PAN card of the taxpayer is joined with the database of Aadhar. Below mentioned are the steps for e-Verification ITR through Aadhar Card:

Step 1: Go to Income Tax Department’s website for e-filing.

Step 2: Search the ‘Login Here' button and log in from there with login credentials.

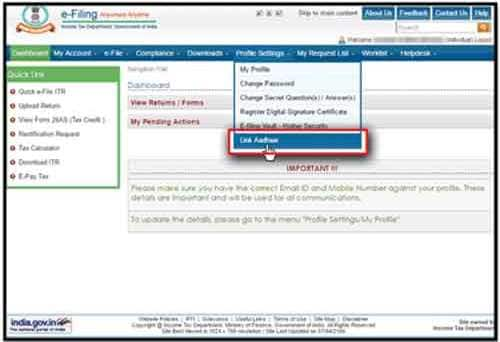

Step 3: If the Aadhar card of an individual is not connected to the PAN card, then a screen pop-up comes for linking Aadhar to PAN card. This page contains a guide that can help to link the two. One can finish the task of linking the Aadhar with PAN anytime by going to the ‘Profile Settings’ tab and selecting ‘Link Aadhar’ option.

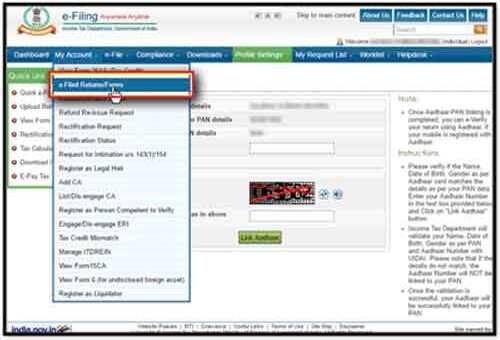

Step 4: Upon linking Aadhar Card with PAN Card, proceed for e-verification of ITR through Aadhar. For the same, go to the ‘Dashboard’ and click ‘My Account’ and select ‘e-Filed Returns/Forms’ option.

Step 5: Select the ‘Click here to view your returns pending for e-verification’ option shown on the next screen.

Step 6: Upon getting the list of pending returns, click ‘e-Verify’ option for e-Verification of ITR.

Step 7: On the next screen, select ‘Option 3 – I would like to generate Aadhar OTP to e-Verify my return’. Upon clicking the same, a taxpayer gets an OTP to his/her mobile number that is registered.

Step 8: Specify the OTP on its specific space and proceed further.

The e-Verification of ITR is completed successfully.

E-Verification of ITR through Demat Account

With this method, a taxpayer can generate EVC by using the demat account number. Follow the below steps to e-Verify ITR through demat account:

Step 1: Go to the website of Income Tax Department for e-filing.

Step 2: On that website, search and click ‘Login Here’ button.

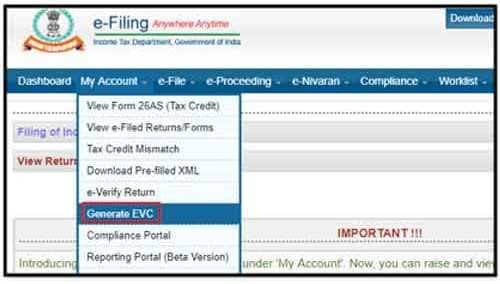

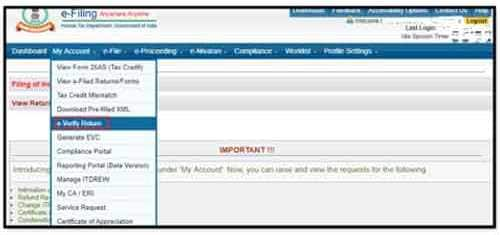

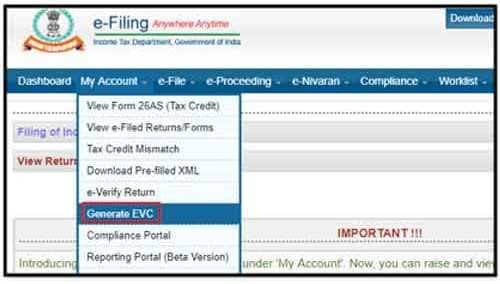

Step 3: Go to ‘My Account >> Generate EVC’.

Step 4: Click ‘Generate EVC using Demat Account Details’.

Step 5: Check the registered mobile number or registered email address in which the 10-digited alphanumeric code is sent.

Step 6: Enter the EVC and file e-verification of ITR in 72 hours of the generation of this code by going to the ‘My Account>>e-Verify Return’ section of the Income Tax Department’s website.

E-Verification of ITR through Bank Account Details

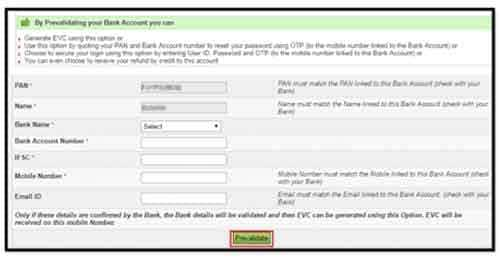

Follow the below steps to e-verify ITR by using bank account details of the taxpayer:

Step 1: Go to Income Tax Department’s website for e-filing the ITR.

Step 2: Select the ‘Login Here' button to log in.

Step 3: After login, go to the main menu of the page and go to ‘My Account>> Generate EVC’.

Step 4: Click ‘Generate EVC using Bank Account details’ to verify return.

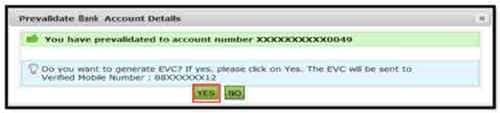

Step 5: Clicking on this option, generates EVC through the bank account number. For the same, a pop-up is generated with the option to pre-validate the bank details, select this option.

Step 6: Pre-validate the bank details.

Step 7: Pre-validating the bank details, sends a confirmation, click ‘Yes’.

Step 8: The EVC is sent to the mobile number that is registered with the bank.

Step 9: Mention the EVC by going to the ‘My Account>> e-Verify Return’ at the provided space and do e-Verification ITR in 72-hours of the EVC generation.

E-Verification of ITR through ATM Card

Follow the below steps to e-Verify ITR through ATM card:

Step 1: The first step is to swipe the credit card/ debit card on the bank's ATM machine.

Step 2: Select the option that says to generate the PIN to file income tax. An Electronic Verification Code is produced then and forwarded to the taxpayer’s mobile number that is registered with the bank. It is suggested to utilize this Electronic Verification Code in 72 hours of its generation.

Step 3: Go to the website of Income Tax Department for e-filing.

Step 4: Click ‘Login Here’ for logging in the account.

Step 5: Soon after log-in go to the ‘Dashboard’ and click ‘e-Filet’ and select ‘Income Tax Return’.

Step 6: On the next screen, three options are displayed, select an option that says that the taxpayer already has EVC.

Step 7: The following screen has a pop-up, wherein space for generated EVC is provided. Enter the EVC at this space and click ‘Submit’.

Step 8: A screen having successful e-verification is shown.

Helpful Resources: Tax Calculator

˜The insurers/plans mentioned are arranged in order of highest to lowest first year premium (sum of individual single premium and individual non-single premium) offered by Policybazaar’s insurer partners offering life insurance investment plans on our platform, as per ‘first year premium of life insurers as at 31.03.2025 report’ published by IRDAI. Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by any insurer. For complete list of insurers in India refer to the IRDAI website www.irdai.gov.in

*All savings are provided by the insurer as per the IRDAI approved insurance plan.

^The tax benefits under Section 80C allow a deduction of up to ₹1.5 lakhs from the taxable income per year and 10(10D) tax benefits are for investments made up to ₹2.5 Lakhs/ year for policies bought after 1 Feb 2021. Tax benefits and savings are subject to changes in tax laws.

¶Long-term capital gains (LTCG) tax (12.5%) is exempted on annual premiums up to 2.5 lacs.

++Source - Google Review Rating available on:- http://bit.ly/3J20bXZ

- SIP Calculator

- Income Tax Calculator

- Compound Interest Calculator

- NPS Calculator

- Show More Calculator

Income Tax articles

Explore the popular searches and stay informed

- LIC

- Investment Plan

- Annuity Plan

- Child Plan

- Pension Plan

- ULIP Plan

- Child Investment Plan

- SIP

- LIC Calculator

- SIP Calculator

- SBI SIP

- ULIP Calculator

- Sukanya Samriddhi Yojana

- Best SIP Plans

- Retirement Planning

- SBI SIP Calculator

- HDFC SIP Calculator

- Sukanya Samriddhi Yojana Interest Rate

- NPS Interest Rate

- Deferred Annuity Plans

- SBI Annuity Deposit Scheme Calculator

- Immediate Annuity Plans

- Post Office Child Plan

- Prime Minister Schemes For Boy Child

- Government Schemes for Girl Child

- 50k Pension Per Month

- Atal Pension Yojana Calculator

- Best Pension Plan in India

- CIBIL Score

- 1 Crore Term Insurance

- Best Term Insurance Plan

- Term Insurance for Women

- Term Insurance for NRI

- Term Insurance

- Term Insurance Calculator

- Life Insurance

- Term Insurance with Return of Premium

- Whole Life Insurance

- Term Insurance vs Life Insurance

- What is Term Insurance

- Life Insurance Calculator

- 5 Crore Term Insurance

- 2 Crore Term Insurance

- 50 Lakh Term Insurance

- Term Insurance for Housewife

- Benefits of Term Insurance

- Term Insurance Terminology

- Medical Tests for Term Insurance

- Term Insurance for Self Employed

- Claim Settlement Ratio

- 10 Crore Term Insurance

- Term Insurance for Smokers

- 1.5 Crore Term Insurance

- Zero Cost Term Insurance

- Home Loan Insurance Calculator

- FIRE Calculator

- EMI Calculator